The rising cost of living has led some Malaysians to tap into their Employees Provident Fund (EPF) savings through Account 3 to cover expenses for Hari Raya Aidilfitri.

Recently, a man named Ahmad Tarmizi Hussein had to withdraw from his EPF’s Flexible Account to prepare for the festive season.

Once an executive at a private company for almost 20 years, he lost his job during the Covid-19 pandemic and has since struggled to secure stable employment.

As an e-hailing driver supporting a wife and five children aged between 5 and 14, Ahmad Tarmizi found himself burdened with financial responsibilities.

Earlier this year, he spent a significant amount on school supplies for his children and later had to prepare for both Ramadan and Hari Raya.

With living costs doubling at the start of the year, he had no choice but to rely on his EPF savings.

“I have tried many times to find a suitable job, but still no luck,” he told Kosmo, adding he withdrew RM1,500 to buy new Raya clothes for his family.

A lifeline for struggling families

Similarly, Siti Noor Asiah Muda, a former general office assistant who has been unemployed for three years, also withdrew from Account 3 to ease her financial burdens.

With her husband’s income as a self-employed worker being unstable, she decided to take out RM1,000 to cover the costs of new clothes and other Raya necessities.

Early last month, we spent a lot on school supplies for our two children, which is why we withdrew our EPF savings,” she explained.

For many struggling families, these savings have become a much-needed lifeline to get through financial strain while still celebrating the festive season.

EPF’s flexible account—a helping hand in tough times

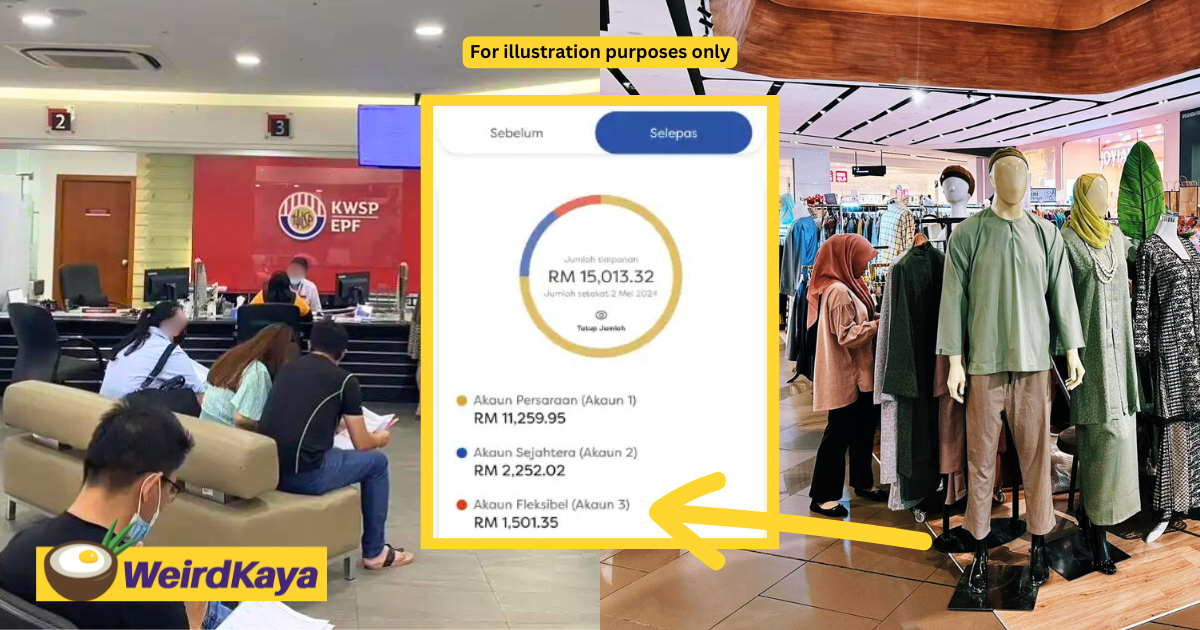

As of May 11, 2024, EPF members under the age of 55 had their savings restructured into three accounts: the Retirement Account, the Welfare Account, and the Flexible Account.

The Flexible Account, or Account 3, allows withdrawals at any time, subject to EPF’s terms and conditions.

Although the fund encourages members to use these withdrawals only for emergencies and urgent needs, some Malaysians see it as their only option to manage expenses, especially during crucial periods like the festive season.

What do you think about this? Share your thoughts with us in the comment section.

READ ALSO: