“What car should someone earning RM2,000 drive then?”

That was the question one Malaysian man threw back at netizens after being told that buying a Honda City on a RM5,000 salary was a financial mistake.

His reply quickly sparked a wider online conversation, not just about car choices, but about what life as Malaysia’s M40 really looks like.

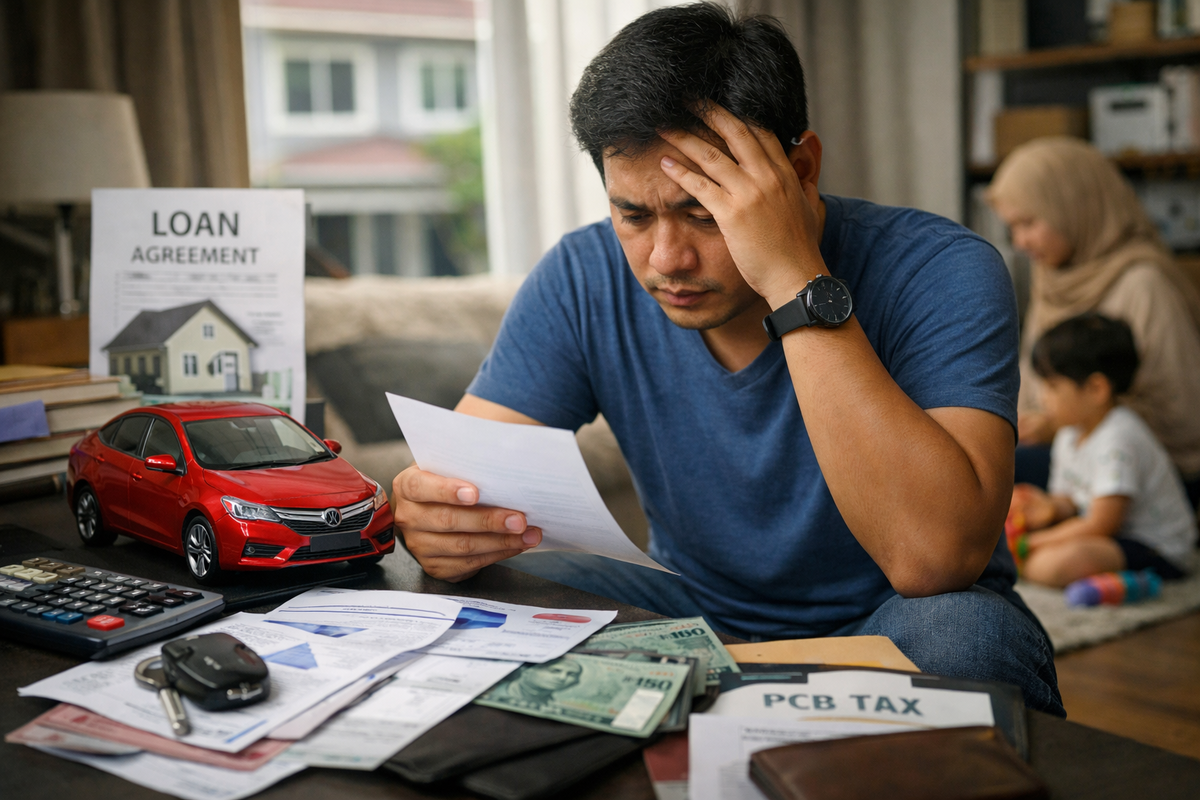

The man described himself as an ordinary kid who studied hard, earned a degree, and eventually landed a job paying RM5,500 a month. A number many would assume signals stability.

But once real-life commitments entered the picture, he realised how quickly that salary shrank.

A “decent salary” that shrinks fast

With a stable job, he wanted a car that matched his professional needs. He applied for a low-spec Honda City, with monthly instalments of RM900.

Next came housing. He did not qualify for PPR or other subsidised housing schemes, so he purchased a RM300,000 home under a 30-year loan, where his monthly repayments were RM1,450.

He later got married. His wife became a full-time homemaker and gave birth to two children. After car and house payments, his RM5,500 salary left him with around RM2,000.

Not eligible for aid, not able to relax

The man attempted to enrol his children into a KEMAS kindergarten but was told he did not qualify under the system. With no alternative, he turned to private kindergartens instead.

With each child costing RM500, he paid RM1,000 per month, which did not include annual fees, uniforms, books, or school activities.

He shared that he receives small amounts of STR assistance occasionally, but it barely stretches far.

One trip to the supermarket only fills a quarter of a trolley. Yet my PCB tax deductions feel like I’m earning a Datuk-level salary.”

Eventually, financial pressure pushed his wife to start working. He sold his Honda City and downgraded to a Perodua Bezza to reduce commitments.

Even when he later received a salary increment, his net take-home pay remained almost the same, pushed into a higher tax bracket, cancelling out the raise.

“For my children, I swallowed my ego. I cut lifestyle, desires, and dreams. That’s the M40 life. Not poor, but always tight. Not eligible for aid, yet among the biggest contributors.”

The Honda City debate

Many netizens zoomed in on one detail, the Honda City.

Some criticised his financial planning.

‘If your salary is RM5k, you should be driving a car with RM400 to RM500 monthly instalments,’ one comment read.

Another said, ‘I earn more than this and still drive an old Persona. You need better research before committing.‘

Others were less sympathetic, arguing that his stress was simply the result of personal choices.

In the face of harsh criticism, the man gave the following reply: “If a RM5,000 salary can’t afford a Honda City, then what car should someone earning RM2,000 drive? Show me a car with RM200 monthly instalments.”

Support from those who relate

Not all reactions were critical. Many Malaysians expressed empathy, saying his story reflected the reality of being stuck in the middle.

‘M40 is the most overlooked group. Not poor enough for B40 benefits, not rich enough to live comfortably,‘ one user commented.

Another shared his own approach:

‘I earn RM6k+. I bought a second-hand Wira for RM5k. My money goes to house payments, family support, savings, and investments. Cars depreciate yearly. Downgrading isn’t shameful.’