The Japanese yen has dropped to its weakest level in 38 years, causing quite a buzz in financial circles.

What happened?

Bloomberg reported that this drop is mainly due to Japan’s persistently low interest rates, especially when compared to the higher rates in other major economies.

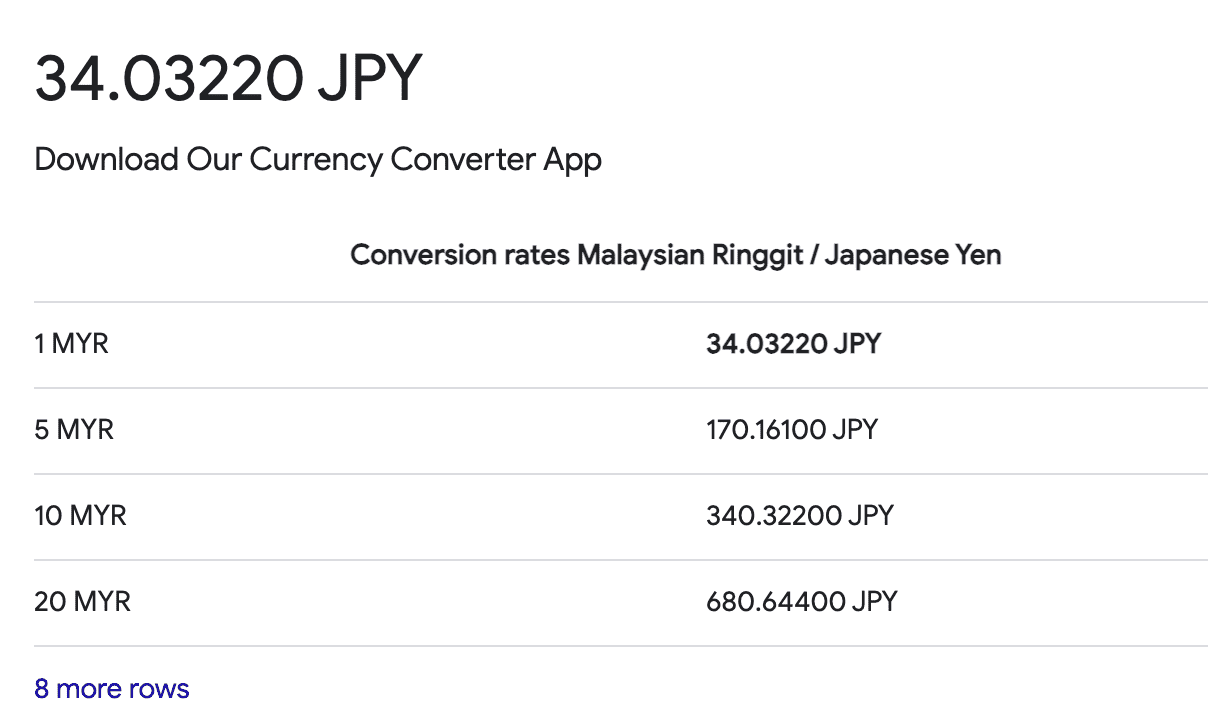

According to Wise, the yen trades at RM1 to 34.03 Japanese Yen and this significant fall harks back to the early 1990s when Japan’s economy faced a similar decline after its asset bubble burst.

Japan’s Finance Minister, Shunichi Suzuki, has warned of potential “decisive steps” to stabilize the currency, showing the government’s serious concern over this rapid depreciation.

The Bank of Japan (BOJ) has kept interest rates low to boost economic growth, which, combined with rising US rates, has increased demand for dollars, weakening the yen further.

Cheaper to travel to Japan now

A weaker yen affects Japan’s economy in several ways. On the plus side, it makes Japanese products cheaper and more attractive on the global market, potentially boosting export sales.

Read also: Japanese Woman Tries Making Ramen, Accidentally Invents ‘Cendol Soup’

For Malaysians, the yen’s drop brings some exciting opportunities.

If you’re planning a trip to Japan, your ringgit will stretch much further, making everything from sushi to souvenirs more affordable.

The yen’s decline also has broader implications for Malaysia. While Japanese goods become cheaper and more competitive, Malaysian imports from Japan will be pricier, which could increase inflation at home.

But for now, let’s focus on the travel perks and the thrill of a more affordable Japanese adventure!