There are four money personas found across Malaysia according to a new research from Wise, a global technology company building the best way to move money around the world.

The conclusion was made based upon a survey which involved 672 respondents and subsequently published on several social media platforms.

In the research, it uncovered that almost half of the respondents (49%) are avid shoppers, or “Shopping Pros”, while budgeting geniuses or “Financial Controllers” made up the remaining 38%.

Hidden fee finders (“Aunty Powers”) stood at only 12%, followed up by value driven buyers (“Kopitiam Uncles”) at a mere 1%.

The survey was curated in collaboration with creative agencies, which aim to create quizzes that resonate with Malaysians, thus the quirky names assigned to each category such as “Aunty Powers” and “Kopitiam Uncle”.

Apart from the research, Wise’s Don’t Kena Con campaign was also launched to look into how “wise” Malaysians are with their spending.

While Shopping Pros and Financial Controllers are clearly in dominance, the campaign also discovered that a majority of Malaysians still have much to learn from “Aunty Powers” and “Kopitiam Uncles” when it comes to understanding hidden fees and markups while on a shopping spree.

In fact, over one-third (37%) of Malaysian respondents who shop online and spend overseas admitted that they have no idea what the fees and exchange rates are until the transaction is complete.

That being said, Malaysians nevertheless display an impressive understanding of currency exchange, with 60% saying that they know what the mid-market rate is.

Cost-conscious behaviour among Malaysians spurs need for transparency

Imagine a bunch of aunties gathering together, putting magnifying glasses on top of each payment and complaining when they find out “hidden” fees within.

This group refers to “Aunty Powers”, where people under this category are experts at discovering hidden fees.

Let us now shift our attention to the Kopitiam Uncles, who make up only a small part of respondents but play a big part in educating others to cultivate cost-conscious behaviours.

See the uncles who drink coffee and read newspapers in the kopitiam? They are the ones who are as thrifty as you can imagine and are only willing to spend money on things that are truly value-for-money.

As their names and the scenarios above suggest, “Aunty Powers” and “Kopitiam Uncles” are those who seek truth and cost transparency.

Despite the fact that they are the minority, they nevertheless wield much influence on those looking to better understand currency conversions.

More than half (52%) of all respondents have the impression that fintech platforms give the best rates when it comes to foreign exchange, although 38% chose money changers.

This may be to their detriment as half (50%) of Malaysians surveyed want to know if the remittance provider charges a receiving fee or the exchange rate used when receiving money from overseas.

Plus, close to a quarter of respondents (24%) said having the lowest service fee was the second most important thing they expect from a remittance provider.

Given the Aunty Power’s ability to sniff out the prawn behind the rock, many Malaysians still have a lot to learn when it comes to understanding hidden fees, and it’s clear that transparency in fees is something consumers are increasingly looking for.

An earlier independent research commissioned by Wise also found that Malaysians had spent RM 10.5 billion in total card fees when shopping overseas from 2015 to 2020 and RM 1.5 billion was paid in transaction fees and hidden exchange rate markups yearly when shopping overseas.

Malaysians are Shopping Pros first, but Financial Controllers keep a keen eye on spending

When it comes to shopping overseas, the Shopping Pros show off their strategic buying capabilities with strong preferences for digital payment methods.

Among the respondents, 39% opted for credit card, 22% for debit cards, 20% for multi-currency cards, and 20% for cash.

Given how many Malaysians use their credit card while shopping, it’s encouraging to see that two-thirds (69%) are aware when it comes to shopping in a foreign currency with their credit card, where they pay more than just currency conversion fees.

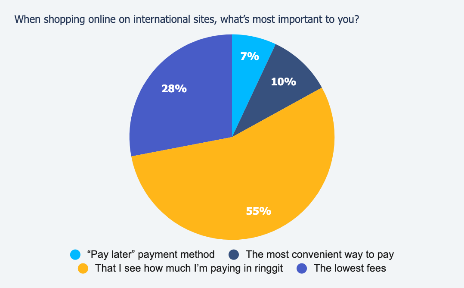

Still, the Financial Controllers are still looking to keep budgets intact and spending on track, as 28% of shoppers noted that whether they are paying the lowest fees is the most important factor of consideration when spending on an international site, and 55% want to know the total cost of the purchase in ringgit.

Importantly, to feel more secure when spending money overseas, respondents say they want to know they are protected from fraud (40%), the total amount they have spent (37%), and the exact fees they have to pay (15%).

‘Should be able to put their hard earned money toward their purchases, not hidden fees’

Lim Paik Wan, Malaysia Country Manager at Wise said that Malaysians need solutions that will help them navigate hidden fees and provide an easier way to make international purchases, as international e-commerce and shopping continues to grow in popularity across the country.

“We know from our research that transparency and convenience are paramount to Malaysian consumers, which is why we’re proud to offer our multi-currency account and card to anyone who needs a better solution for their spending needs.

“Malaysian shoppers should be able to put their hard earned money toward their purchases, not hidden fees, and we hope they take their financial savvy even further by using Wise.” she added.

In addition, Lim shared method of helping Malaysians to be more wise in decision-making when almost everything is on its way to becoming digitalised.

“Moving towards the era of digitalisation, I believe education is key when it comes to raising awareness on hidden fees and whatnot.

“A lot can be done not only by us, but all service providers, such as providing more transparent fees to customers, so that they are aware of what they’re paying at the end of the day and are able to make more shrewd choices.” Lim said to WeirdKaya at the media event.

For more information, please follow Wise on Facebook (@Wise) and Instagram at (@wiseaccount), or visit https://wise.com/my/.

Read also: