In a landmark decision made by the High Court, credit rating agency CTOS Data Systems Sdn Bhd (CTOS) has been ordered to pay a hefty sum of RM200,000 in damages for issuing an inaccurate credit score.

The decision was made by Judge Datuk Akhtar Tahir, who ruled that CTOS had overstepped its boundaries and failed to exercise duty of care for one of its customers, reported NST.

CTOS allegedly gave inaccurate credit score

The case which led to CTOS having to pay RM200,000 involved a businesswoman named Suriati Mohd Yusof, the owner of a resort in Pulau Perhentian.

In May 2019, Suriati tried applying for a car loan but got rejected due to a negative credit score issued by CTOS. When she probed further, she realised that the data collected and kept by CTOS were inaccurate.

In the lawsuit, Suriati claimed that CTOS’ credit score was based on inaccurate criteria which was not updated, causing her to suffer a loss of confidence from financial institutions.

However, CTOS counterclaimed by arguing that the information was given with Suriati’s consent and that any information given by CTOS was subjected to verification by the parties applying for the credit report.

Ordered to pay RM200,000 in damages

In his ruling, Akhtar said CTOS only had the authority to to be a repository of credit information that its subscribers have access to.

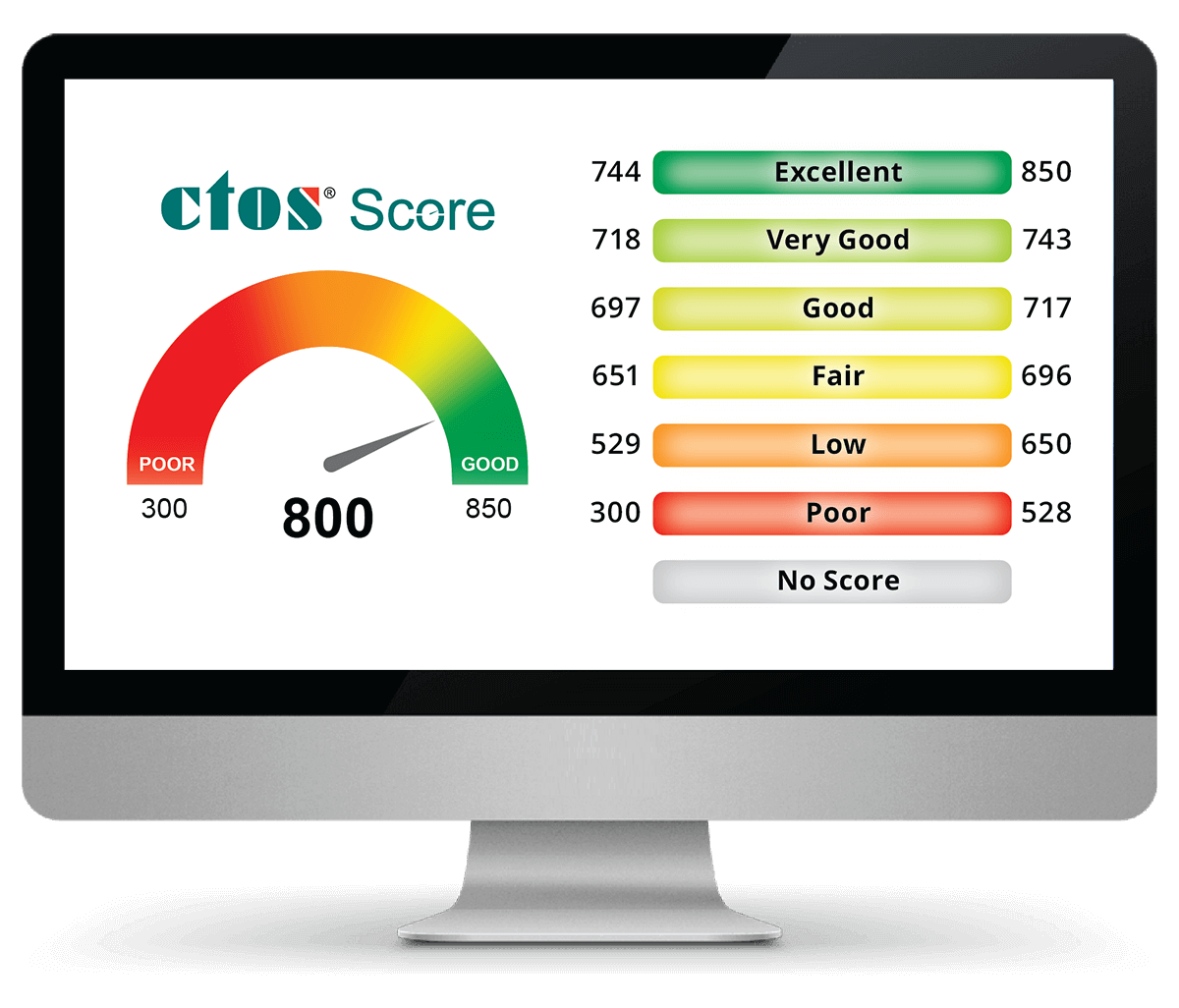

He added that there was no provision in the Credit Reporting Agencies Act 2010 (CRAA) which allowed CTOS to come up with its own credit score or create criteria/percentage in formulating a credit score.

CTOS’s main role is to collect, record, hold and store the information received. The company is also empowered to disseminate the information to its subscribers, and this includes financial institutions.

“By formulating a credit score, CTOS has gone beyond its statutory functions,” he said.

Akhtar also ruled that CTOS had deliberately ignored Suriati and continued to base her credit score on inaccurate information.

“Accurate information provided by the defendant was vital in the decision making of financial institutions. The defendant therefore had a duty to provide accurate credit information not only to the financial institutions but also to persons concerned against whom the information was related to.

“The plaintiff had evidence that the defendant was alerted that the information against her was inaccurate.

“The evidence in this case shows that the defendant chose to ignore the communication from the plaintiff and continued to maintain the said information.”

In addition to the damages, the court also awarded RM50,000 in costs to Suriati.

CTOS files appeal

FMT later reported that CTOS has since filed an appeal, where it hopes to overturn the court’s decision.

In a Bursa filing issued by CTOS, it said its board of directors was advised that there was basis for an appeal.

“(The company) consequently lodged a notice of appeal to the Court of Appeal. No material losses (are) anticipated as a result of this matter and no provisions shall be required.”

READ ALSO: