Bank Negara Malaysia (BNM) and the Monetary Authority of Singapore (MAS) have officially linked Malaysia’s DuitNow and Singapore’s PayNow real-time payment systems.

This follows the earlier announcement on March 31, 2023, about enabling cross-border QR payments for merchants.

DuitNow Can transfer up to RM3,000 daily

The launch was commemorated at the Singapore FinTech Festival, where BNM Governor Datuk Abdul Rasheed Ghaffour and MAS Managing Director Mr. Ravi Menon conducted live cross-border fund transfers.

The DuitNow-PayNow linkage facilitates instant, secure, and economical peer-to-peer (P2P) fund transfers and remittances between Malaysia and Singapore.

Notably, it’s the first real-time payment system linkage to involve non-bank financial institutions from both countries, expanding access to a wider user base.

Now, consumers of participating financial institutions can transfer funds up to RM3,000 or S$1,000 daily using just the recipient’s mobile number or Virtual Payment Address (VPA).

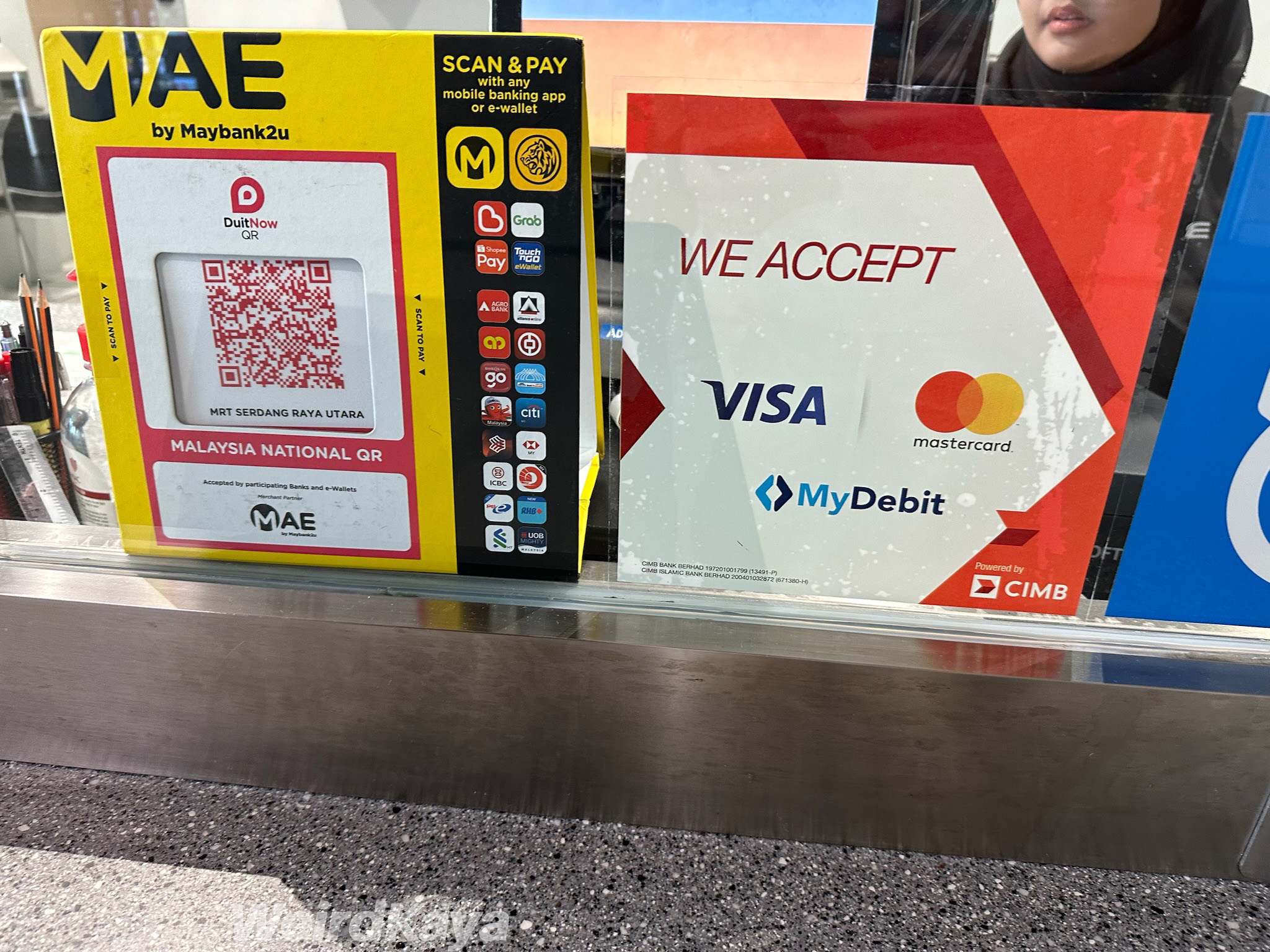

Maybank, CIMB & TnG Digital users will be the first to access

In Malaysia, Maybank, CIMB, and TNG Digital’s users will be the first to access this service, with plans to incorporate more financial institutions gradually.

In Singapore, the service will roll out in phases at Liquid Group, Maybank Singapore, OCBC, and UOB, with gradual expansion of eligible user groups through January 2024, aiding customer familiarization with the new service.

According to BNM, this linkage, a result of comprehensive collaboration among central banks, payment system operators, scheme owners, and participating financial institutions, marks a significant achievement in enhancing the efficiency, accessibility, and transparency of cross-border payments.

In 2022 alone, P2P and remittance transactions between the two countries reached RM7.8 billion.

Governor Ghaffour highlighted the immense benefits of fast, secure, and cost-efficient cross-border payments, particularly for individuals and small businesses in closely connected economies like Malaysia and Singapore.

The DuitNow-PayNow linkage is seen as a step towards shared growth and a foundation for scalable cross-border payment networks in ASEAN and beyond.

Mr. Menon reiterated the linkage as a realization of Singapore and Malaysia’s joint goal to ease cross-border payments, advancing ASEAN’s vision for regional payment interconnectivity.