Insurance is supposed to provide peace of mind, offering financial protection during unexpected events such as accidents or illnesses. Policyholders trust that their insurance company will uphold their promises, ensuring that claims are processed smoothly and efficiently.

However, when this trust is broken, the consequences can be both financially and emotionally devastating.

M’sian woman claims insurance company refused to foot RM19k hospital bill

A Malaysian woman recently took to Facebook to share a deeply disappointing and frustrating experience she and her husband had with their insurance company, sparking a wave of reactions and raising concerns about the reliability of insurance claims in the country.

She begins her post with palpable frustration, “Today, I am sharing with disappointment the case that happened to my husband a few months ago. I want to share how dangerous it can be when you face something like this with our insurance provider.”

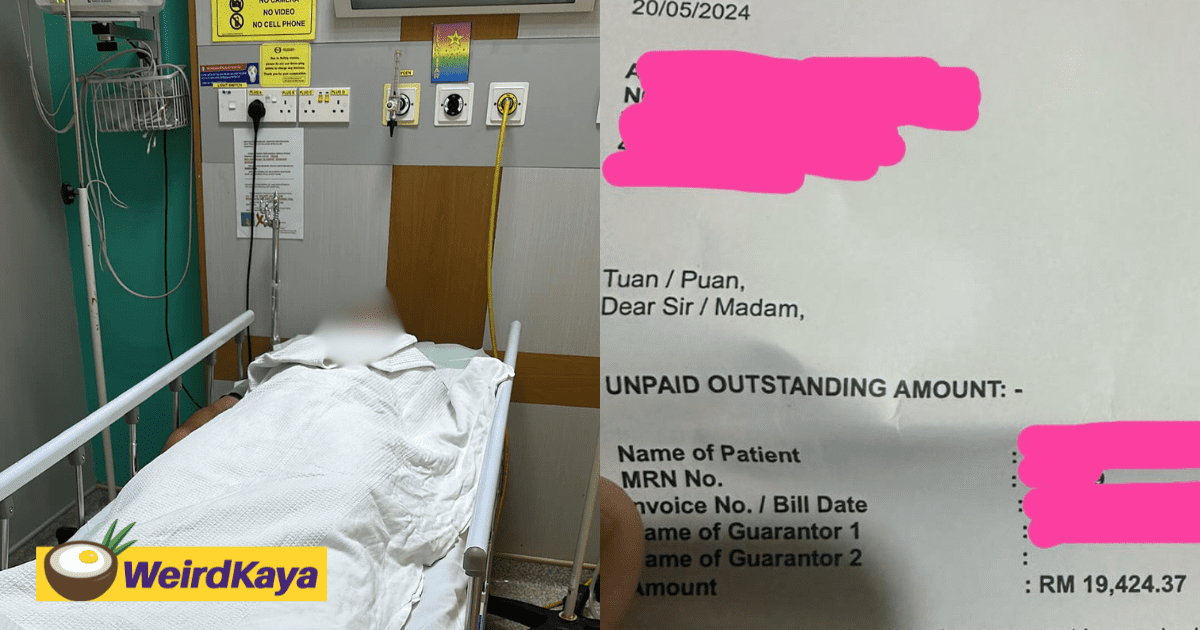

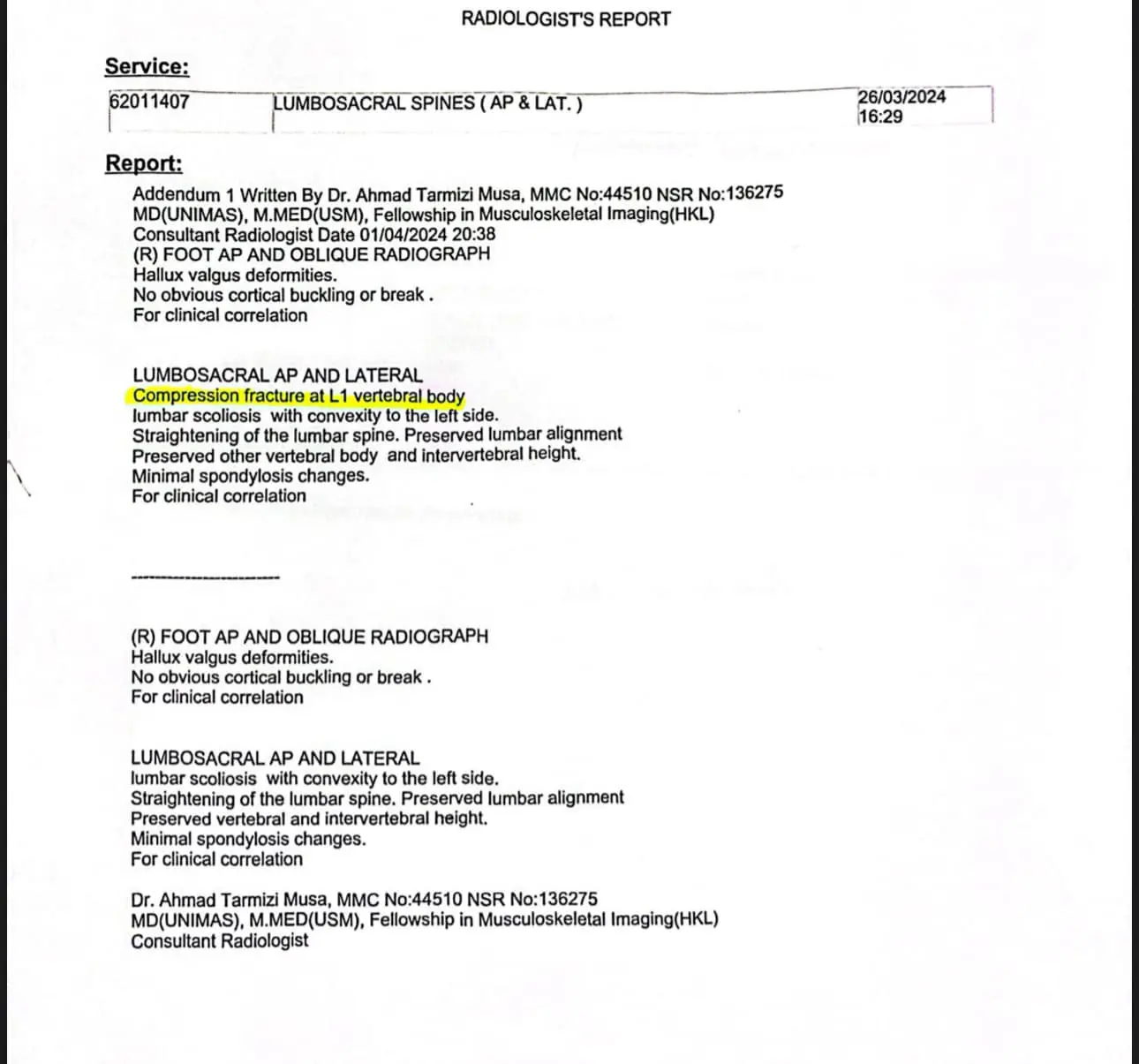

According to her post, her husband had a severe accident where he fell from the first floor of a building. Given the severity of the fall, they immediately sought treatment at a private hospital.

Having been loyal customers of this insurance company for nearly five years, this was the first instance they needed to claim their medical insurance.

The approved Guarantee Letter rejected

Initially, things seemed to be going smoothly. The Guarantee Letter (GL) requested by the hospital was promptly approved by the insurance company, and her husband was admitted.

However, the relief was short-lived. Despite multiple GLs being approved during his 7-day hospital stay, the situation took a drastic turn upon discharge.

On the day of discharge, they were informed by the hospital staff that they needed to deposit RM400 as a precautionary measure for any costs that might not be covered by insurance.

They complied and returned home, expecting a straightforward claims process. However, they were soon informed that all the previously approved GLs had been DECLINED by the insurance company.

The reason: The treatment could have been done as an outpatient

The reason given? The insurer stated that the treatment could have been done as an outpatient, despite it being an accident requiring immediate and specialised medical attention.

The woman expressed her utter disbelief and frustration:

“The hospital even sent a demand letter from their lawyer to claim the bill, but the insurance company remained silent. How can a Guarantee Letter that was approved suddenly change status to DECLINED? Isn’t this like putting a gun to the patient’s head?”

She detailed the financial nightmare they faced:

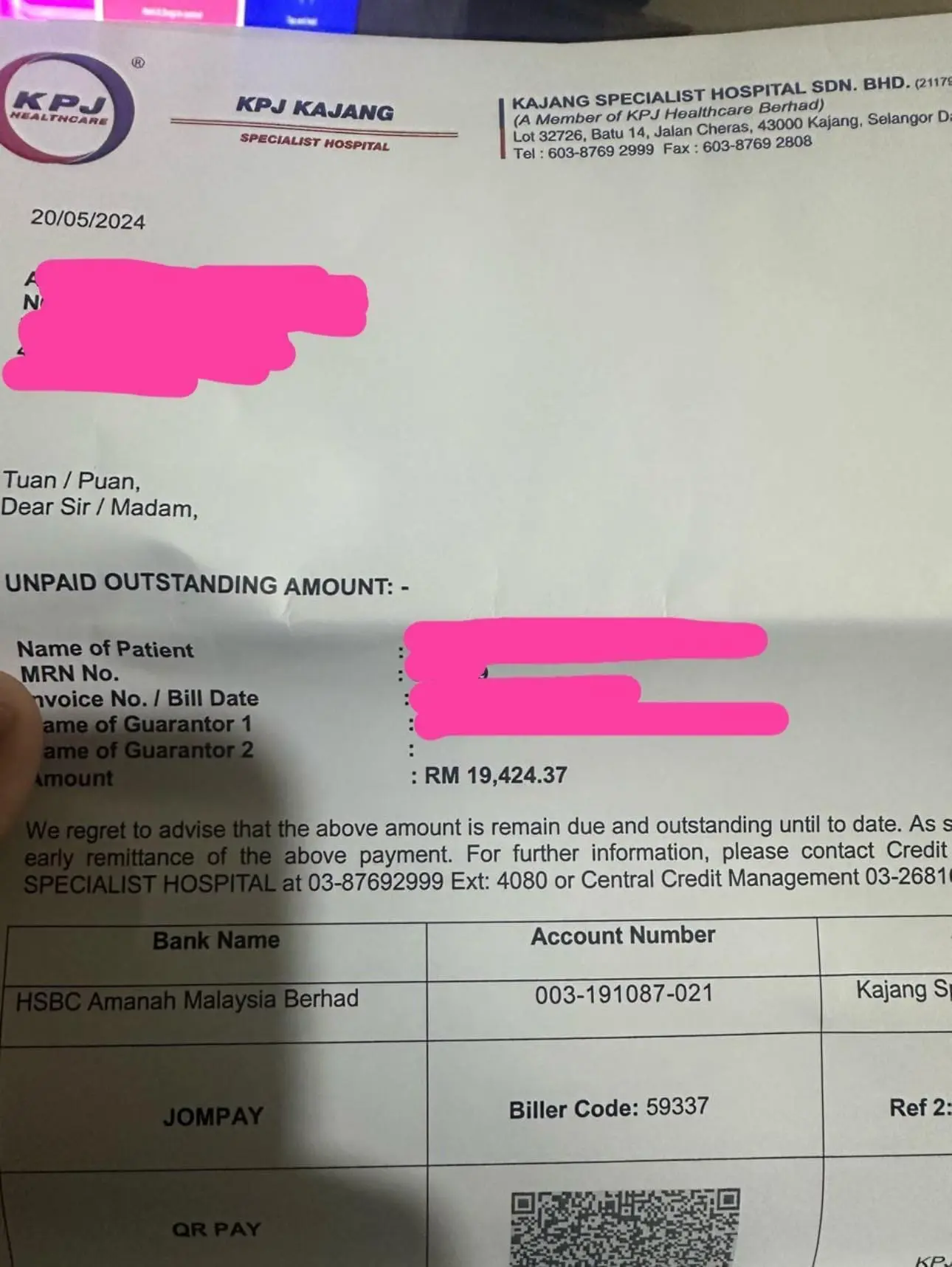

- Initially, they had to deposit RM400 on the discharge day.

- The total hospital bill amounted to RM19,424.37.

- The insurance company did not cover a single cent of the expenses.

- Despite numerous follow-ups through calls and emails, they received no satisfactory response.

- The hospital even sent a demand letter from their lawyer to claim the bill, but the insurance company remained silent.

With a total hospital bill amounting to RM19,424.37, and the insurance company not covering a single cent, the woman and her husband found themselves trapped in an unexpected and enormous debt.

‘I wouldn’t have proceeded with any treatment under a private hospital‘

Despite numerous follow-ups through calls and emails, they received no satisfactory response from the insurer.

“We’ve called and emailed, but due to being busy with work, we haven’t had time to go to their HQ. The problem with this big insurance company, which has so many sales agents, is that suddenly everything related to claims becomes LOUSY.”

She ended her post with a desperate plea: “Please, anyone who has had a similar problem with your insurance, can you advise what should be done? Seriously, this is a SCAM!”

In her latest update, the woman demands a firm answer from the insurance company, questioning why their initially approved GL was later rejected.

“If the insurance company had DECLINED my GL at first, I wouldn’t have proceeded with any treatment under a private hospital. This is something my husband and I DID NOT WANT. Suddenly we are trapped with this much DEBT. Put yourself in my situation. How would you feel?”