Whether you’re a fresh graduate, a working adult, or someone considering a loan in the near future, eCCRIS holds significant importance for you, as it serves as a key indicator that financial institutions use to assess your loan application.

But first.. what is eCCRIS?

eCCRIS, or the electronic Central Credit Reference Information System, is an online platform managed by the Central Bank of Malaysia (BNM).

What is eCCRIS?

eCCRIS provides a comprehensive record of an individual’s financing and repayment history over the past 12 months, as reported by participating financial institutions.

This includes details of all your credit facilities, both active and non-active, from various financial service providers.

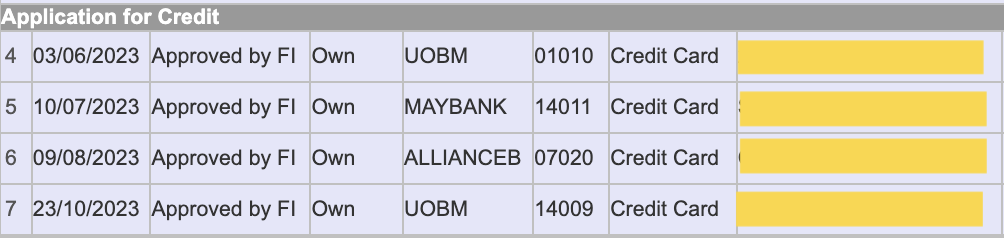

For example, it has a column called ‘Application for credit’, where it shows all your approved credit cards, housing loans or personal loans applications for the past 12 months.

eCCRIS also features a ‘Special Attention’ section. Loans reported under this section refer to impaired loans that the participating financial institution has placed under special monitoring, either in view of recovering the loan or in the midst of collection.

It is also worth noting that this service is not available for:

- Malaysian individuals without internet banking

- Permanent Residents and non-Malaysians

- Businesses

2. Why is eCCRIS Important?

When you apply for financial products, such as credit cards or loans, banks will evaluate your credit record based on your eCCRIS report. They’ll check for any outstanding debts or if your DSR (Debt Service Ratio) is too high.

eCCRIS also serves as an indicator for financial institutions. It provides them with a clear picture of your credit history, helping them determine your creditworthiness, loan amount, and most importantly, the interest rates they should offer.

For instance, if you maintain a good credit card repayment history and don’t have any late payments, your likelihood of securing loan approval is greater compared to individuals who lack any credit history in eCCRIS.

Besides, a credible credit history is paramount when seeking housing or car loans. Banks need to trust that you can repay the borrowed amount, and eCCRIS provides them with the necessary insights.

It’s vital to check eCCRIS regularly to ensure there are no inaccuracies or bad credit records under your name. Mistakes can happen, so it’s best to catch them early.

3. What’s the Difference Between CTOS and eCCRIS?

While both CTOS and eCCRIS deal with credit information, they are not the same. Here’s a breakdown:

- Ownership: CCRIS is owned and managed by Bank Negara Malaysia (BNM). In contrast, CTOS, Credit Bureau Malaysia, and Experian are credit reporting agencies registered under the Ministry of Finance, as per the Credit Reporting Agencies Act 2010.

- Data Access: These credit reporting agencies have the approval to access the CCRIS system. This means they can provide private credit reports to their users, which might contain more comprehensive information than what’s available on CCRIS.

- Scoring System: CTOS, Credit Bureau Malaysia, and Experian each have their own credit scoring systems. They obtain data from eCCRIS and then use their unique algorithms to evaluate and score an individual’s creditworthiness. For instance, CTOS has its proprietary credit scoring system that other financial institutions might use to assess loan or credit applications.

It’s essential to note that while eCCRIS is completely free to use, CTOS and other credit reporting agencies may charge fees.

This means you might have to pay to obtain information from these third-party credit reporting agencies.

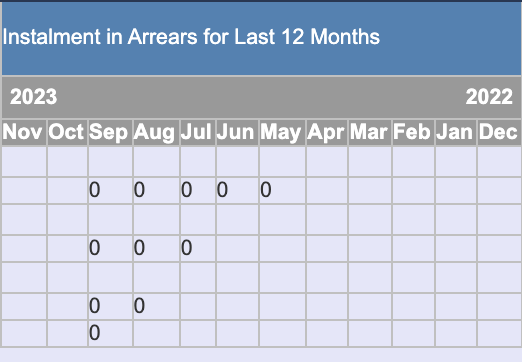

4. Understanding the 0/1 in the eCCRIS Report

In the eCCRIS report, you might come across numbers like ‘0’ or ‘1’. Here’s what they signify:

- 0: This number indicates a clean slate, meaning you’ve made all your payments on time and have no late payments recorded against your name.

- 1: If you see a ‘1’, it denotes that you’ve made a late payment for one month. Similarly, a ‘2’ would mean two months of late payments, and the pattern continues.

In essence, these numbers serve as a quick reference to gauge an individual’s payment habits and reliability. As such, always aim for a ‘0’ to maintain a stellar credit record.

Paying your PTPTN on time is important

One crucial piece of information that eCCRIS gathers is related to PTPTN (National Higher Education Fund Corporation) loans.

If you have been delaying your PTPTN payments, this will be recorded in eCCRIS. So, always ensure timely payments to maintain a clean credit record.

Remember, a good credit score can open many financial doors, while a poor one can limit your opportunities. Stay informed, check your eCCRIS regularly, and ensure you maintain a healthy financial record.

How to open an eCCRIS account?

Now that we know the importance of eCCRIS, here’s the step-by-step guide on opening your eCCRIS account for free.

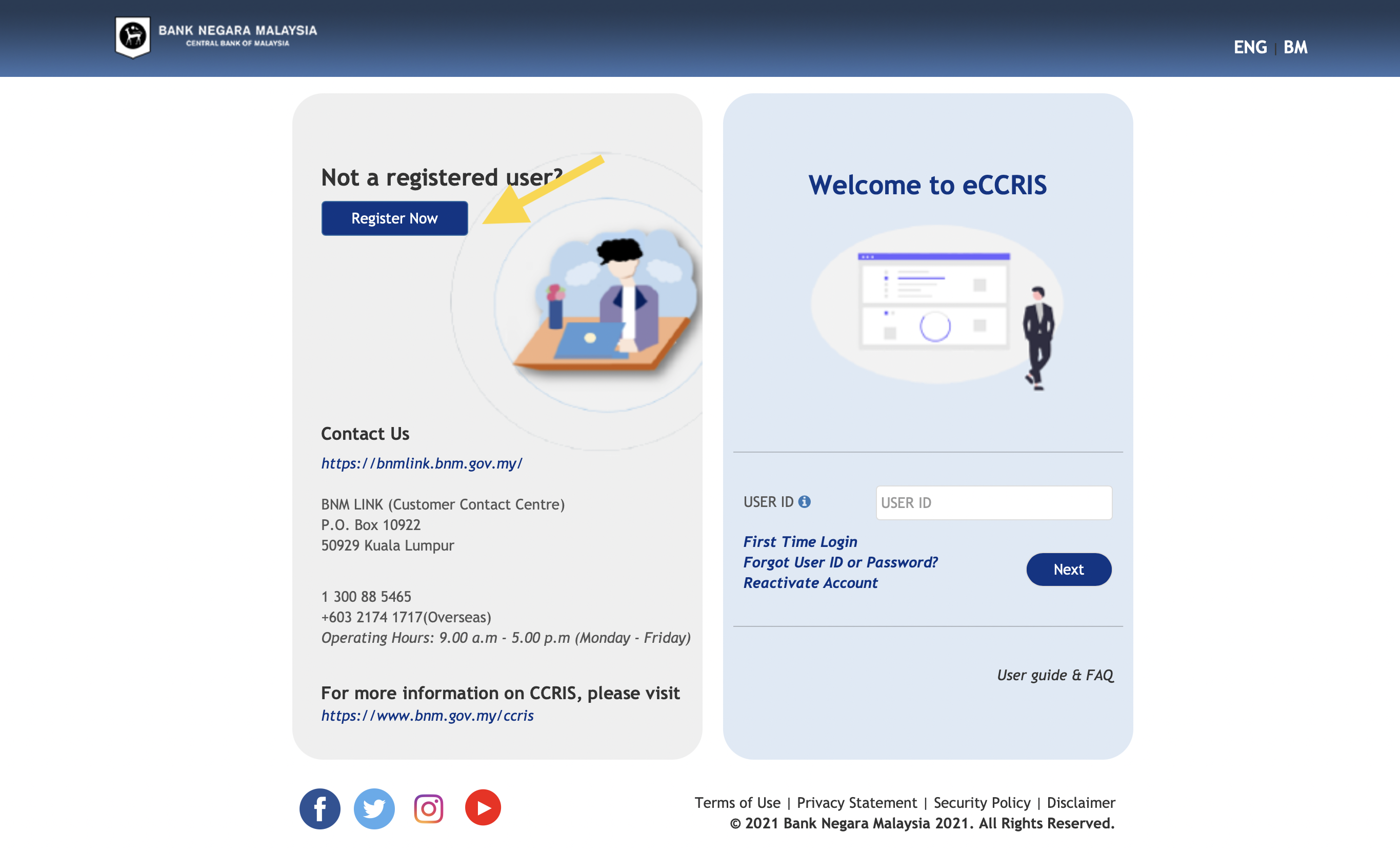

Step 1: Open your browser and visit https://eccris.bnm.gov.my/.

Step 2: On the left-hand side of the page, you’ll see a button labeled ‘Register Now’. Click on it.

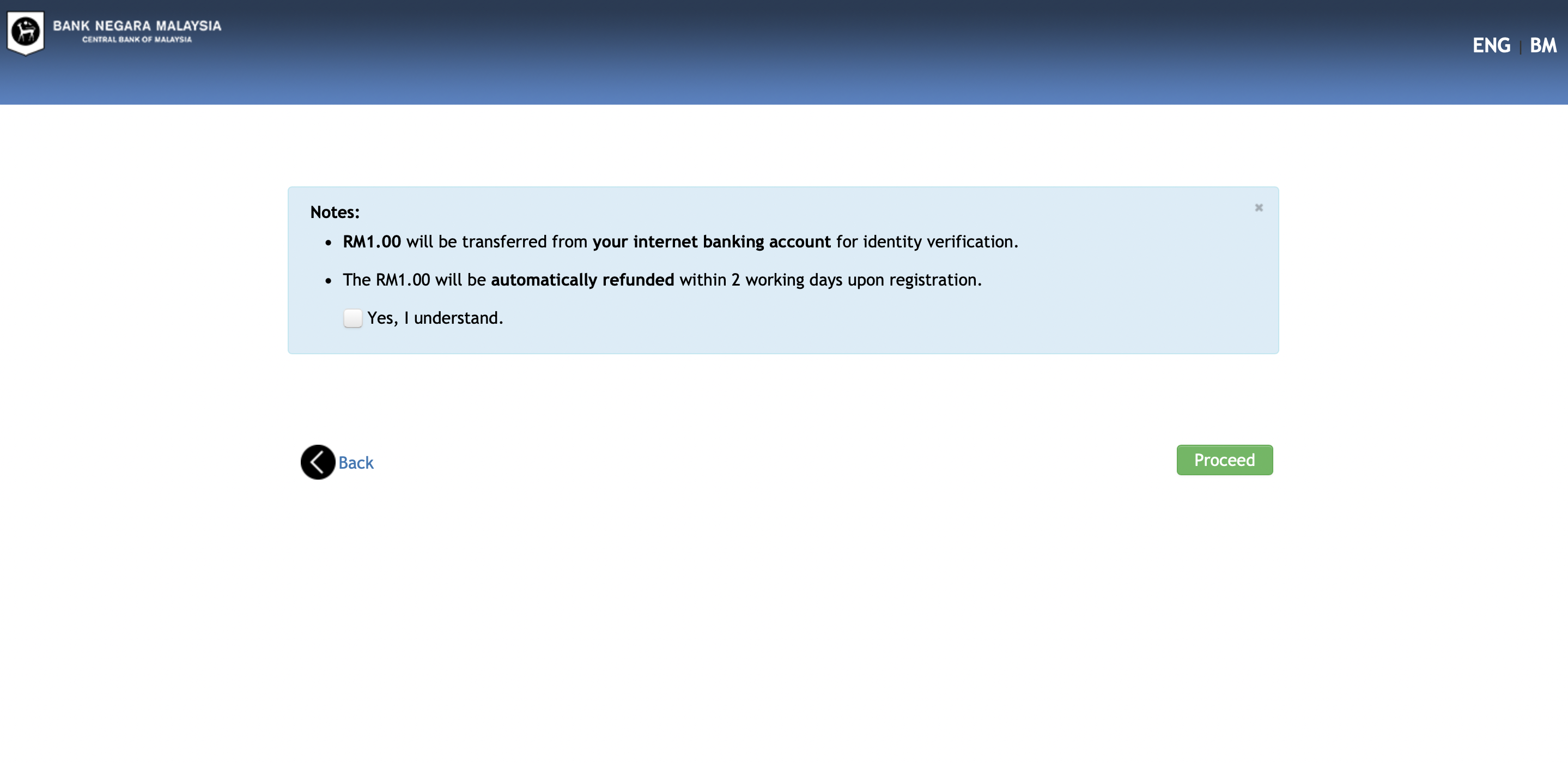

Step 3: As you proceed, please be informed that RM1.00 will be transferred from your internet banking account for verification purposes.

But don’t worry. This amount will be automatically refunded to you within 2 working days after registration.

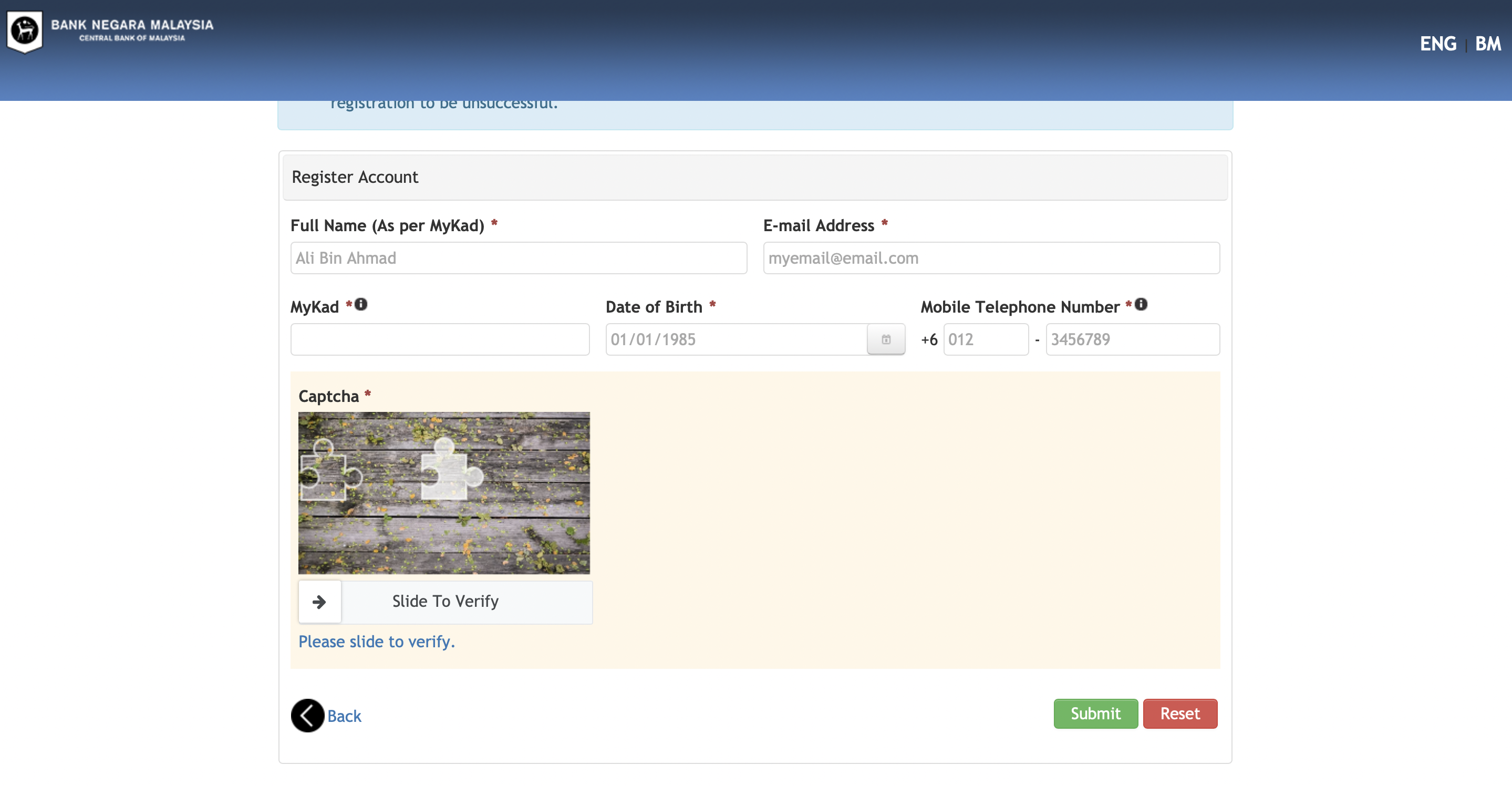

Step 4: A form will appear, prompting you to enter your personal information. Fill in the required fields, including your full name, IC number, birthdate, phone number, and email address.

Step 5: Review all the details you’ve entered. Ensure they are accurate and then agree to the Terms & Conditions.

Step 6: Complete the registration by making a one-off RM1 transfer to a designated Bank Negara Malaysia account. Remember, this amount will be refunded to you within two working days.

Step 7: Once the bank verifies your identity, you will receive a 6-digit OTP (One-Time Password) on both your registered mobile phone and email.

Step 8: At this point, one of these two screens will appear:

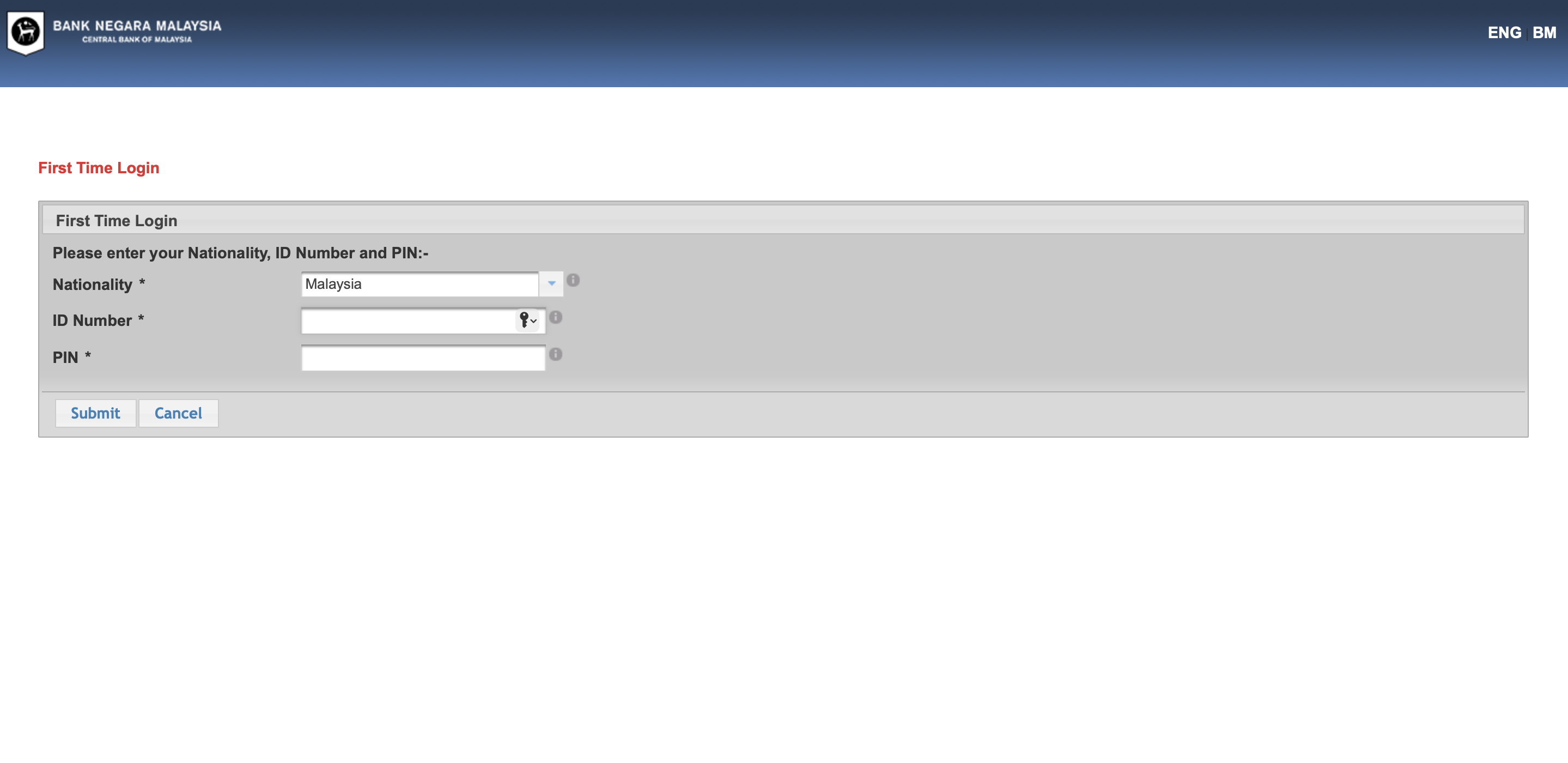

- A screen confirming that your eCCRIS account registration was successful. If you see this, click on ‘Proceed to First Time Login’

- The eCCRIS front page. If this is what you see, click on the ‘First Time Login’ option to continue

Step 9: Enter your IC number and the 6-digit OTP you received. Note that this OTP is valid for only seven days, so make sure to use it promptly.

Step 10: You’ll be prompted to set your User ID, email, and a secure password. Make sure to remember these details as you’ll need them to log in in the future.

Step 11: For added security, you’ll be asked to set a personal security picture, a security phrase, and answer some security questions. This information is crucial for future access to your CCRIS report, so choose something memorable.

Step 12: Your registration is now complete! You can now log into the eCCRIS website using the User ID you just created to access your CCRIS report.

How to check your credit history on eCCRIS?

Having completed your eCCRIS registration, you can proceed to the ‘Enquiry’ section to perform a self-enquiry regarding your credit history.

Once you select self-enquiry, you will be guided to a disclaimer page where you can check the ‘I agree’ box and then click ‘report enquiry’.

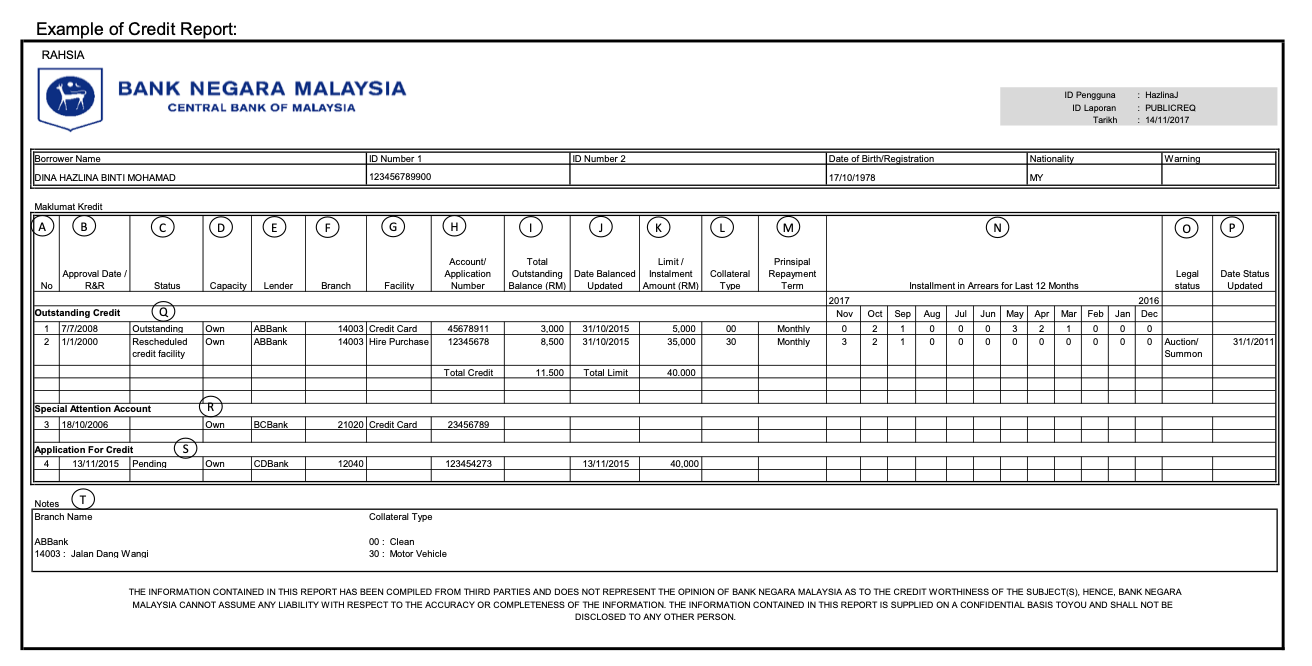

After that, you will be directed to your own eCCRIS report. For first timers, it may be hard to understand but thankfully BNM has provided an explanatory note for everyone to refer to.

Here’s the explanatory note:

A. Sequence number in the Credit Report:

B. Refers to:

- approval date for accounts under Outstanding Credit, Special Attention Account and Application For Credit that have been approved by the financial institutions;

- application date for applications under Application For Credit that are still pending for decision by the financial institutions; or

- restructured/rescheduled date based on when the account was first reported by financial institution as “Rescheduled” or “Restructured” whichever is earlier.

C. Credit status; example:-

- Outstanding: All outstanding credits obtained by the borrower.

- Rescheduled credit facility: The original payment schedule of the credit facility has been rescheduled.

- Facility restructured under AKPK.

D. Credit facility taken either directly by the borrower, joint borrower or obtained by sole proprietorship in which the borrower is the owner.

E. Financial institution which disbursed the credit.

F. Refers to the branch of the financial institution where the credit facility was obtained.

G. Type of credit facility such as credit card, charge card, housing loan, personal loan etc.

H. Reference number assigned by the financial institutions for the credit facility extended to the borrower.

I. Refers to total outstanding amount of the credit facility.

J. Refers to date when the total outstanding was last reported.

K. Refers to:

- total loan amount approved by the financial institution; or

- contractual obligation amount to be repaid by a borrower at successive fixed times until the total amount of debt is settled.

L. Type of collateral or security pledged for the credit facility.

M. Frequency of payments for each facility; i.e. monthly or weekly.

N. Refers to the payment records of the credit facility, e.g. O (no arrears), 1 (1 month in arrears), 2 (2 months in arears) etc.

O. Legal action taken against the borrower as a result of defaulted payments.

P. Refers to the latest date of the status of the legal action.

Q. Oustanding credit facilities taken by the borrower.

R. Credit facilities under close supervision by the financial institution.

S. Approved credit applications or applications pending for decisions, made over the last 12 months period.

T. Contains the explanation for the branch name of the lender and collateral

Now that you have access to your credit history, you can proactively prepare whenever you plan to apply for a housing loan or a credit card! :)