Indeed, family means everything. But for one young woman, things aren’t so simple. She’s facing tough choices about trust, money, and family relationships.

Sharing her story online, she’s struck a chord with others who know the struggle. It’s opening up a conversation about how tricky it can be for families to handle their finances.The main focus here is on ID cards, especially the MyKad, which are super important for Malaysians.

But lately, there have been some problems. People are using them in dodgy financial deals, which is causing some trouble.

‘Is it reasonable for PERKESO to request copies if IC and driver’s license?’

In the middle of all this, a young woman reaches out for advice online on a Facebook group named Tanya Peguam. She’s feeling a mix of vulnerability and strength as she tells her story.

“My question is, is it reasonable for PERKESO to request copies of IC and driver’s licenses supposedly as evidence for heirs?”

It starts with her mum asking for copies of her IC and driver’s license. Supposedly, it’s for insurance purposes, helping out self-employed folks.

But there’s more to it than meets the eye. There’s talk about loans for her mom’s small business, adding to the financial complexity.

‘My parents have been constantly chased by debt collectors for years’

As she tells her story, the young woman reveals a family life full of money troubles. It’s like a tangled mess of bad financial decisions and promises that never seem to come true.

Growing up, she saw her parents always borrowing money but never paying it back on time. They’re good at sweet-talking when they need cash, but when it comes to actually paying bills, they fall short.

“My parents are always short of money to pay bills, constantly chased by debt collectors for years and stuck here and there. But when they have a large sum of money, they never save for the future or remember to pay off debts; instead, they prefer to splurge on outings or buy second-hand cars with cash.”

The family’s money problems go deeper than just borrowing. They’re not saving up like they should.

Instead of putting money aside for later, they’re spending it on fun stuff that doesn’t last. Her parents’ businesses used to do well, but now they’re struggling as they get older, and the money isn’t coming in like it used to. They’re settling for just enough to get by.

Too many responsibilities to cary by just one person

She also mentioned that her mother’s current situation has led her to be forced to provide a monthly allowance of RM500.

Additionally, her younger brother is also experiencing financial problems to the extent that his MARA loan debt has accumulated to RM8,000.

“My mum often asks for money every month on top of the RM500 that I give her. Coincidentally, my younger brother is currently in arrears of MARA payments amounting to RM8,000, and my mum is making a fuss because my younger sister who is currently taking SPM won’t be able to borrow from MARA due to my brother’s situation.”

On social media, people are responding to the daughter’s story. She’s wondering if she really needs to hand over her ID documents to PERKESO.

‘That doesn’t seem right. What does a license have to do with it?‘

Some netizens think there might be other reasons behind it, like trying to get loans for buying a car, and she might end up getting stuck in the middle without even knowing it.

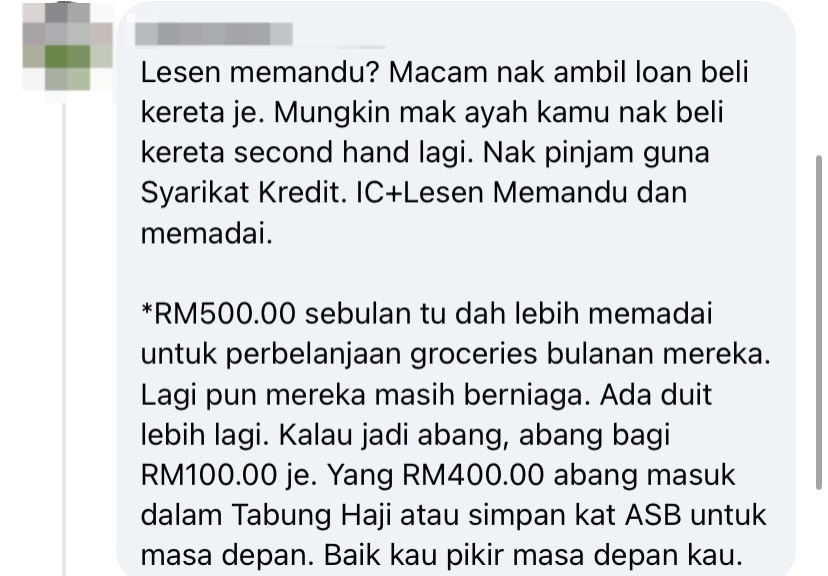

One wrote: “A driver’s license? Sounds like they’re planning to get a car loan. Maybe your parents are thinking about buying another second-hand car. If they need to borrow money, your IC and driver’s license should be sufficient.

That RM500.00 per month is already more than enough for their monthly grocery expenses. Plus, they’re still running a business and have extra money. If I were you, I’d only give RM100.00. Put the remaining RM400.00 into Tabung Haji or save it in ASB for the future. It’s important to think about your own future.“

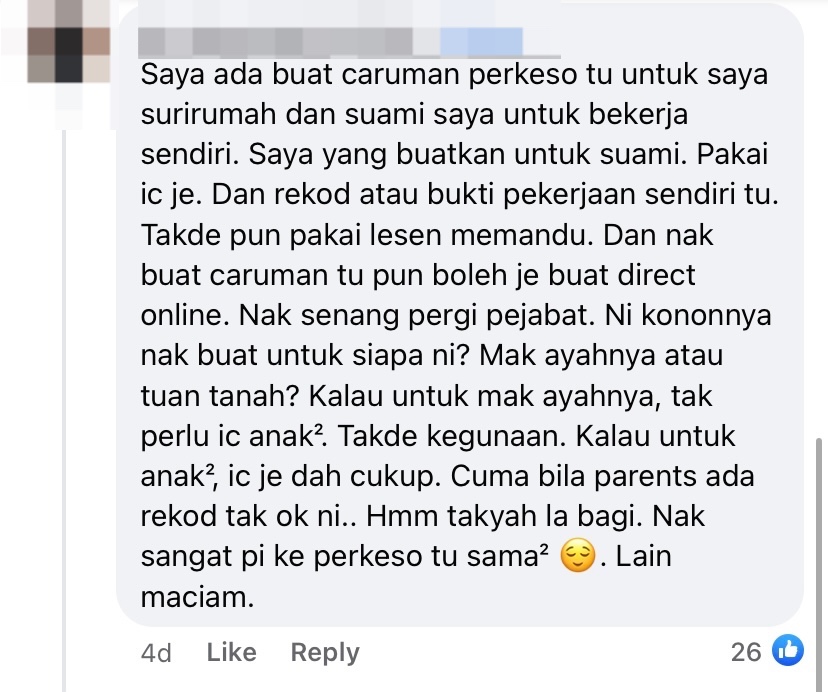

Another commented: “I signed up for PERKESO myself as a homemaker and for my husband as a self-employed person. “I handled it for him using only his IC, which proves his self-employment. We didn’t need a driver’s license at all. And you can easily do these contributions online; no need to visit the office.

So, who is this really for? His parents or the landlord? If it’s for his parents, there’s no point in providing the child’s IC. It’s unnecessary. If it’s for the child, just the IC is sufficient. But if the parents’ records aren’t right… Hmm, there’s no need to give it. If they really insist, they can go to PERKESO together. It seems very suspicious.”

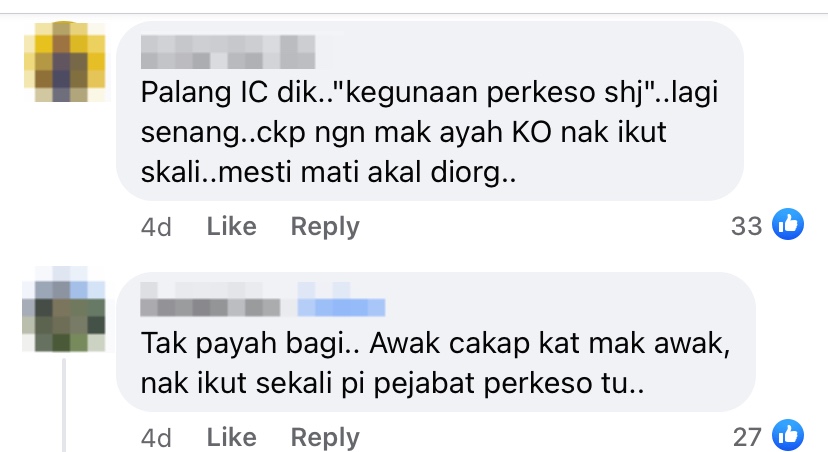

One suggested: “Cross out the IC. Write “PERKESO use only.” Even easier…just tell your parents that you want to go with them. They’ll definitely be dumbfounded.“

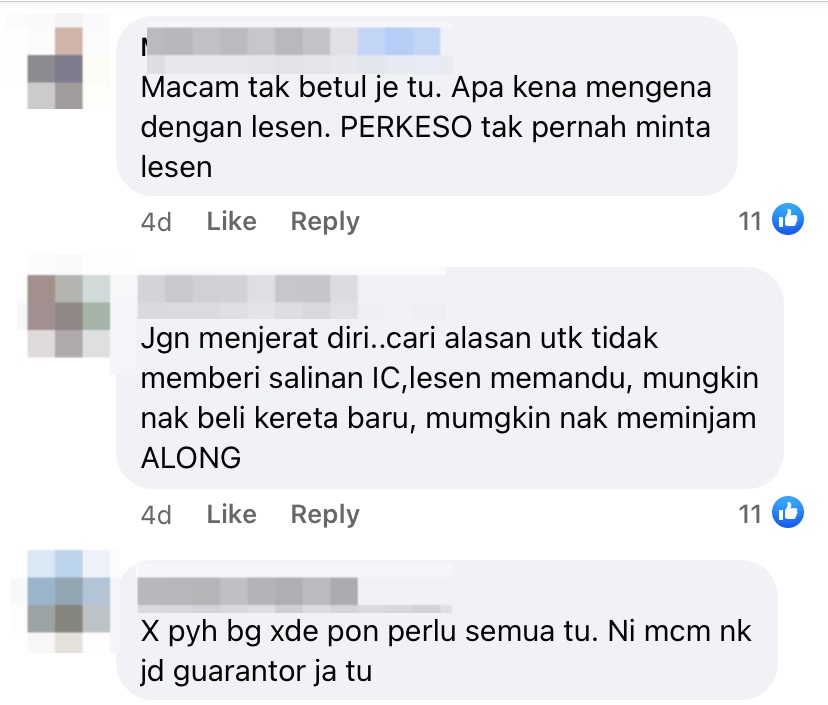

One questioned: “That doesn’t seem right. What does a license have to do with it? PERKESO never asks for a license.”

Another chimed in: “No need to give it. None of that is necessary. It seems like they want to make you a guarantor.”

What do you think of this incident? Let us know!