Starting a job brings independence and financial freedom for many young people. However, amidst the allure of earning a monthly income, it’s crucial to tread cautiously, especially in today’s economic landscape.

And earning up to RM4,000 a month might seem like a significant achievement, but without prudent financial planning, it can quickly lead to a spiral of debt and financial insecurity.

M’sian woman with RM4k salary goes broke every month

In a poignant narrative shared by an anonymous individual on Facebook, concerns about their younger sibling’s financial decisions highlight the pitfalls that await the financially inexperienced.

The story revolves around a younger sibling who secured a two-year job contract, earning a monthly salary of RM4,000, a respectable sum in today’s economic landscape.

However, instead of approaching this income with careful consideration and planning, the individual swiftly succumbed to the allure of consumerism, accumulating debts at an alarming rate. She has:

- Motorbike loan of RM300

- Toyota Yaris car loan of over RM950

- Rent costing RM1,000

- PTPTN loan repayment of RM200

- iPhone 15 Pro payment of RM270 monthly

“I have a younger sister. She just started a two-year job. She earns RM4,000 a month.

But she’s got a RM300 motorbike loan, spends over RM950 monthly on a Yaris, pays RM1,000 for rent, has a RM200 PTPTN loan, and RM270 for an iPhone 15 Pro with Maxis. But every month, she still asks me for money,” they sadly shared.

Despite her income, she frequently asks her sibling for additional money.

‘She shouldn’t be buying a Yaris’

Even after receiving good advice, the younger sibling kept on spending freely, thinking their salary was enough to buy whatever they wanted.

“I’ve told her countless times that with a salary of only RM4,000, she shouldn’t be buying a Yaris,” the sibling laments.

“She only thinks about the monthly instalments, not the additional costs like insurance and road tax.”

This shows a common mistake among young workers: they think their income is enough to splurge without thinking about their financial future.

‘I have bills to pay too’

Depending like this can cause problems beyond just money. It might strain relationships with family and make people rely too much on others. The older sibling couldn’t help much, not because they didn’t care, but because they had their own bills to pay.

“My salary is higher than hers, but I have a family and bills to pay, so I can’t always help her out. I’m worried she’ll get into more debt if she keeps this up,” they explained, feeling concerned.

The concerned sibling asked for advice online, and many people agreed that being careful with money is important.

“I’d like to hear your thoughts on avoiding debt in the future. What car would you recommend for someone earning RM4,000 and starting their career?” they asked in a Facebook group.

Just live within your means

They suggested paying off debts first, thinking about what they really need, and living within their means. Everyone seemed to agree that it’s better to plan for the future than to spend too much now.

One person wrote: “She thinks RM4,000 is a lot.”

Another commented: “Does she really need an iPhone 15?”

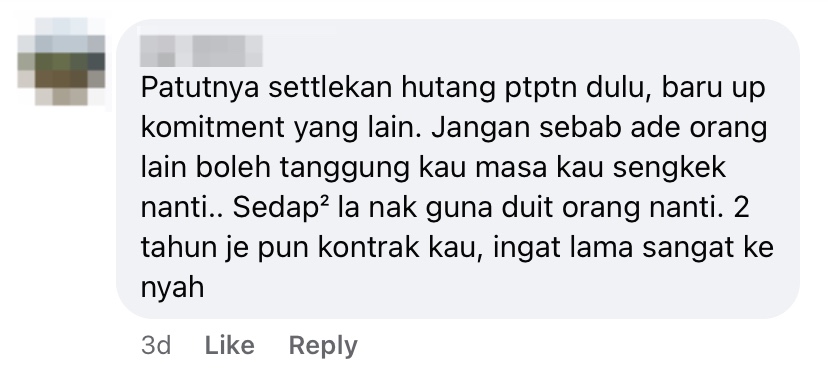

Someone else chimed in: “She should pay off her PTPTN debt before committing to other expenses. Don’t rely on others for money later on. Your contract is only for two years – is that enough?”

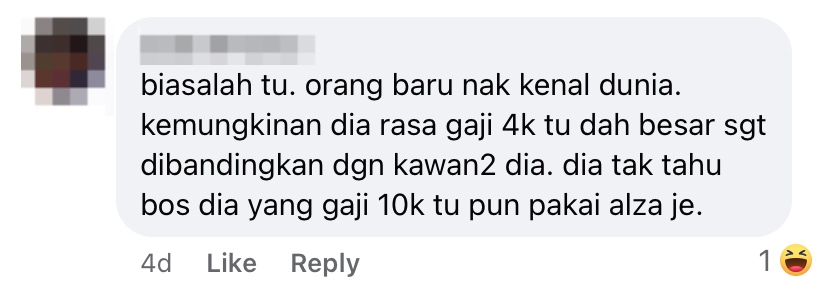

Another person said: “It’s common. She is just getting to know the world. Maybe she thinks RM4,000 is a big salary compared to her friends. She might not realise that her boss, who earns RM10,000, still drives a Perodua Alza.”

Read the post here.