Retirement may seem like a far-off chapter, but securing a stable financial future requires early planning.

For Malaysians, the Employees Provident Fund (EPF) provides a foundation, yet with rising living costs, it’s essential to set realistic and robust savings goals to retire comfortably.

Recently, a user on the platform X, known as The Futurist, shared insights into ideal EPF savings benchmarks for Malaysians, sparking conversations on how to strategically approach retirement.

Alongside their suggestions, a story emerged about a young Malaysian who accumulated nearly RM2 million in her EPF by the age of 35, showcasing how disciplined saving can turn future dreams into achievable goals.

Ideal EPF savings goals by age 35: A breakdown

To build a strong financial foundation, The Futurist recommends Malaysians aim for the following EPF savings milestones by age 35:

- Save at Least RM57,000 in Account 1

Account 1 is reserved for long-term retirement savings, and reaching RM57,000 by 35 lays a crucial foundation for future needs. - Achieve RM76,000 in Total EPF Savings

This includes the balance across all EPF accounts—Account 1, Account 2, and the Flexible Account. While Account 2 can be used for education, housing, or medical expenses, maintaining this savings level ensures a secure retirement path. - Set a Long-Term Goal of RM240,000 in Account 1 by Age 55

Reaching these early benchmarks can help Malaysians amass RM240,000 in Account 1 by 55. With an EPF dividend rate of 5.50% annually, this amount would generate approximately RM1,100 in monthly dividends, providing retirees with a steady income stream to cover basic living expenses.

An inspiring success story: Reaching RM2 Million in EPF by age 35

Another story gaining traction online is that of a Malaysian woman who managed to save nearly RM2 million in her EPF account by 35.

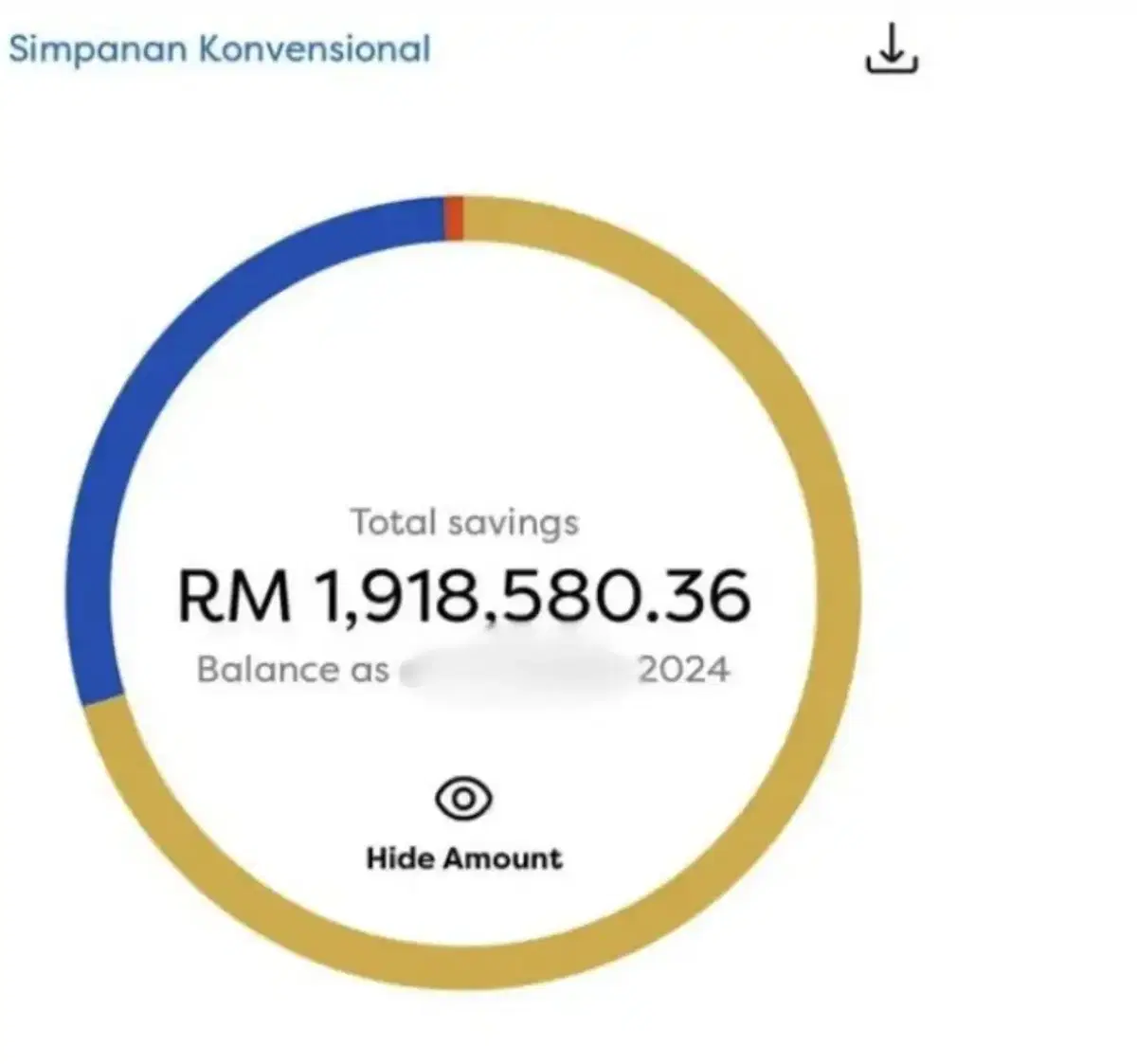

Her post, which included a snapshot showing a total of RM1,918,580.36 across her Retirement, Sejahtera, and Flexible Accounts, has captured widespread attention.

Unlike the trend of job-hopping, she stayed with the same company since the beginning of her career, benefiting from consistent promotions and salary increases.

Her approach didn’t stop there; she maximised her EPF savings by contributing up to RM100,000 annually, pushing her retirement savings to new heights.

While eligible to withdraw over RM1 million, she chose to leave her savings untouched, capitalising on the compounded growth from the EPF’s annual dividends. Her story reflects how dedication to long-term savings goals can set the stage for a secure financial future.