Renting a shared car is supposed to be convenient and affordable, until an accident turns into a five-figure repair bill.

A 26-year-old woman in Singapore was left stunned after discovering she had to pay over RM34,000 (S$10,900) in repairs and liability costs following a traffic accident despite having purchased rental insurance.

According to 8World, the woman, identified as Joey Chok, shared her experience on TikTok earlier this month.

Accident happened during lane merge

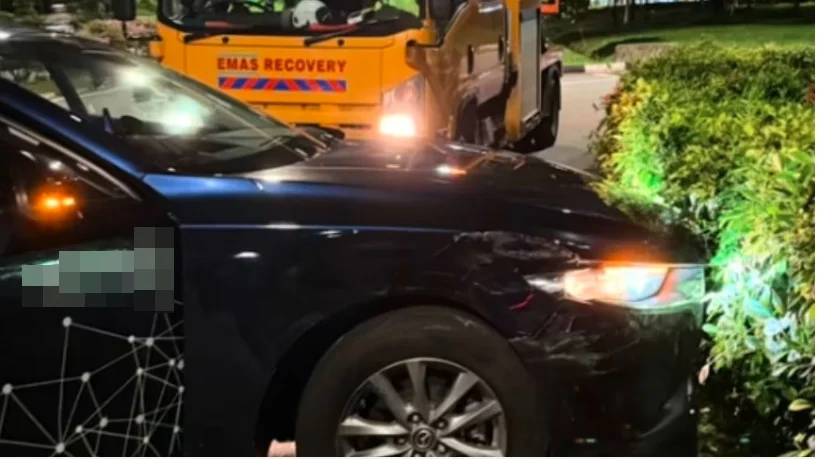

Joey explained that the accident took place on Dec 30, 2025, at around 1.30am, when she was merging onto a highway. She turned too sharply and ended up colliding with another vehicle.

As it was my first time being involved in a traffic accident, I didn’t know what to do next,” she said.

After the crash, she contacted the shared car company through its emergency hotline and later emailed photos of the accident scene as instructed.

She was told to extend her rental period, costing an additional RM435 (S$137.99), and to pay towing fees to send the damaged car to an authorised repair workshop.

Repair bill came without breakdown

However, what shocked her most was the repair quotation.

The workshop initially informed her she needed to pay a lump sum of S$4,800 (RM15,139) for repairs, without providing an itemised breakdown.

On top of the repair costs, she was also charged RM2,207 (S$700) in loss-of-use fees and RM17,189 (S$5,450) as a third-party excess fee. This brought her total bill to over RM34,378 (S$10,900).

To make matters more confusing, Joey discovered that the company handling the repairs was not the shared car operator itself, but a third-party leasing company that supplied vehicles to the platform.

Attempt to adjust bill for insurance claim rejected

Joey revealed that the total repair cost was RM630 (S$200) below the threshold needed to qualify for an 80% insurance reimbursement.

She asked if the repair cost could be adjusted to meet the claim threshold, but the leasing company rejected her request, stating no changes could be made.

Eventually, the total bill was revised slightly down to RM33,589 (S$10,650), and an itemised statement was sent to her a week later.

She said she has accepted that she must bear the consequences of the accident — but hopes to gain clarity on how the charges were calculated.

Whats shared car company said

Responding to queries, the shared car company confirmed they were aware of the incident and had reached out to Joey to provide further explanation.

They stated that Joey’s viral video did not present the full context of the situation.

The company explained that they operate a hybrid fleet model, where some vehicles are owned by third-party partners. Each partner has its own authorised repair workshop for maintenance and accident repairs.

We have no financial interest in these workshops. We do not carry out the repairs ourselves and do not profit from accident-related repairs,” the company clarified.

The company also emphasised that rental insurance is an optional add-on, which can reimburse most of the excess amount during accidents.

The company explained that Joey could not claim compensation for damage to the rented vehicle because the repair cost was lower than the applicable excess.

However, she may still qualify to claim for third-party vehicle damage, subject to further assessment. They also added that without rental insurance, no third-party excess reimbursement would apply.