Keeping track of expenses and maintaining a budget is crucial for financial stability.

However, it’s disheartening to learn that a staggering 76% of Malaysians struggle to stick to their financial plans, as highlighted by EPF chairman Ahmad Badri Mohd Zahir.

Bank Negara Malaysia’s Financial Capability and Inclusion Demand Side Survey 2021 and the National Financial Literacy Strategy 2019-2023 by the Financial Education Network revealed that 47% of individuals find it challenging to set aside RM1,000 for emergencies.

Introducing the Belanjawanku app

In response to these challenges, the Employees Provident Fund (EPF) has introduced the Belanjawanku app. This app serves as a tool for Malaysians to track their expenses and manage their financial well-being.

The Belanjawanku app is accompanied by EPF’s expenditure guide for 2022/2023, developed in collaboration with the Social Wellbeing Research Centre at Universiti Malaya.

Insights and recommendations

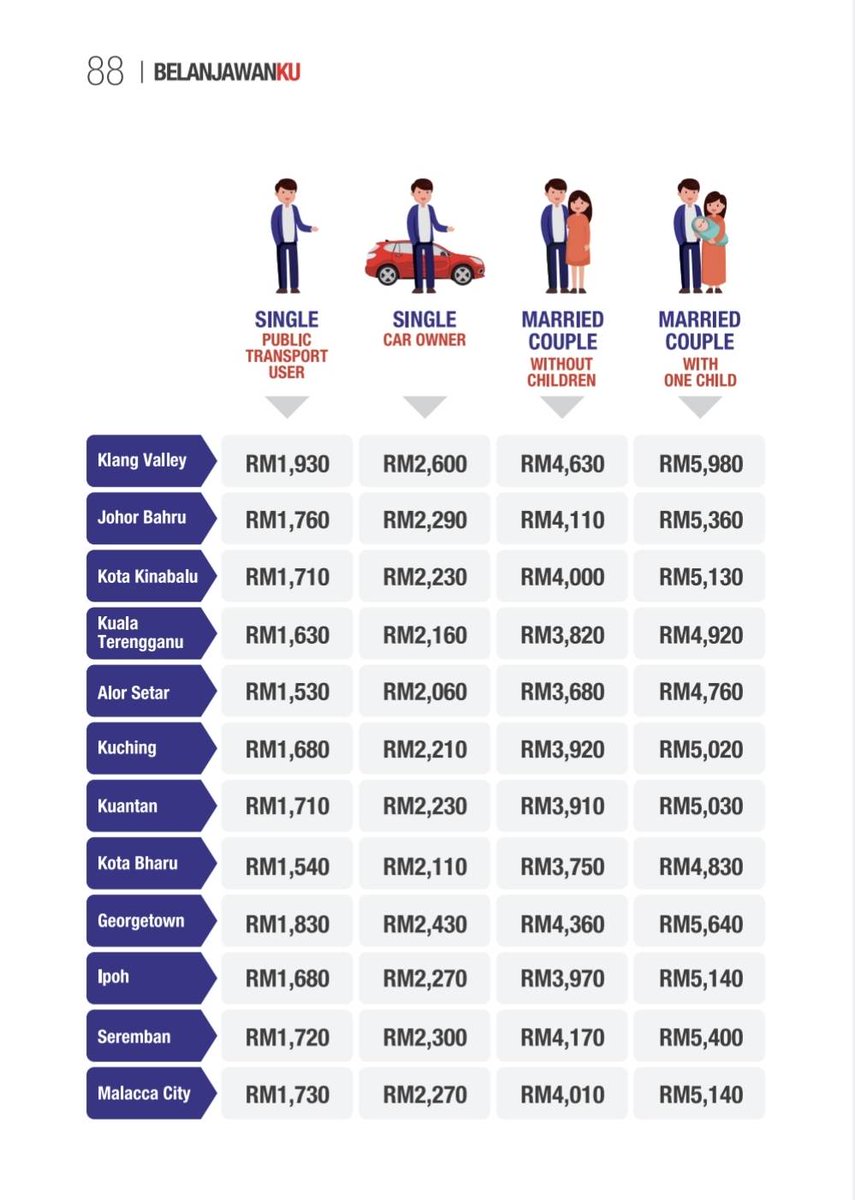

This guide presents insights into minimum expenses across various household categories and offers recommendations for allocating funds towards necessities, optional spending, and personal savings.

It covers 11 cities throughout Malaysia, ensuring individuals from different regions can access financial advice based on their specific circumstances.

The guide aims to ensure that individuals from different regions can access impartial and tailored financial advice based on their specific circumstances.

My Belanjawanku app POV

Now, let me share my own experiences to illustrate the significance of the Belanjawanku guide in practical terms.

Disclaimer: I currently reside in Selangor with my parents and I am gainfully employed. However, I prefer to maintain the confidentiality of my salary information.

Food expenses

Firstly, let’s talk about food expenses. The Belanjawanku guide suggests allocating RM610 for this category, but in reality, my spending tends to hover around RM650.

This figure encompasses grocery runs for the entire household, my daily meals at work, and occasional food deliveries when I want to treat myself.

Furthermore, my weakness for cafes and mamaks, particularly when work takes me outside the office, leads me to surpass the guide’s suggestions in this area.

Transportation

Transportation is another category where the numbers don’t quite align.

The guide proposes an allocation of RM140, but my actual spending amounts to around RM250.

This discrepancy arises from covering Grab rides and my My50 pass for public transport and oh FYI, I don’t drive. Clearly, the guide’s estimate does not fully capture the comprehensive cost of getting around.

Utilities

Regarding utilities, the Belanjawanku guide suggests budgeting RM90, but my actual expenditure is closer to RM80.

Granted, I only pay for my internet phone bill and similar expenses, which helps keep costs down.

However, factoring in home WiFi and electricity bills may slightly increase the budget. Overall, I find the guide’s estimate to be reasonably accurate, if not slightly conservative.

Healthcare

When it comes to healthcare, the guide recommends a modest RM30 allocation.

However, my actual expenditure in this category amounts to approximately RM155. The difference arises from the fact that my company provides health insurance, covering my doctor visits and check-ups.

Consequently, the guide’s estimate falls short in reflecting the true cost of healthcare in my situation.

Lifestyle

Moving on to the lifestyle category, Belanjawanku suggests allocating RM150, but I tend to spend around RM300.

This includes occasional splurges on clothes and admission fees for museums and galleries.

While the guide’s estimate gets close, I admit that I’m willing to go the extra mile to enjoy some leisure activities.

Comparing Belanjawanku’s budget with actual spending

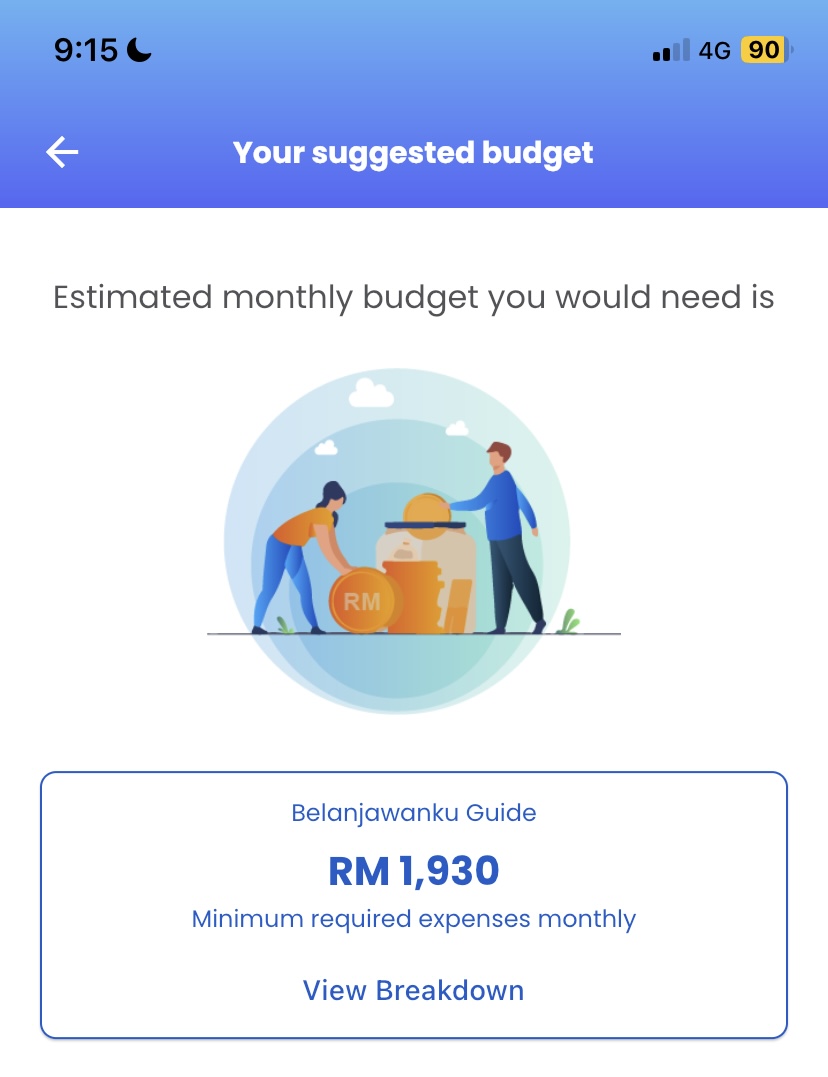

When tallying it all up, Belanjawanku’s suggested budget amounts to approximately RM1,930 (excluding savings), whereas my actual spending totals around RM1,465.

This translates to a significant difference of approximately RM455.

It appears that Belanjawanku’s estimates may not fully align with my specific situation, either underestimating or overestimating certain expenses.

In wrapping up, while Belanjawanku’s budgetary suggestions aim to meet the bare minimum, it’s essential to embrace the fact that being human entails more than just surviving.

As a self-proclaimed minimalist who strives to avoid excessive spending, I consistently find myself surpassing the guide’s proposed budget.

This leads me to question whether Belanjawanku’s estimates truly capture the full scope of our needs and desires. Each of us is unique, with diverse circumstances that warrant personalised budgeting approaches to safeguard our financial well-being.

By aligning our goals, embracing balance, and adapting our budgets, we unlock the potential for a fulfilling financial journey. It’s not just about surviving; it’s about thriving and embracing our complete human experience.

READ ALSO: