Effective January 1, 2024, Malaysia will introduce a 10% sales tax on online purchases for items priced at RM500 or below, signalling the end of a suspension period for this tax regulation.

Originally planned for implementation on April 1 of the current year, this change impacts all online goods entering Malaysia by air, sea, or land routes, under the Sales Tax Act of 2018. However, the tax excludes certain items due to their nature.

Exemptions include cigarettes, tobacco products, intoxicating liquors, smoking pipes including pipe bowls, electronic cigarettes, similar personal vaporizing devices, and preparations for these devices, such as liquids or gels, with or without nicotine.

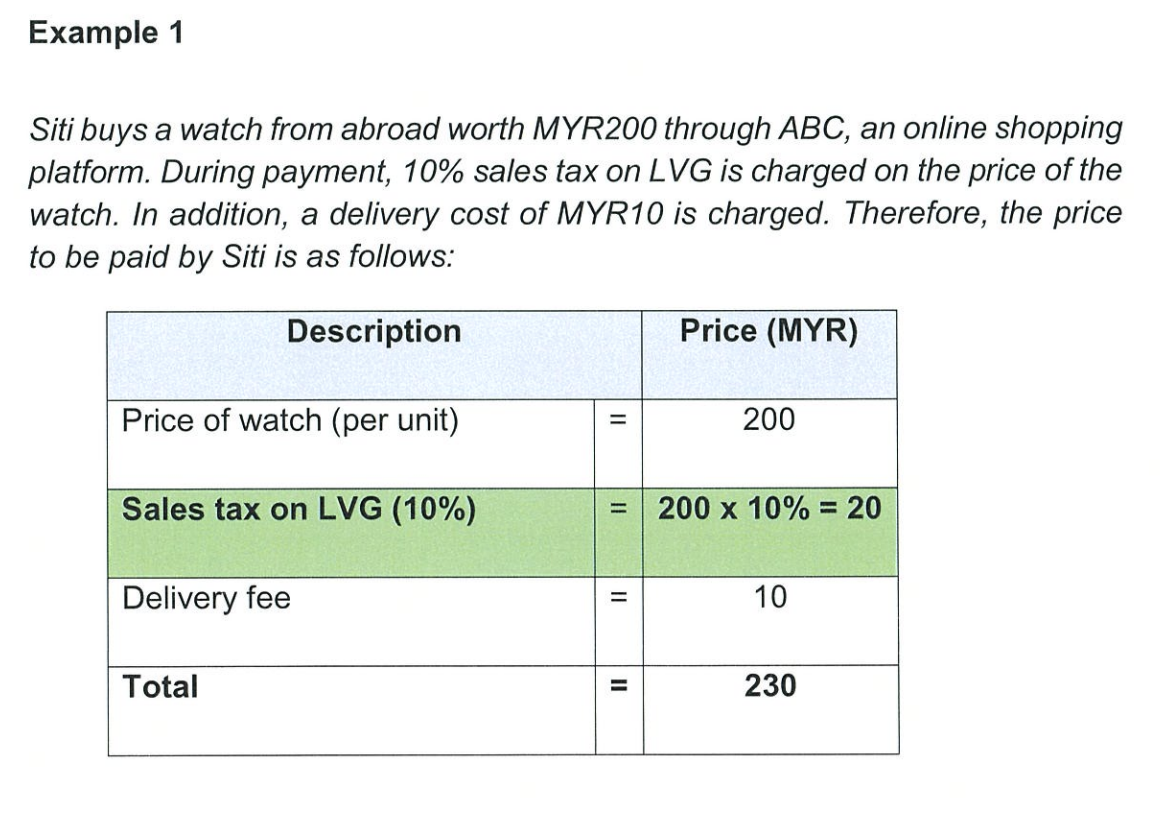

Termed the ‘Low Value Goods (LVG) Tax,’ it applies only to the sale value of goods, excluding additional costs like taxes, duties, or shipping and insurance fees.

The Royal Malaysian Customs Department has released a detailed document clarifying the new tax.

First announced in the 2022 Budget, this fiscal measure received official endorsement from Datuk Seri Anwar Ibrahim, Prime Minister and Minister of Finance, through the signing of the Federal Government Gazette on December 4, with a public release on December 8.

As per the document, vendors with annual sales exceeding RM500,000 from these imported low value goods must register with the Customs Department under the Sales Tax Act 2018.

Malaysia joins countries like Australia, Switzerland, New Zealand, Norway, and the United Kingdom in implementing similar taxes on low-value online purchases.

Read more: