Imagine hitting your mid-forties and finding out you’re a millionaire – at least in your EPF account. Sounds like a dream, right?

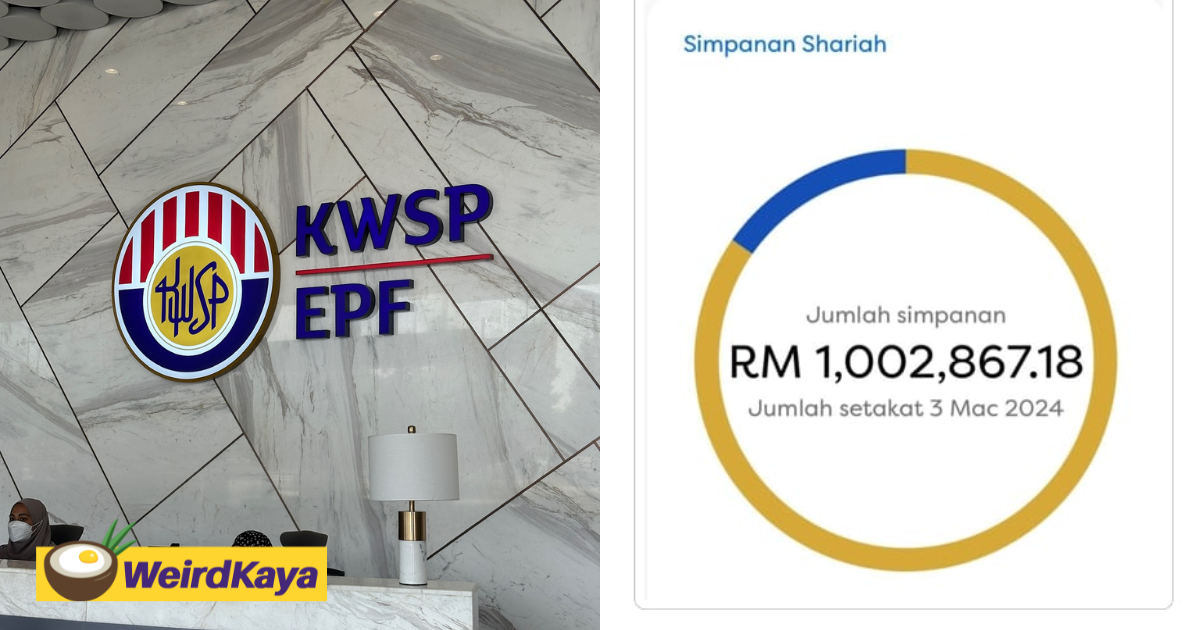

A Facebook netizen shared how their friend, at the tender age of 45, has already amassed a staggering RM1 million in Employees Provident Fund (EPF) savings.

A social media user named Nur Fadhli Bassar share the story of a 45-year-old man blessed with over RM1 million in EPF savings.

The man, an information technology professional in KL, is married with children.

His approach to financial savings for retirement through the EPF highlights the importance of judicious spending and saving.

The netizen noted, “He commutes to work on a motorcycle to avoid traffic jams. He started working immediately after completing his studies at 23, like many others, and withdrew funds from his second EPF account for housing purposes.

4 simple but crucial tips

But how did he manage to accumulate RM1 million in his EPF account?

Firstly, a stable job and sufficient salary are imperative.

Secondly, consistent EPF contributions are essential. He started by contributing 11%, then increased it to 12% and 13%.

Despite the financial strains imposed by previous movement control orders, Nur Fadhli highlighted his friend’s astute savings management, allowing him and his family to sustain their livelihood without dipping into their EPF savings.

“Considering the impact of the previous movement control orders, he managed to maintain his financial stability, indicating he has adequate emergency savings,” she added.

The last strategy was through job-hopping for better salary prospects, having changed jobs eight times.

Nur Fadhli believes if his friend continues to manage his savings diligently, he can retire comfortably with a substantial monthly income.

“With the EPF declaring a 5.4% dividend rate in 2023, he earned RM54,154. If he were retired, this means he could spend RM4,512 monthly just from the dividends without touching the principal RM1 million, ensuring a comfortable life.”

“At 45, if he plans to retire at 60, his EPF savings could exceed RM2 million, potentially enjoying a monthly pension of RM10,000 without depleting the principal RM1 million.”

Embracing wise financial management and avoiding unnecessary expenditures are crucial for ensuring sufficient savings to navigate the challenges of retirement and emergencies effectively.