When you land your first job, it feels like unlocking a door to a world of possibilities. Suddenly, all those dreams you’ve held onto for years start to feel within reach. For a lot of people, one of those dreams is owning a car – a sign that you’ve made it, that you’re independent. But for one young teacher, this dream has become the centre of a big conversation about being smart with money.

A recent post originally shared on Reddit has surfaced on X platform, grabbing the attention of netizens. In the post, a 23-year-old teacher seeks advice on purchasing a car that aligns with his monthly salary

M’sian teacher looks to buy Honda Civic with RM3K salary,

With a modest income of RM3,100, inclusive of allowances and other perks, the young educator finds himself at a crossroads, contemplating a significant financial commitment.

Expressing his need for a vehicle for daily commute, the teacher emphasised the importance of fuel efficiency, comfort, and minimal cabin noise.

“I’m thinking of buying a car that I can use every day. So, I want a fuel-efficient car but comfortable, and the car cabin is not noisy.”

However, his considerations extend beyond mere preference, delving into the realm of financial feasibility.

Presented with a choice between a used 2018 Honda Civic TC 1.5 priced at RM94,000, a new 2023 Toyota Vios J Variant priced at RM90,000, a new 2023 Proton Saga 1.3 Premium S AT priced at RM45,000, and the Nissan Almera (New), the young teacher solicited opinions from the online community.

With RM6,200 in savings and a rule to keep monthly payments under RM1,100, his thoughts highlight the tricky balance between what he wants and being smart with money.

‘Don’t bite off more than you chew’

Nevertheless, when the teacher asked for advice online, he got more than he bargained for. People from all walks of life chimed in, warning him not to bite off more than he can chew.

They shared stories of their own struggles with expensive cars on tight budgets. Some even broke down all the extra costs, like maintenance and insurance, that he might not have considered.

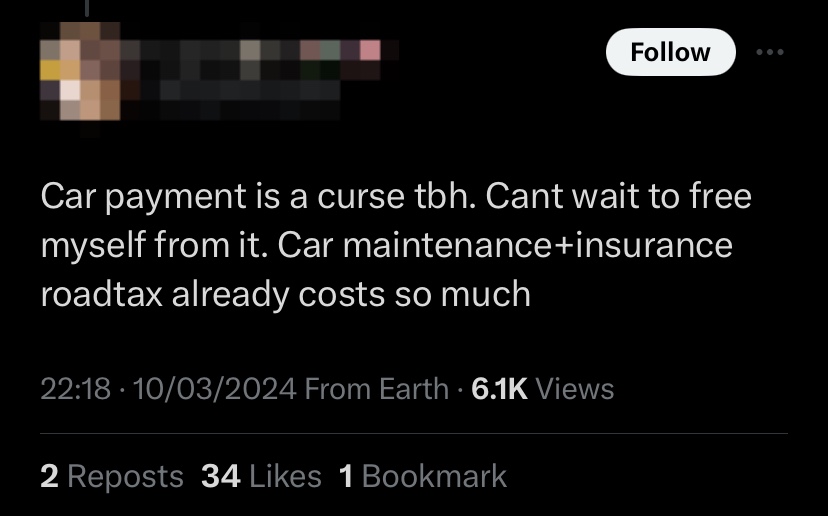

Reflecting on their own journeys, individuals shared regrets and lessons learned, urging the young teacher to reconsider his aspirations. “Car payment is a curse tbh,” remarked one commenter.

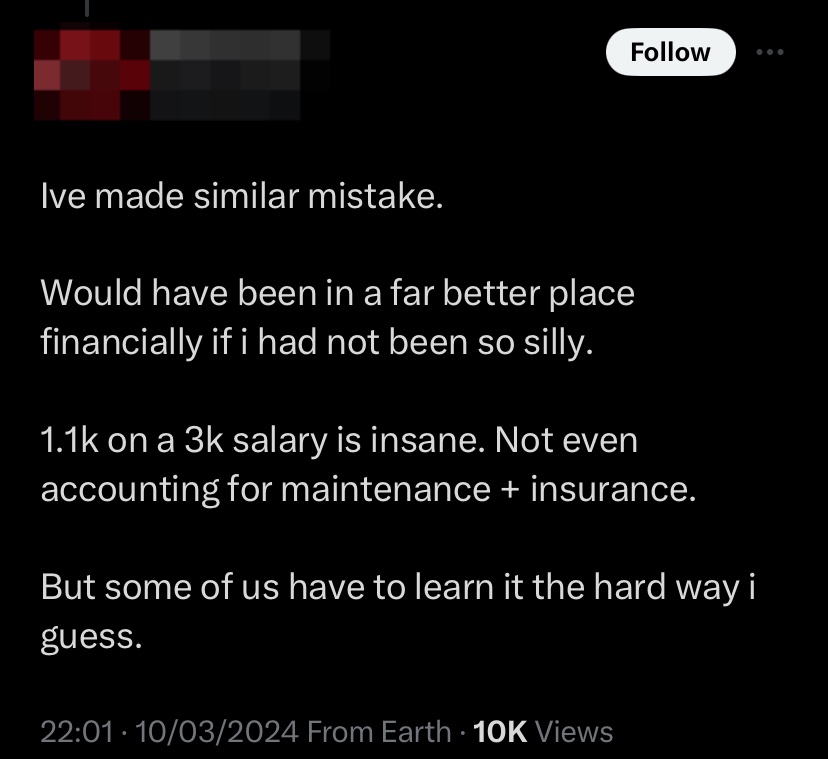

One wrote: “I’ve made a similar mistake. Would have been in a far better place financially if I had not been so silly. 1.1k on a 3k salary is insane. Not even accounting for maintenance + insurance. But some of us have to learn it the hard way I guess.”

One commenter stated: “Even though I earn five figures, I still opt for the KTM & LRT. Trying to keep my commitments as low as possible.”

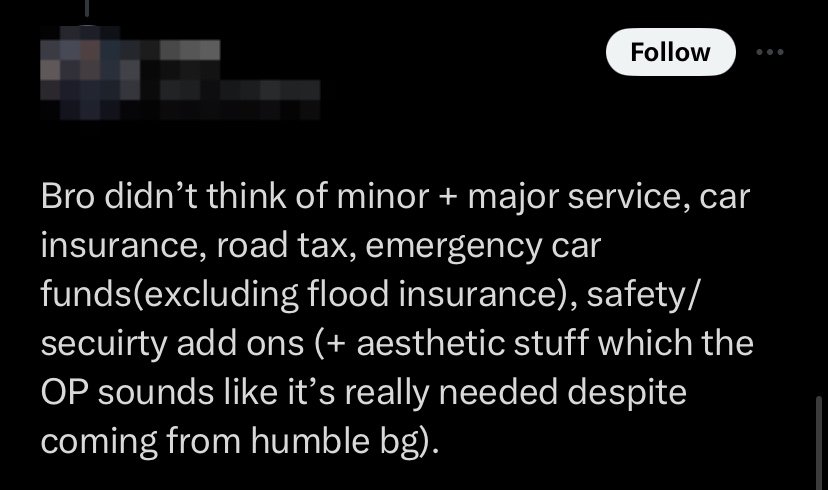

Another person added: “Bro, you didn’t consider the costs of minor and major servicing, car insurance, road tax, emergency car funds (excluding flood insurance), and safety/security add-ons. Plus, there’s aesthetic stuff, which seems necessary despite coming from a humble background.”