A netizen, who makes a five-figure income monthly recently took to Facebook to share his financial struggles of only being able to save RM23 a month despite his high income.

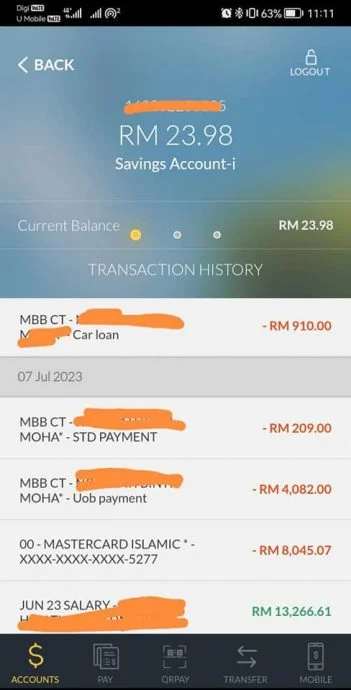

In a now-deleted Facebook post, the netizen shared that he is left with less than RM50 in his account after settling his debts and covering his monthly expenses.

The post was initially shared on the Facebook page “B40 Buat Perangai Apa Harini”, where the user expressed his frustration, “I can only be a part of the T20 group for an hour every month.”

Although his monthly income qualifies him to be part of the T20 tier (top 20% income earners), after deducting contributions to the Employees Provident Fund (EPF), taxes, and debt repayments, he is left with only RM23.98.

Read also: 27yo M’sian shares his struggles as he approaches 30 and we found it too relatable

M’sian man shares his struggle despite earning RM13k a month

The man revealed that his monthly obligations are significant, including a car loan payment of RM910 and credit card debts to two banks amounting to RM209 and RM4,082 respectively.

He currently holds credit cards from four different banks, with a total credit limit of RM100,000.

‘Poor financial management’

The post has sparked heated discussion among netizens, many of whom suggest that individuals with higher incomes often have greater material needs and, consequently, spend more, leading to increasing credit card debts.

One user advised, “Life is not expensive, what’s expensive is lifestyle, keep going.”

Another netizen also said that the OP had a poor management on his personal finance

“The higher the salary, the higher the cost of living.”

Others were more direct, stating, “Once you start using a credit card and don’t know how to control it, you’re destined to remain poor all your life. No matter how much you earn, constant spending without saving is futile, even if you earn a lot of money.”

Another netizen also suggested him to pay off his debt on time to avoid interest charges.

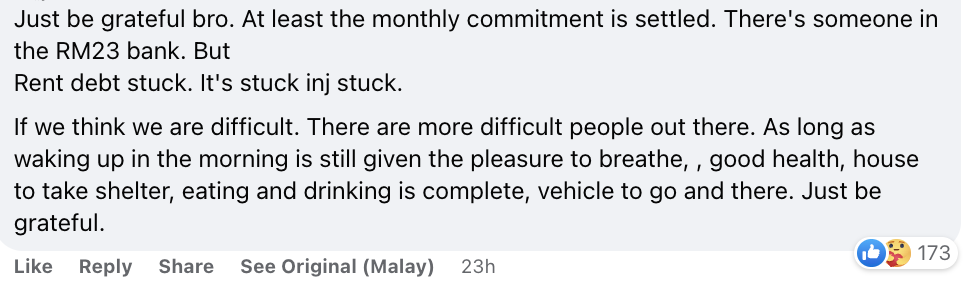

One also advised the OP to be grateful to what he has.