Malaysia International Humanitarian Organisation (MHO) has announced a nationwide awareness campaign to urge Malaysians not to repay loans taken from loan sharks, also known as Ah Long.

MHO stressed that illegal moneylending is a criminal offence, and borrowers are not legally required to repay such debts.

Illegal lenders not protected by law

MHO secretary-general Datuk Hishamuddin Hashim said in a press conference that loan sharking itself is unlawful.

Therefore, any agreement made through such means is not valid under Malaysian law,” he said.

He said victims should not feel obligated to repay debts obtained from illegal lenders, adding that over 100 related cases have already been reported to MHO.

RM10 million involved in social media loan scams

He revealed that among the cases received, 15 involved people who borrowed from loan sharks through ads on social media.

The total amount involved is around RM10 million.

He also called on the police to take action under various laws, including the Moneylenders Act, Anti-Money Laundering Act, Personal Data Protection Act, and Section 130V of the Penal Code for involvement in organised crime.

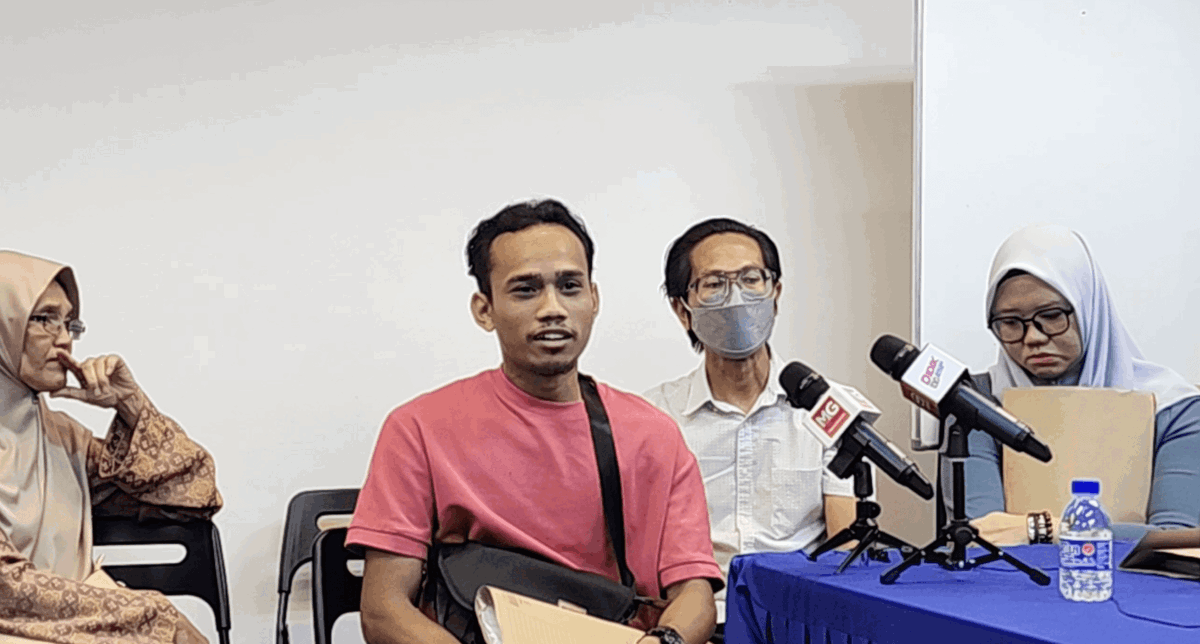

Borrowers speak out at press conference

Nine of the affected borrowers appeared at a press conference on Nov 3 at MHO’s office. They were accompanied by Hishamuddin and MHO’s Loan Shark Affairs Unit director Datuk Nain Sanusi.

They shared how they were harassed and threatened, even after repaying the original loan amounts.

Victim paid in full but still owes RM100,000

One of the victims, Hanizul (45), a self-employed man, said he borrowed RM9,000 after clicking on a Facebook loan ad last year.

He only received RM4,500 after deductions.

Even after making full repayment, he was told to pay an extra RM100,000.

When he refused, the lenders began harassing his family, distributing flyers with his face, splashing paint on his home, and even revealing his children’s school and wife’s workplace.

He was eventually forced to move out of his home. Despite police reports, no action has been taken.

Online seller harassed over RM134,000 after a RM4,000 loan

Another victim, Miya (38), an online seller, borrowed RM4,000 in June to keep her business afloat.

Even after settling the amount, she was chased for RM134,000.

She broke down during the press conference, saying her family relationships were affected.

“My brother even wants to cut ties with me,” she said.

She added that debt collectors threatened to kidnap her children and shared photos of them as part of the intimidation.

Elderly woman paid RM93,000 for RM3,000 loan, still told she owes RM156,000

Umi, a 65-year-old woman, borrowed RM3,000 through a social media ad to pay her child’s school fees.

Over time, she repaid RM93,000, but was still told she owed another RM156,000.

She said loan collectors threw firecrackers at her home and followed her in public. Fearing for her child’s safety, she told him not to return home.

She added that police reports have been made, but no concrete action has been taken. “Must someone die before the police intervene?” she asked.