Starting from September 1, 2024, Malaysians will have more choices in medical and health insurance/takaful (MHIT) products.

You’ll have the option to pick between more budget-friendly plans with co-payment features or traditional plans with higher premiums but no co-payment.

Here’s a straightforward guide to help you get a handle on these changes and understand their impact.

Why this matters to you

It is a smarter way to keep insurance costs in check while still getting the coverage you need based on your financial and health needs.

Healthcare budget decisions: Think of it as selecting between full payment and shared expenses with your insurance/takaful company which is capped at minimal amount that you can afford at point of purchase.

Impact on monthly payments: Co-payment plans are cheaper than products without co-payments, especially with higher co-payment amounts.

Coverage vs. cost: By choosing a co-payment plan, you strike a balance between affordability and coverage that you can still get from a product without co-payment plan.

What is co-payment insurance?

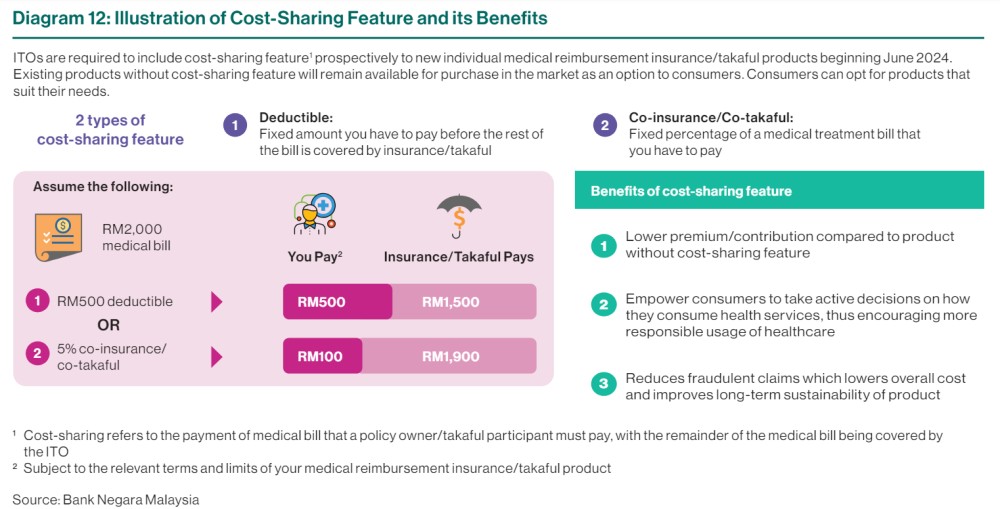

Co-payment insurance means sharing the bill with your insurer—think of it as a financial tag-team. You might pay a percentage such as 5% of the medical expenses (capped at an amount) or a fixed amount like RM500, while the insurer covers the rest. Typically, this results in lower monthly premiums compared to full coverage plans.

According to the Life Insurance Association of Malaysia (LIAM) chief executive officer Mark O’Dell, insurers are considering co-payment rates between 5% and 20%, with 5% being the most common and acceptable rate.

He explained that the caps on expenses used to calculate the co-payment will mostly range from RM10,000 to RM20,000. This means the co-payment is based on a percentage of this capped amount, not the total out-of-pocket cost.

Key changes coming in 1 September 2024

With this understanding, let’s look at the key changes coming up.

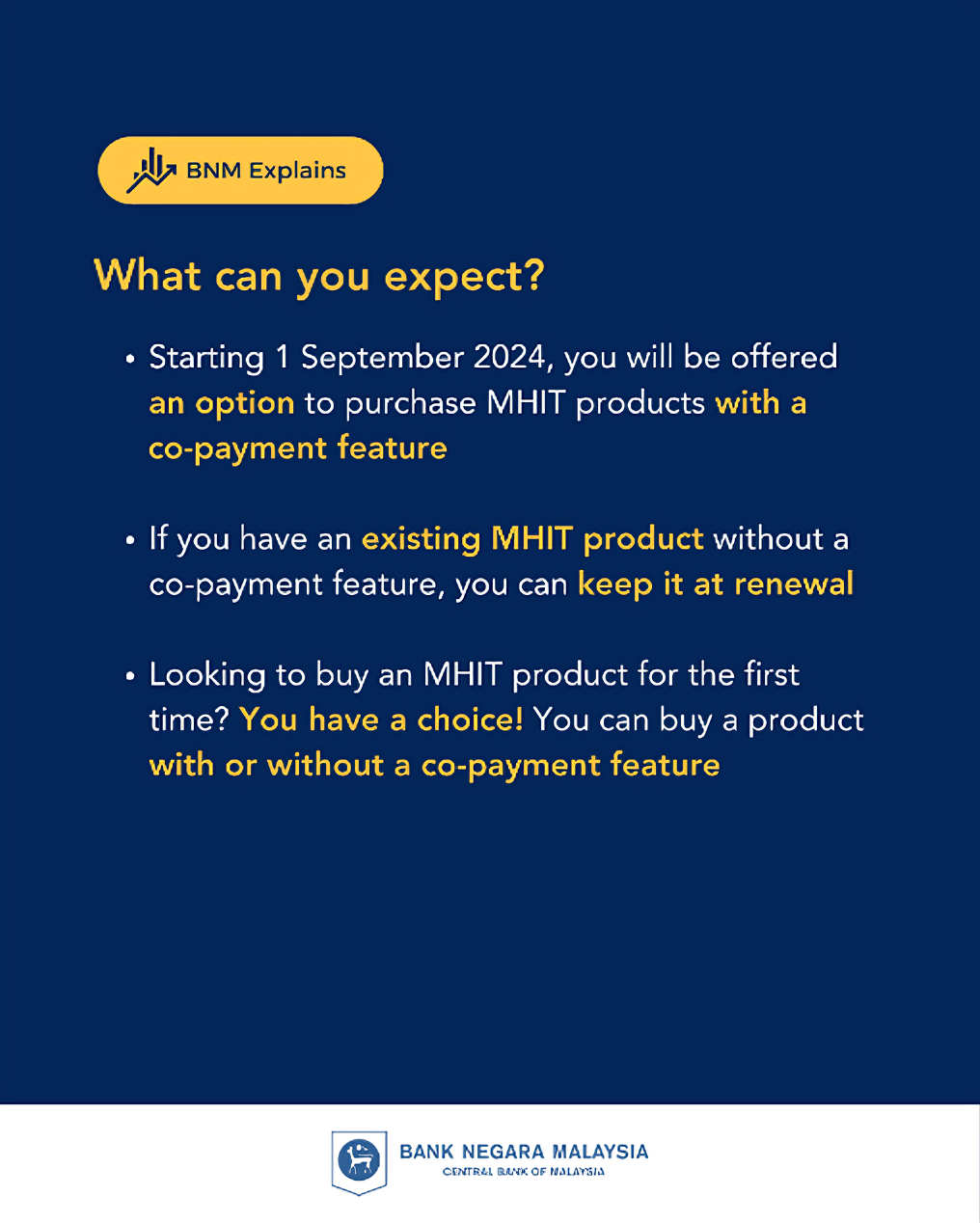

New policies: From September 1, 2024, when you purchase a MHIT plan, your insurance companies must offer new co-payment features. You’ll be able to choose from these new options or stick with existing features that have no co-payment but higher premiums.

Flexible co-payment amounts: The minimum co-payment is either 5% of the hospital bill or a RM500 deductible. Insurers will set their own maximum co-payment limits. This allows insurance companies to offer a wider range of co-payment feature plans to cater to consumers with varying financial needs.

Existing plans: If you prefer your current product without a co-payment plan, you can keep it. It will not affect you as companies will continue to offer these options.

Common misconceptions

Now, let’s clear up some common misconceptions out there that may have hindered your views on the benefits of co-payment. This will also make help you to make informed decisions about getting MHIT protection.

“Co-Payment Will Increase My Expenses”

- Co-payment plans are designed to lower your overall premiums due to medical inflation. In fact, co-payment plans are cheaper than those without co-payment. This can make them a more cost-effective choice if you’re looking to reduce your monthly premiums. This means you could save money in the long run. You can channel your savings to other financial needs. Now that’s a budget win!

“I Can’t Afford Co-Payment”

- As mentioned above, co-payment plans are cheaper than those without co-payment. Additionally, insurance/takafuk operators (ITOs) are required to gather sufficient information about their customers before providing any product options or recommendations based on your financial and health needs. If you need treatment and face financial difficulties, you may discuss with your insurer on alternative payment options.

- For individuals or families on a limited budget or those from lower-income households, you could consider co-payment plans as they are usually more affordable than full medical plans.

“Co-Payment Will Delay My Treatment”

- Co-payments won’t apply in all situations. There are exemptions such as emergency treatments including accident cases, outpatient treatment for follow-ups arising from critical illnesses such as kidney dialysis or cancer, and treatment at government hospitals. So, it is not as bad as you think. Safeguards are put in place to protect consumers’ interest too!

BNM should set the co-payment cap”

- Co-payments are subject to a maximum cap set by ITOs which serves to limit the amount of expenses borne by consumers. Once the cap is reached, the ITO takes on the remaining covered costs. This arrangement allows flexibility for ITOs to design and offer a wider choice of MHIT products for Malaysians, catering for various financial and health needs. In fact, this promotes competition so consumers can shop around!

“Policyholders continue to be affected by premium increase”

- It is crucial to tackle the rising medical costs before they become unaffordable for many. Addressing medical inflation requires a whole-of-nation approach.

- Globally, medical inflation is driven by rising treatment costs due to technological advancements, an increase in non-communicable diseases (such as cancer, diabetes, stroke etc.) and an ageing population.

- In Malaysia, additional contributing factors include a lack of transparency in medical bills, higher hospital supplies and service charges and higher utilisation of healthcare services and claims among policyholders with medical cards.

- To ensure MHIT products remain viable and sustainable, premiums/contribution have been increasing to keep up with the rising medical costs. Introducing co-payment products is one initiative to manage medical cost inflation, but it is not the only measure being taken.

Advice for choosing the right plan

As you weigh your options, keep in mind that from September 1, 2024, you’ll have an option to purchase MHIT products with and without co-payment at the point of sale or upon policy renewal. Compare these options to find the best fit for your needs and budget.

Evaluate Your Options: There will now be a wider variety of MHIT products available in the market. Remember to shop around for the best plan that meets your needs!

Budget Wisely: Ensure that any co-payment amount fits within your budget to avoid unexpected financial strain.

Choosing the right insurance plan with or without co-payment can be a significant decision. By understanding how co-payment works and considering your personal needs and budget, you can make an informed decision that provides the coverage you need at a price you can afford. Don’t hesitate to ask your insurance provider for more details to ensure you pick the best option for your situation.

For more details of co-payment insurance, please contact your insurance/takaful companies.