The World Bank has recommended that Malaysia consider raising the Employees Provident Fund (EPF) withdrawal age to between 65 and 70 to help Malaysians retire with stronger and more sustainable savings.

This suggestion comes from the World Bank’s latest policy brief, which highlights how Malaysians are living longer, withdrawing early, and often running out of EPF money within a few years.

Withdrawing at 55yo but living much longer

At present, Malaysian EPF members can make a full withdrawal of their savings once they reach age 55, giving them the legal option to access the bulk of their retirement funds at that age.

According to the report, many Malaysians withdraw their entire EPF savings as soon as they turn 55.

The World Bank notes that these balances are usually exhausted within three to five years, leaving retirees with little long-term financial security.

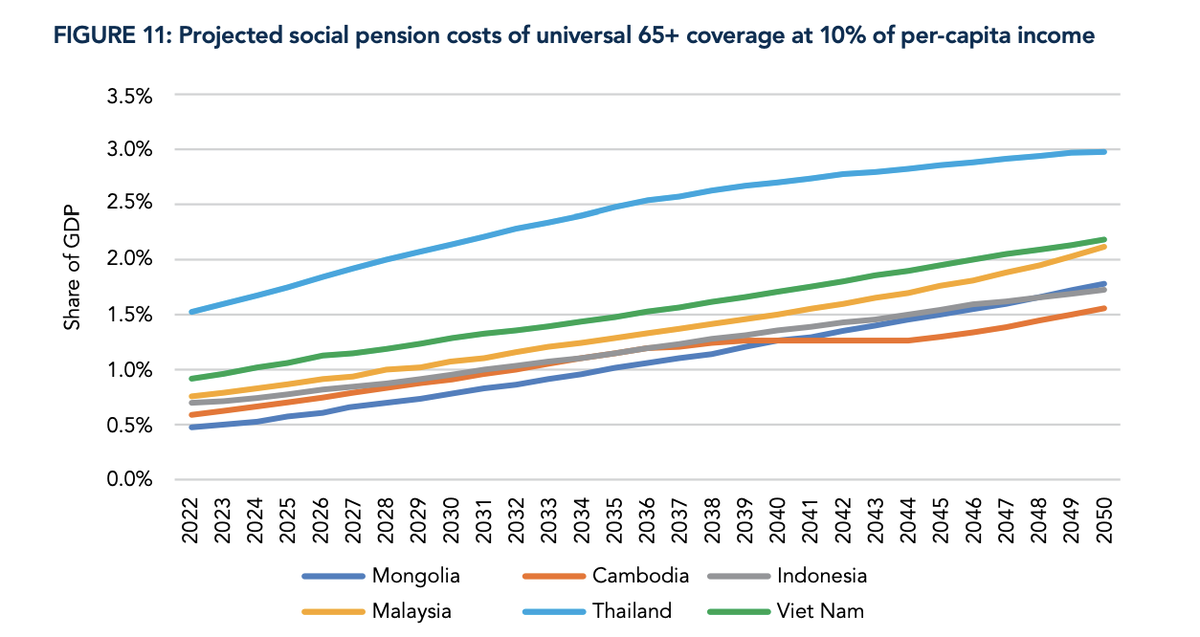

The report noted that Malaysia is ageing rapidly and will see its population aged 65 and above double between 2020 and the mid 2040s.

With longer life spans and low savings, retiring early is becoming financially risky for many households.

Why withdrawal age should be higher

The recommendation to raise the EPF withdrawal age to 65–70 is based on several factors:

1. Longer investment period

Keeping money invested for an extra 10 to 15 years can significantly boost compound returns.

2. Retirement savings last longer

A later withdrawal age reduces the chances of retirees depleting their savings too quickly.

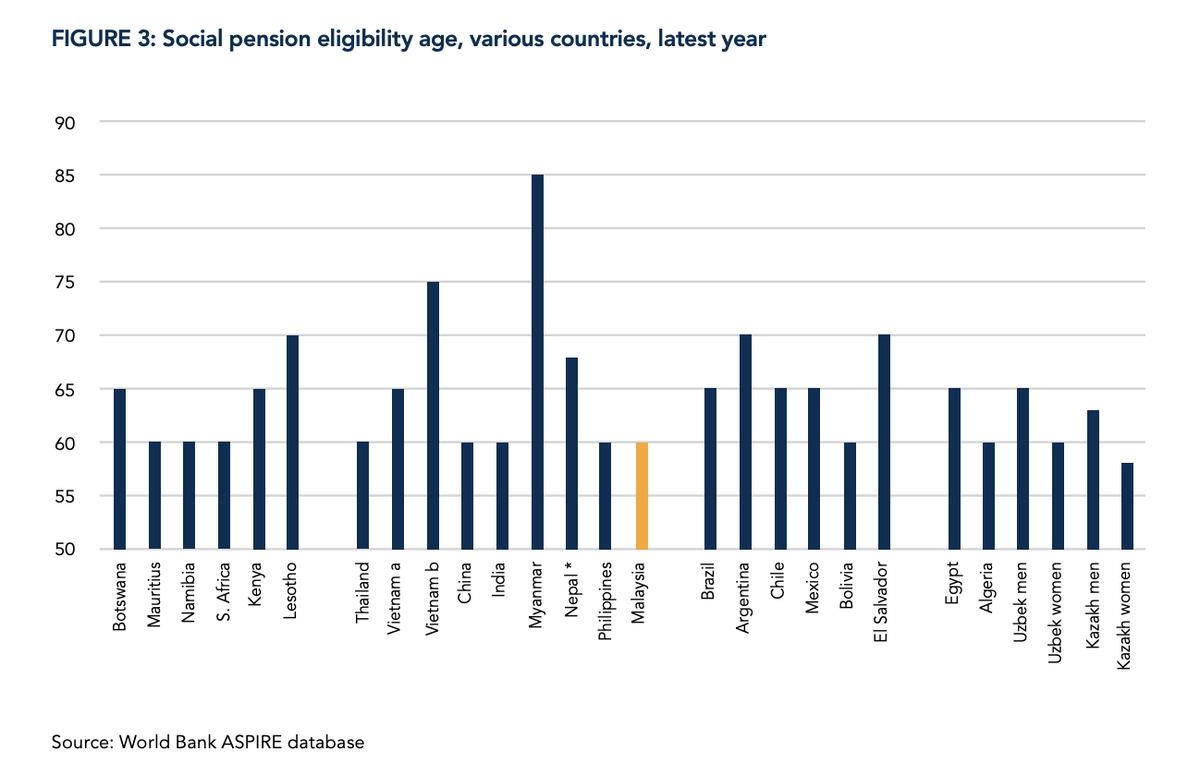

3. Matches global trends

Many countries have already pushed retirement ages higher due to ageing populations and longer life expectancy.

4. Helps reduce long term fiscal pressure

The World Bank warns that early withdrawals combined with low coverage could create sustainability issues for Malaysia’s social protection system in the long run.

Not just about raising the age

The report stresses that increasing the withdrawal age should come with other reforms, including:

- Improving EPF coverage, especially for informal workers

- Ensuring those in physically demanding jobs are not left behind

- Enhancing financial literacy so Malaysians understand long term planning

- Communicating changes early so workers can adjust their retirement plans

The World Bank also emphasised that simply raising the age will not solve everything unless it is paired with broader structural improvements.

What this could mean for Malaysians

If Malaysia adopts the recommendation, future retirees may need to wait longer before withdrawing their full savings.

However, the World Bank argues that this delay could help Malaysians retire with healthier balances and avoid the common problem of running out of money too early.

Still, the recommendation may spark debate, especially among Malaysians who rely on early withdrawals to support their families, settle debts or transition out of the workforce earlier.

READ ALSO: