Personal loans can be a helpful financial tool, but they often come with risks if not managed responsibly.

Bankruptcy is a growing issue in Malaysia, with recent statistics from the Malaysian Department of Insolvency (MdI) revealing a worrying trend.

Over the past five years, more than 15,000 Malaysians have been declared bankrupt due to personal loans, making it the leading cause of financial ruin in the country.

Over 31,000 bankruptcy cases since 2020

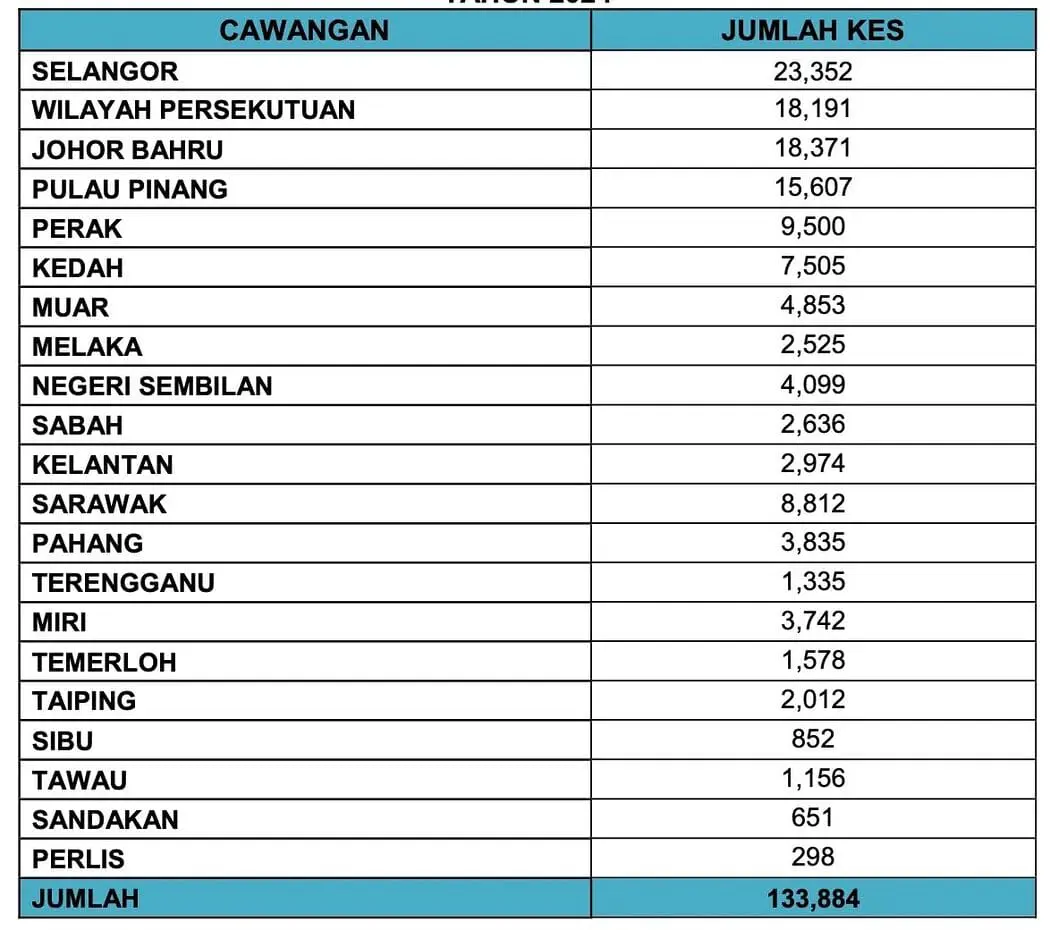

According to The Vocket, between January 2020 and December 2024, MdI reported 31,387 bankruptcy cases, contributing to a total of 133,884 cases since the department’s establishment.

Among these, 49.11% (15,413 cases) were caused by personal loans, highlighting the significant financial burden faced by individuals.

Other major contributors to bankruptcy during this period were business loans, which accounted for 5,865 cases (18.69%), and vehicle hire purchase agreements, which led to 2,902 cases (9.25%).

Selangor leads bankruptcy cases

In terms of state-by-state breakdowns, Selangor recorded the highest number of bankruptcy cases overall, with 23,352 cases.

From 2020 to 2024 alone, the state registered 7,581 cases, cementing its position as the region most affected by insolvency.

Following Selangor, the regions with the highest number of cases in the past five years are:

- Federal Territories – 3,954 cases

- Johor Bahru – 2,623 cases

- Kedah – 1,930 cases

- Penang – 1,723 cases

Bankruptcy across genders and age groups

The statistics also shed light on the demographics of bankruptcy in Malaysia. Men made up the majority of cases, with 22,876 cases (72.88%), compared to 8,421 cases (26.836%) among women.

Interestingly, 90 cases (0.29%) involved individuals whose gender was not recorded.

As for age groups, individuals aged 35 to 44 years were the most affected, accounting for 12,304 cases (39.2%).

This was followed by those aged 45 to 54 years (8,660 cases or 27.59%) and 25 to 34 years (5,133 cases or 16.35%).

Malays formed the largest ethnic group affected by bankruptcy, with 18,161 cases (57.86%) reported since 2020.

The Chinese community recorded 8,227 cases (26.21%), while the Indian community faced 2,338 cases (7.45%).

MdI’s data also revealed the inclusion of non-citizens in their statistics for the first time.

However, their numbers remain relatively small, with only 135 cases reported between 2020 and 2024, accounting for just 0.43% of total cases.

These figures paint a sobering picture of the financial challenges faced by Malaysians, especially as personal loans continue to dominate as the main cause of bankruptcy.

What do you think about this? Share your thoughts with us in the comment section.

READ ALSO: