In many parts of the world, the dream of homeownership often entails decades-long commitments to mortgage payments.

While this avenue provides the opportunity for individuals to secure a place to call their own, it also comes with its share of challenges and risks, as exemplified by a recent viral incident on social media.

17 years of payments and surprises

In a viral post on Facebook, an individual shared their frustration over the seemingly perpetual burden of their housing loan, despite diligently making payments for 17 years.

The individual expressed astonishment at the substantial remaining balance of their loan, despite consistent monthly payments and even withdrawing funds from their Employees Provident Fund (EPF) to aid in repayment.

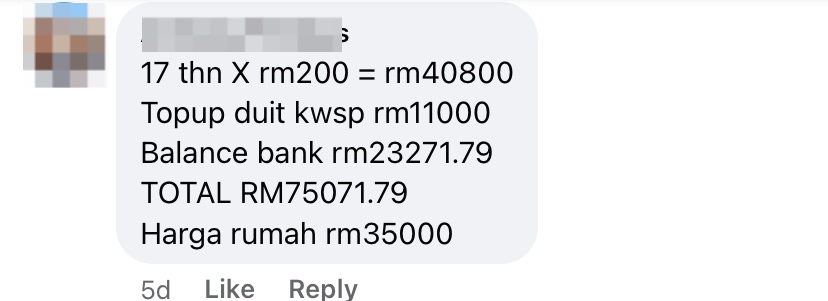

“The house was bought for RM35,000. Monthly payment of RM200. Been paying for 17 years. Then made a withdrawal from the Employees Provident Fund (EPF) of RM11,000.”

According to the individual’s account, the initial purchase price of the house stood at RM35,000, with a monthly payment of RM200. Over the course of 17 years, this amounted to a significant sum.

“Went to pay off the house again, but when checked at the bank, there was still a lot of remaining balance. If you calculate, it should have been paid off by now. Anyone else experienced this?” the individual shared on Facebook.

Yet, upon attempting to settle the remaining balance, they were confronted with the realisation that a considerable debt still loomed over them.

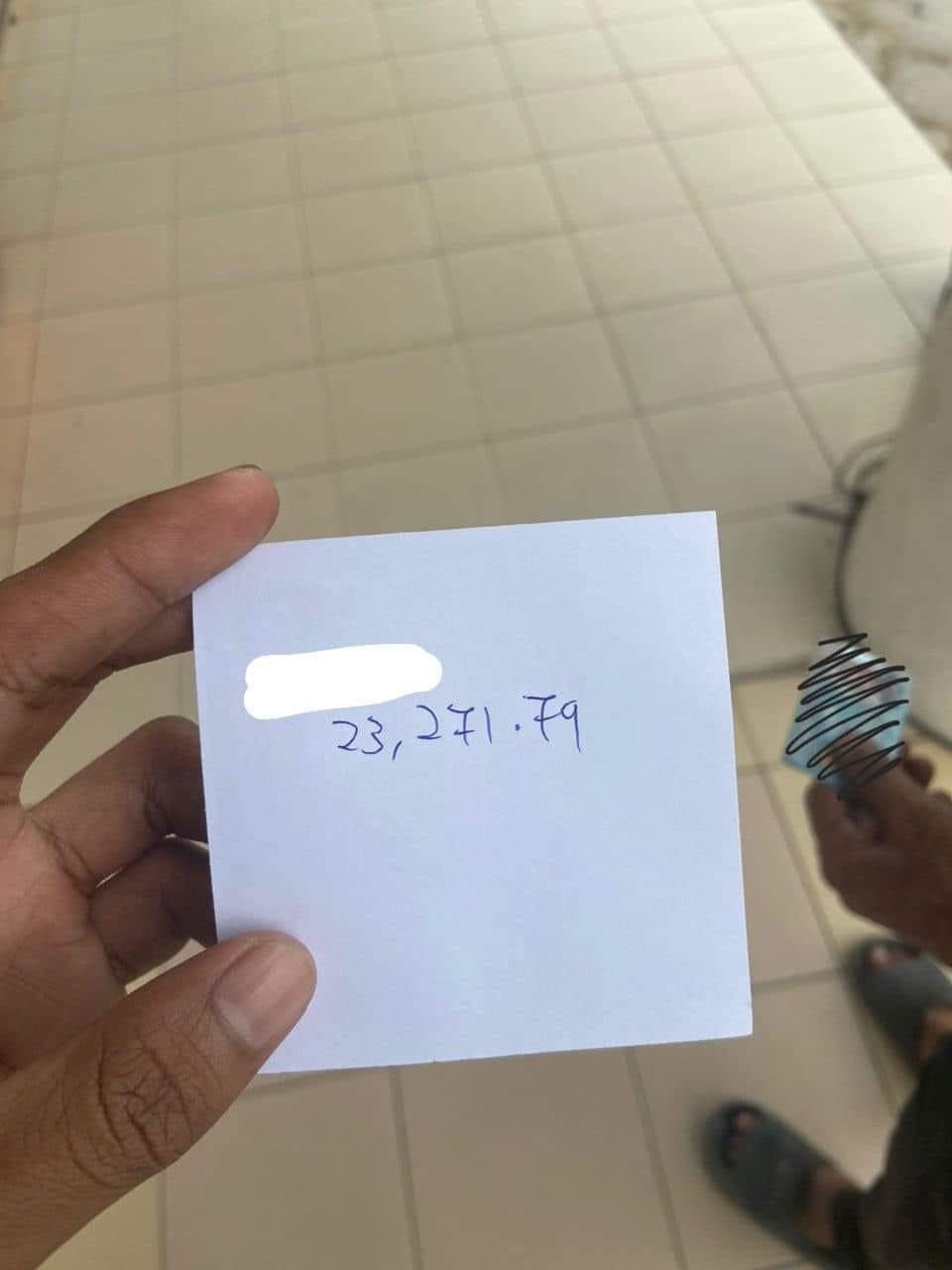

They also shared a photo showing a piece of paper with the amount 23,271.29, believed to be the remaining balance of their loan.

The post sparked a wave of responses from netizens, with many offering their perspectives on the situation.

Doing the math: What’s really left after 17 Years?

Some engaged in calculations, highlighting the total amount paid over the years, including contributions from the EPF, juxtaposed against the remaining balance.

“RM200 X 12 months X 17 years: RM40,800. Plus EPF RM11,000: RM51,800. RM51,800 plus remaining balance RM23,271: RM75,071.”

The figures painted a stark picture of the financial burden endured by the individual, raising questions about the underlying factors contributing to such predicaments.

‘You signed the agreement, you agreed to it’

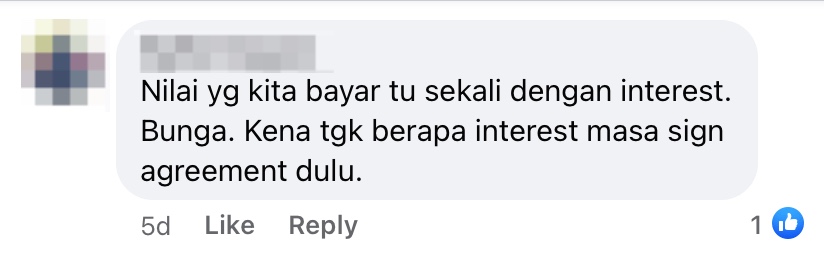

One crucial aspect that emerged from the discourse was the role of interest rates in mortgage agreements.

One wrote: “The amount we pay includes interest. We need to see how much interest was agreed upon initially.”

Several commenter stressed the importance of understanding the terms and conditions, particularly regarding interest rates, before entering into loan agreements.

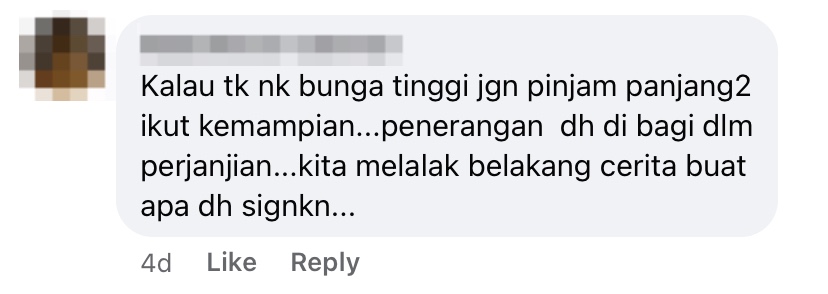

They urged individuals to be vigilant and mindful of the implications of long-term borrowing, advising against overextending oneself beyond financial capabilities.

Another commenter wrote: “If you don’t want high interest, don’t borrow for too long. Do it based on your ability to pay. The details were in the agreement. Why complain about it now? You agreed to it, didn’t you?”

Another commenter chimed in, asking: “You didn’t know about this when you signed the agreement?”

Read the full post here:

What do you think of this incident? Let us know in the comment.