The Employees Provident Fund (EPF) has declared an overhaul of its members’ accounts starting 11 May 2024. This restructuring aims to improve financial security for members post-retirement and cater to their present life cycle requirements.

Introduction of Account 3

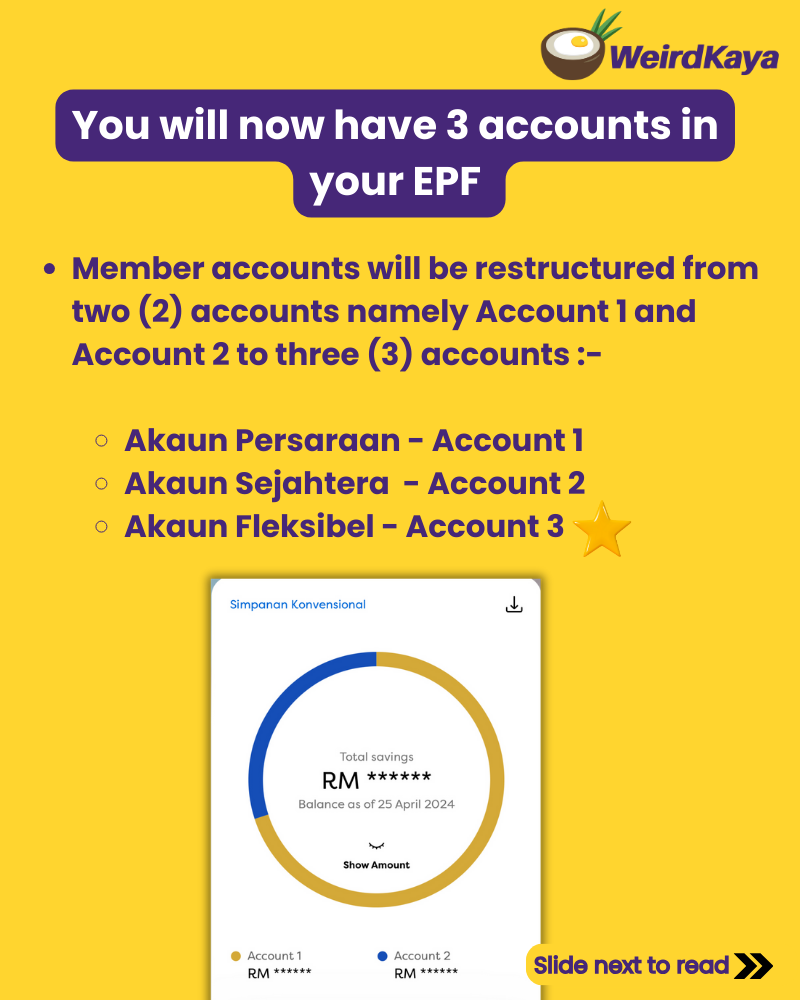

The restructuring of member accounts by the Employees Provident Fund (EPF) effective 11 May 2024 will transition from the existing two-account system—Account 1 and Account 2—to a three-account framework.

This includes:

- Akaun Persaraan: Designed to accumulate savings that will provide a stable income during retirement.

- Akaun Sejahtera: Focused on meeting life cycle needs that enhance wellbeing in retirement.

- Akaun Fleksibel: A new addition that offers flexibility for short-term financial requirements, allowing withdrawals at any time based on members’ needs.

Account Fleksibel – How it works?

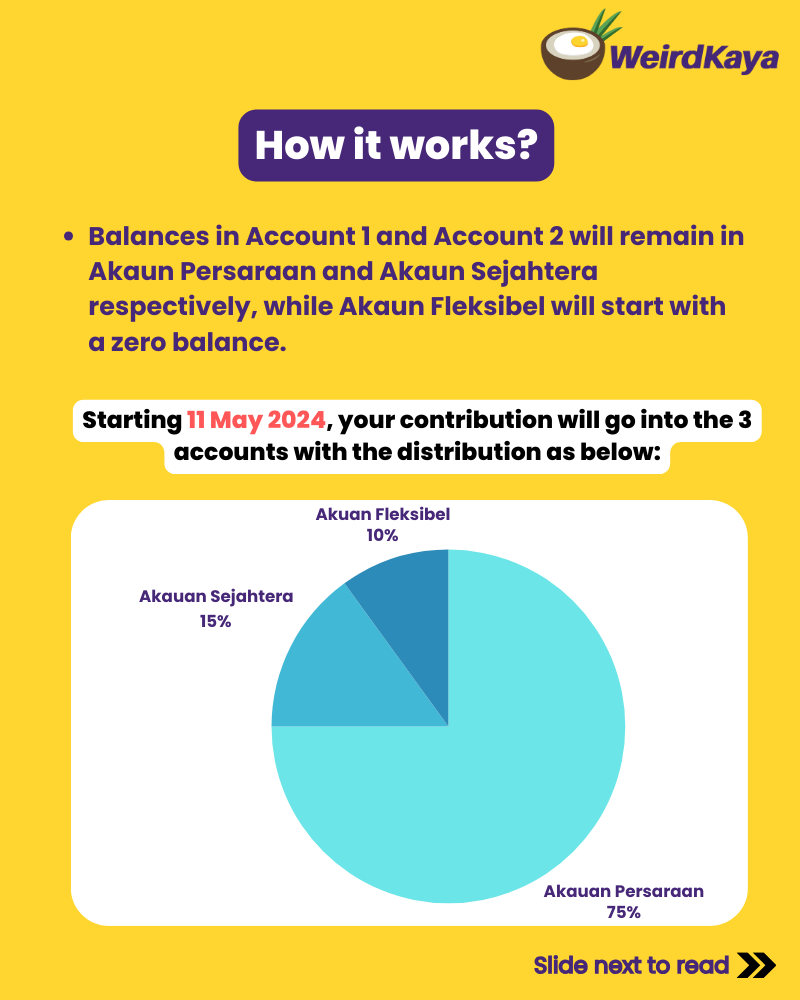

Existing balances in Account 1 and Account 2 will be transferred to Akaun Persaraan and Akaun Sejahtera, respectively.

Following the restructuring on 11 May 2024, all future contributions will be distributed across the three accounts as follows: 75% will be allocated to Akaun Persaraan, 15% to Akaun Sejahtera, and 10% to Akaun Fleksibel.

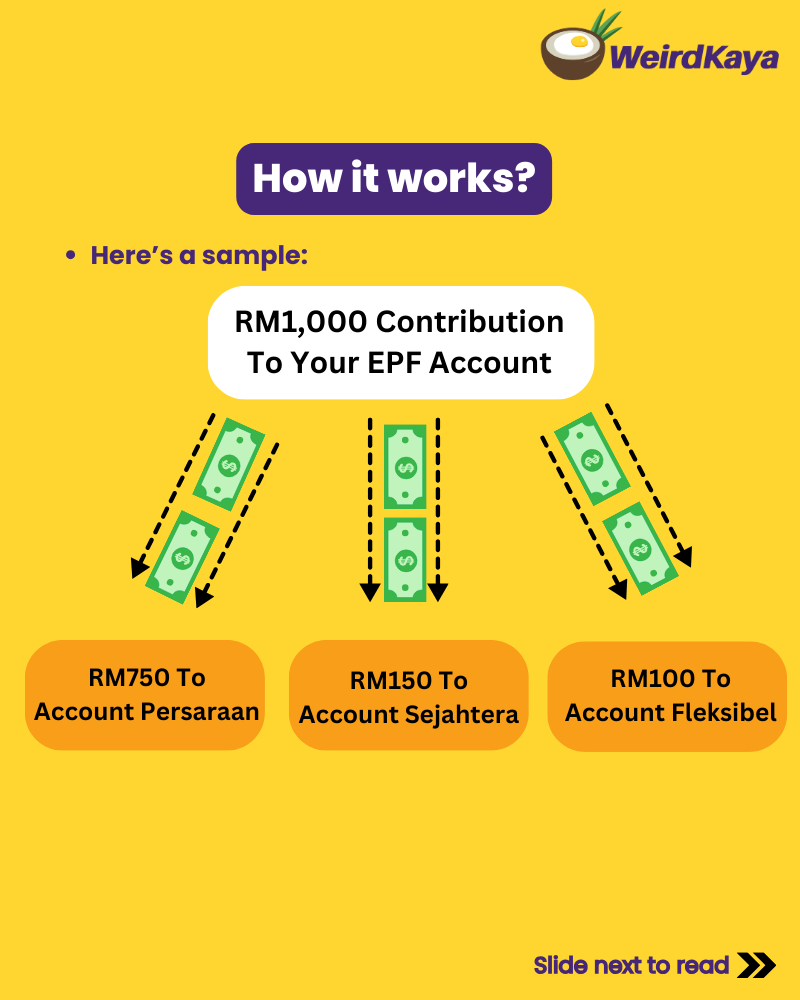

Here’s a sample of what your contribution will look like starting 11 May 2024:

Your account 3 will start from RM0

The new Akaun Fleksibel will begin with a zero balance.

Read also: EPF Officially Rolls Out Account 3 To Its Members

However, from 11 May 2024 to 31 August 2024, members are granted a one-time option to transfer a portion of their savings from Akaun Sejahtera (formerly Account 2) into Akaun Fleksibel as an initial deposit. If members do not opt to transfer funds during this period, the existing balance will remain in Akaun Sejahtera, with no transfers made to Akaun Fleksibel.

If your Account 2 has more than RM3,000:

If your Account 2 has less than RM3,000: