We’ve all heard that you need around RM1.3 million in your EPF to retire comfortably in Malaysia, but how do you actually reach that figure?

It sounds like a huge number, especially if you’re in your 20s or 30s and just started working.

A recent post by finance creator The Futurizt on X breaks it down in a way that’s surprisingly clear.

The post explains how much salary you need to earn monthly to reach RM1.3 million in your EPF by the time you turn 60, based on some realistic assumptions.

Let’s walk through it in a way that actually makes sense.

Why RM1.3 million?

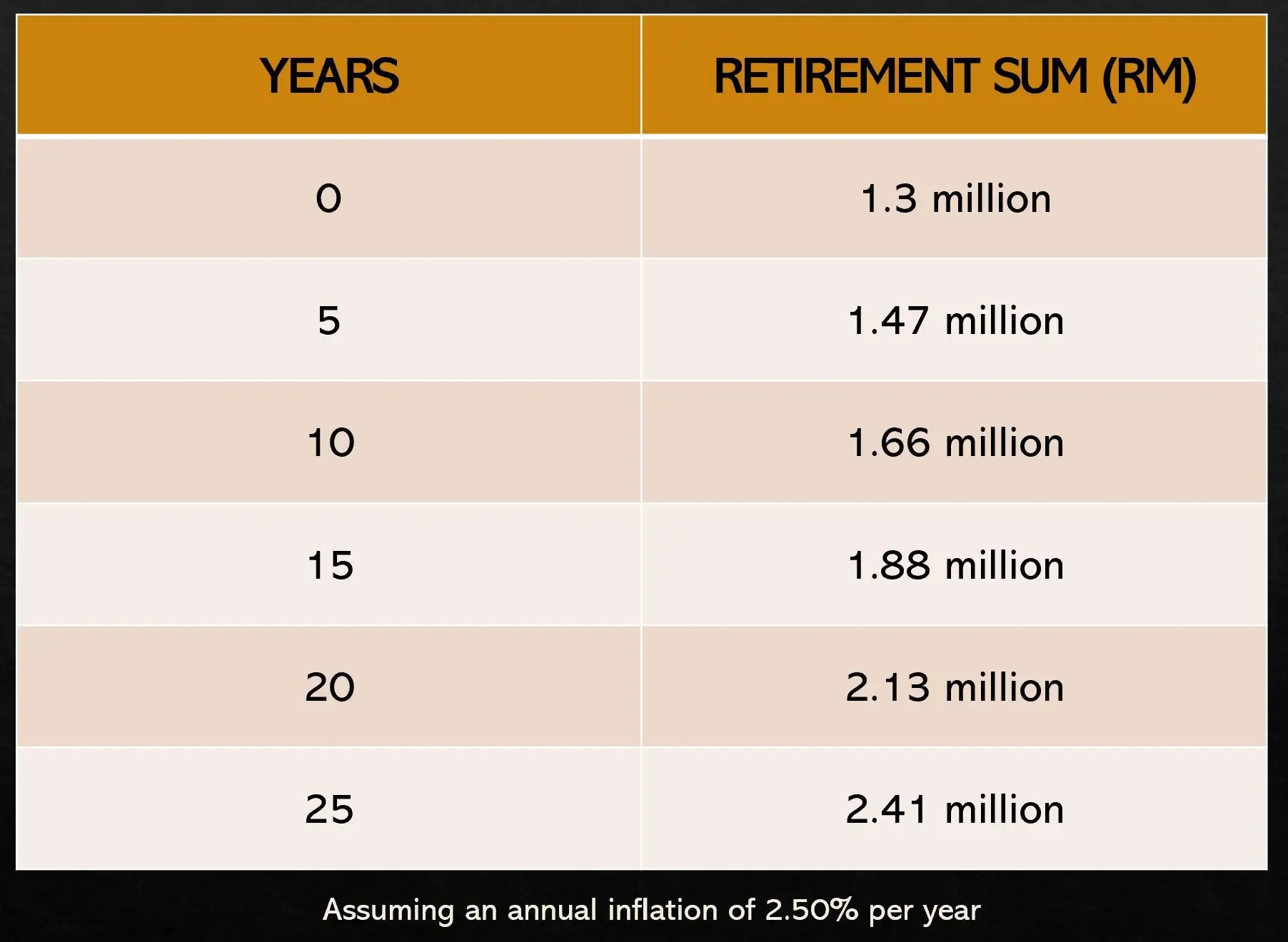

RM1.3 million isn’t just a random number. It’s a commonly suggested benchmark for Malaysians who want a stable, worry-free retirement.

While everyone’s lifestyle and needs are different, this amount is generally seen as enough to cover essentials, medical costs, and some personal comfort without relying heavily on others.

Reaching that goal depends on a few key factors, and that’s where things get interesting.

The assumptions behind the calculation

To keep things straightforward, The Futurizt’s calculation is based on a few fixed conditions:

- No inflation

- No bonuses or salary increments, assuming inflation cancels them out

- Full reliance on EPF savings, with no personal savings or other investments

- An annual EPF dividend rate of 5.5 percent

These assumptions paint a very conservative picture. In short, it assumes you’re only depending on EPF, with no extra contributions or salary growth.

So, what kind of salary do you need based on that?

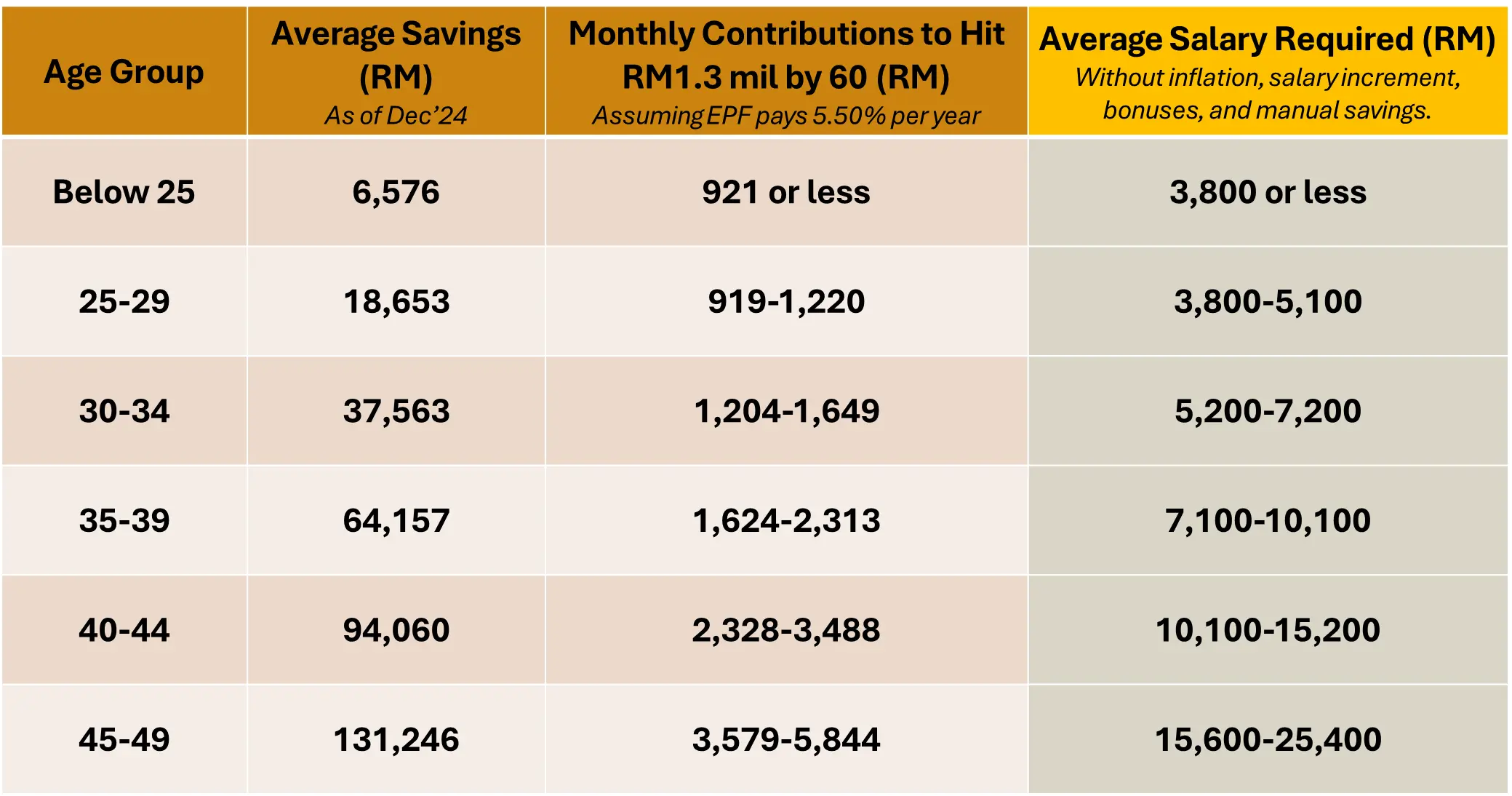

What salary do you need to earn?

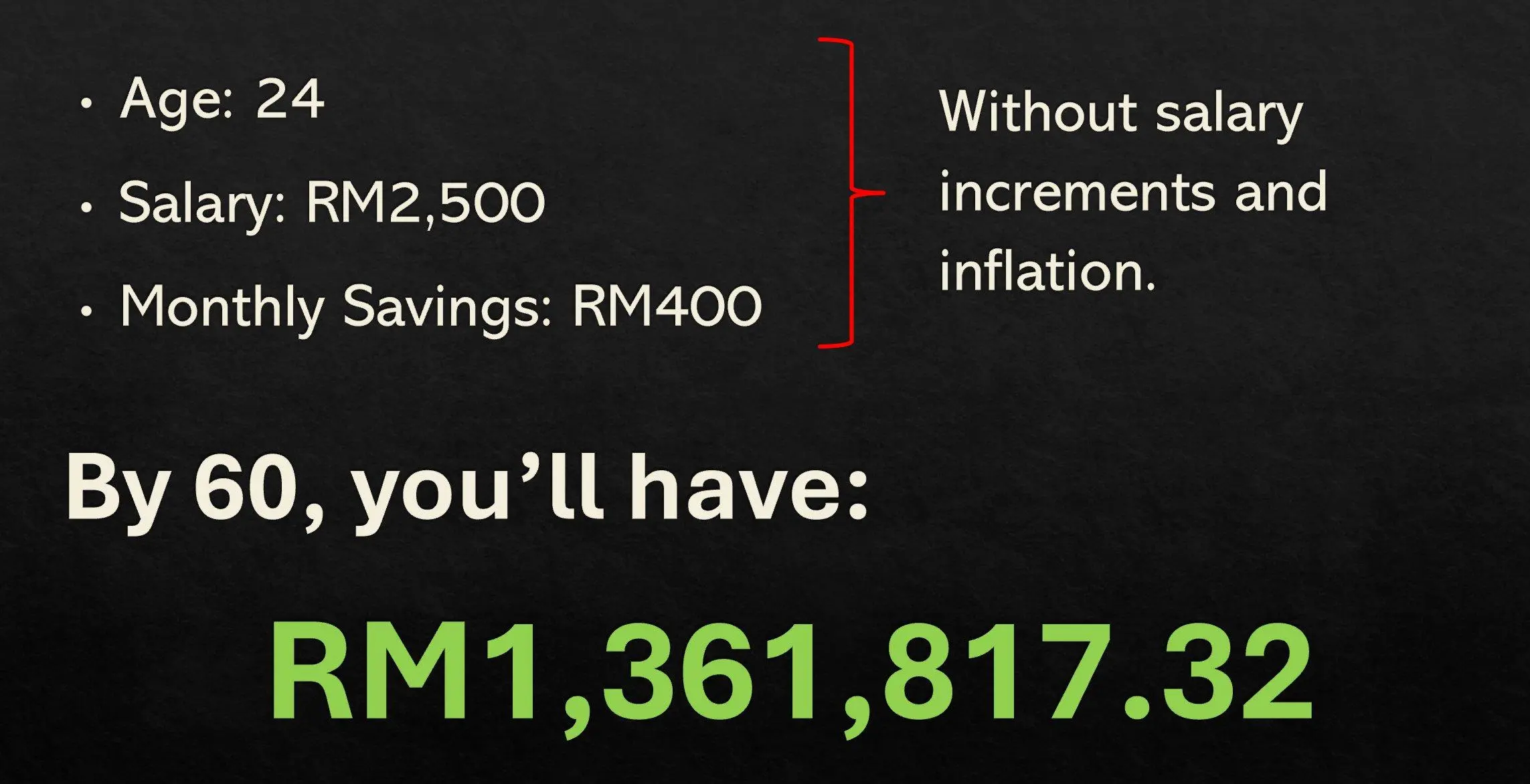

Here’s where things get a bit more specific. According to The Futurizt:

- If you start saving at age 30 and retire at 60, you’ll need to earn an average monthly salary of RM4,000 to RM5,000

- If you start at age 40, you’ll need around RM7,000 to RM8,000 per month

Keep in mind these are average salaries across the entire period. You don’t need to be earning RM5,000 right now, but your salary should eventually reach that level and stay consistent.

But what if you want to rely on more than just EPF?

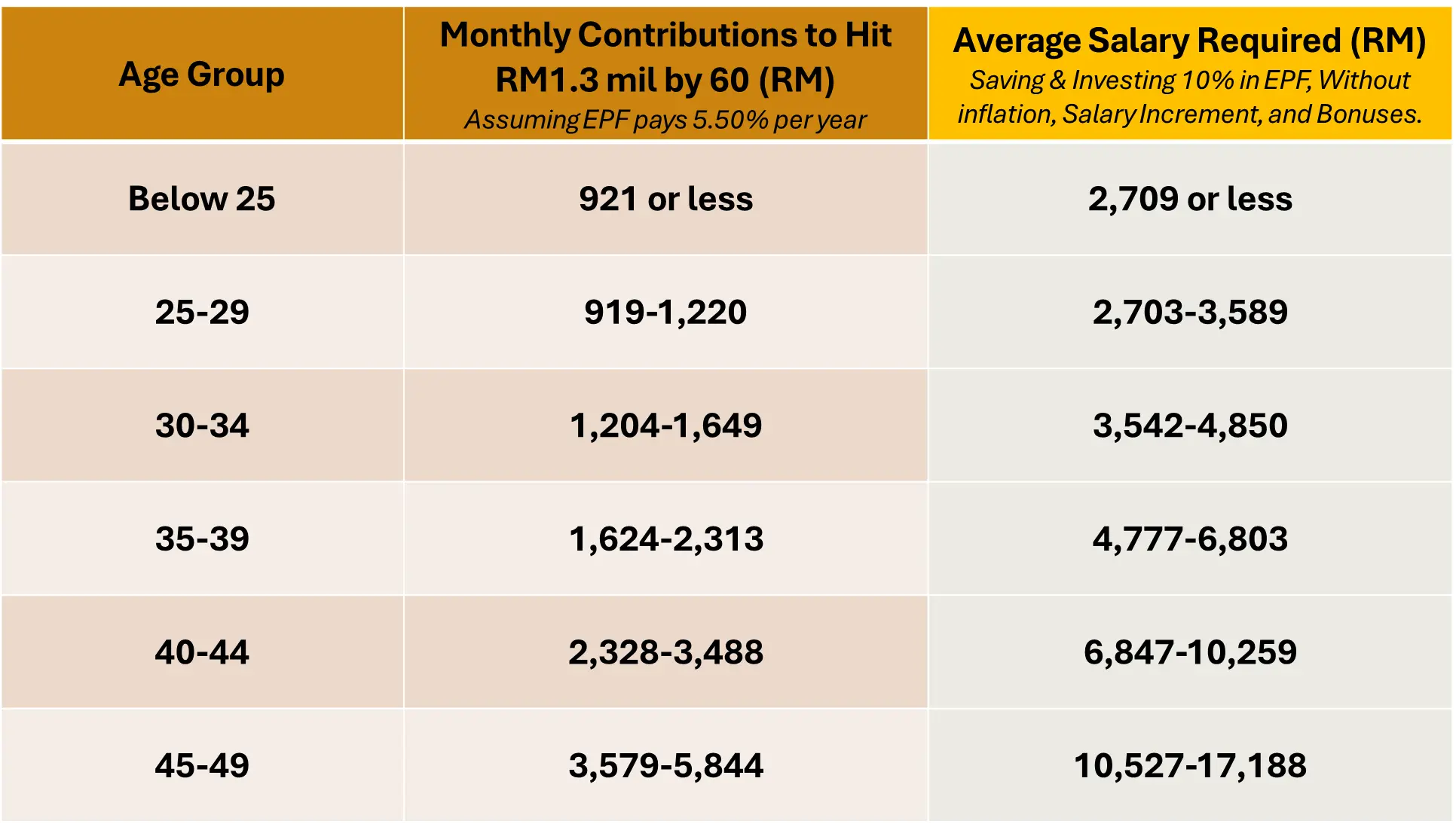

Can saving extra help reduce the salary you need?

Definitely. This is where additional savings and investments can really help.

If you save just 10 percent of your salary every month and invest it in something that gives you 5.5 percent returns annually, the required salary to hit RM1.3 million drops by 30 to 50 percent.

That’s a big deal. It means you don’t need to earn as much if you’re willing to consistently save and let your money grow over time.

How do you know if you’re on track?

Not sure whether you’re doing okay? Here’s a quick self-check.

If you’re relying only on EPF:

You’re on track if your current salary and EPF balance are above the recommended figures for your age group. That likely means you’ll reach or exceed the RM1.3 million target.

If you’re saving more than 10 percent of your income monthly:

Even if your salary is lower than the estimated range, your consistent savings will help fill the gap. Compound interest will do most of the work in the long run.

In both cases, what matters most is consistency.

What you can do now to reach RM1.3m faster

If you want to give your savings a boost, here are a few things you can do right away:

- Save and invest more than 10 percent of your income

- Save at least 50 percent of your bonuses instead of spending them all

- Aim for a 3 to 5 percent pay raise each year

- Invest in financial products that offer better returns than EPF’s 5.5 percent

If that sounds like a lot, start with just one or two and build from there.

What other investment options are there?

EPF is safe and consistent, but it’s not the only place to grow your money. If you’re open to more risk and want better returns, here are a few common options:

| Risk Level | Examples |

|---|---|

| High risk | Bitcoin, US Stocks, ETFs, P2P Lending, Aggressive Unit Trusts |

| Medium-high risk | Gold, Malaysian stocks |

| Medium risk | Malaysian bank stocks |

Just remember, higher returns usually come with higher risk. Make sure you understand what you’re putting your money into, and don’t invest blindly.