If you’ve ever tried applying for a credit card but got hit with a rejection letter instead, you’re not alone.

A recent TikTok by Financial Faiz broke down the not-so-obvious reasons why some Malaysians, despite earning more than RM2,000 a month, still get turned down.

“My salary is RM2,200. Why is it not enough?”

According to Faiz, while Bank Negara Malaysia (BNM) has set RM2,000 as the minimum salary requirement to apply for a credit card, that doesn’t mean all banks will accept it.

Why? Because banks are private entities. They can set their own criteria, including requiring a higher minimum income.

So even if your salary exceeds RM2,000, it might still fall short of what a particular bank expects.

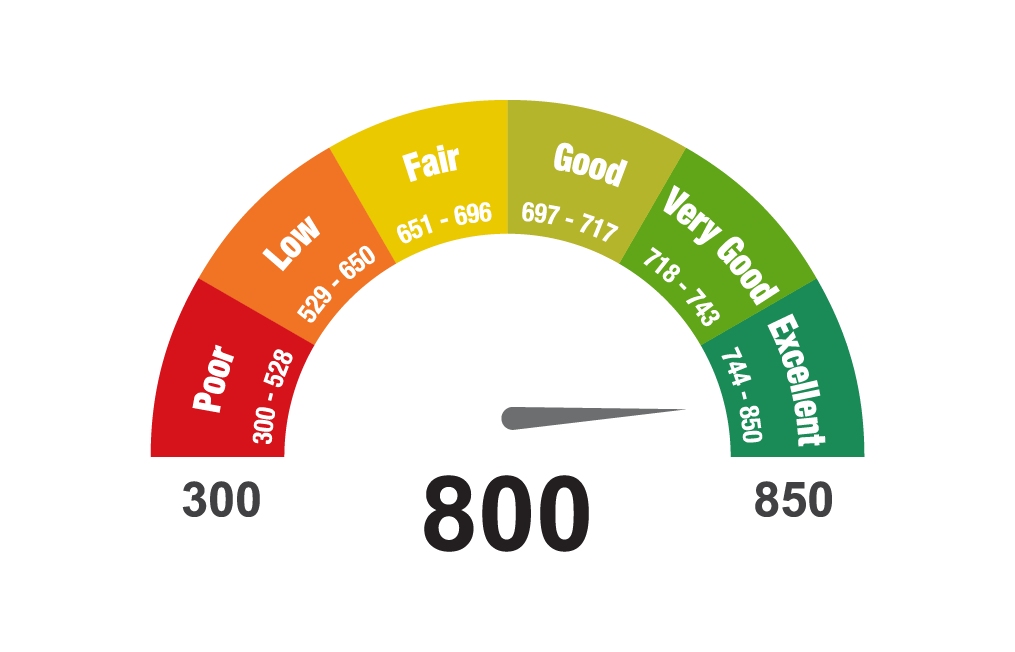

Bad CCRIS or CTOS record? You’re in trouble

Another major reason people get rejected is due to their CCRIS or CTOS credit reports. Some banks might be lenient about one late payment, while others might immediately blacklist you for it.

Whenever you apply for a credit card, the bank will first check your income through your EPF statement.

But before they give the green light, your credit report goes through a credit assessor to determine if your financial history makes you a worthy candidate.

High salary & high debt

You could be earning RM10,000 a month and still get rejected if your Debt Service Ratio (DSR) is too high.

Let’s say you’re paying RM8,000 in loan repayments every month. That doesn’t leave much room for the bank to confidently offer you credit.

Banks want to ensure you won’t default on credit card payments. A heavy debt load, even if managed well, might still raise red flags.

Too clean? Yes, that’s a thing

Here’s something ironic. Even if you don’t have any existing loans or credit cards, some banks might still reject you.

Why? Because your credit report is too clean, meaning they don’t have any record of how you manage credit.

If you’re in this situation, Faiz suggests applying for a secured (or pledged) credit card.

For example, if you have RM10,000 in cash, you can put it in a fixed deposit (FD) and ask the bank to issue you a credit card backed by that amount. If you fail to pay, the bank takes from the FD. Plus, your FD still earns interest.

Sometimes, you’ll never know why

Frustratingly, banks are not obligated to tell you why your application was rejected. Each person might be rejected for different reasons, and unless you ask or dig deeper, the exact cause might remain a mystery.

So if you’re planning to apply for a credit card soon, check your financial health first. Don’t just look at your salary.

Clean up your credit report, manage your debts wisely, and if needed, start small with a pledged card to build your credit score.