Nowadays, many people need to take out loans for big purchases like cars or houses. However, if they don’t manage these loans carefully, they can end up in serious financial trouble.

Govt worker with RM4.5K salary gets loan rejected

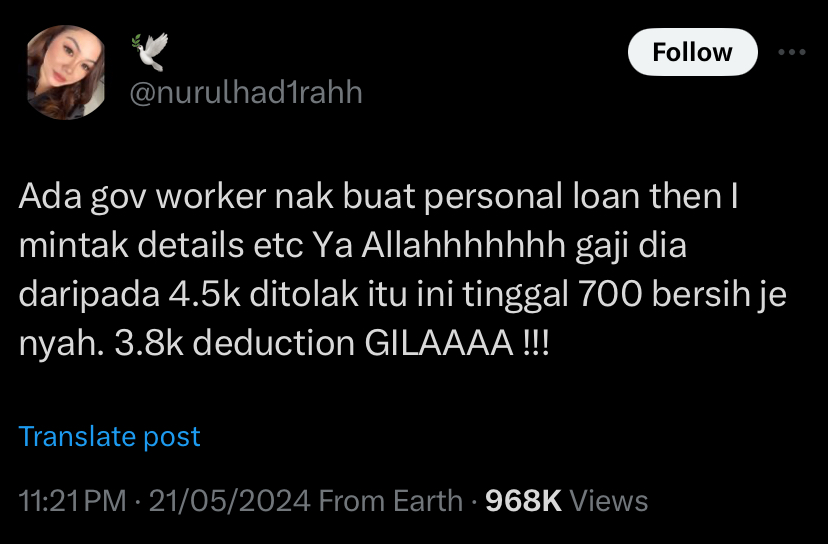

A recent story shared by a financial consultant highlights the severity of this issue among government employees.

The consultant recounted an encounter with a government worker who applied for a new loan despite already having substantial monthly financial commitments.

Shockingly, the employee’s salary of RM4,500 left him with only RM700 after deductions for existing commitments.

This scenario is not uncommon. In this case, nearly 90% of the employee’s salary, amounting to RM3,800, was used to cover monthly financial obligations. The consultant shared their astonishment on social media, stating,

A government worker wanted to take out a personal loan, so I asked for details. Oh my God, his salary of RM4.5K, after various deductions, only left him with a net amount of RM700. RM3.8K in deductions. Crazy!!!”

The loan application was eventually canceled. Surprisingly, the applicant had only one child, yet his financial commitments were already overwhelming.

This revelation sparked significant concern among netizens, many of whom were shocked that individuals would consider taking on additional loans despite their high existing commitments.

This incident has shed light on the growing issue of financial debt among some government employees, attributed largely to the ease of obtaining loan approvals.

One netizen commented, “The serious level of financial indebtedness. It shouldn’t be more than 60%.”

Questions arose about the approval process for such loans, with one individual asking, “So if that’s the case, did his loan get approved? I have an acquaintance who works in government. He is drowning in debt, yet he still gets loans to pay off old loans. It’s like a bad cycle.”

The original poster clarified, “Automatically not approved, because the minimum amount for a loan requires at least RM2.5k net salary.”

Another commenter pointed out a broader issue: “Many have the mindset that working in government makes it easy to get loans. Maybe that’s one of the reasons for high indebtedness among government employees.”

A further comment highlighted recent regulatory changes, stating, “That’s why now government employees can only be in debt up to 60% compared to 80% previously. Uniformed personnel are the most trapped in cooperative debts, personal loans, and others.”

Read the original post here: