Imagine wanting that new phone, a laptop for work, or even just everyday groceries, but payday is still weeks away.

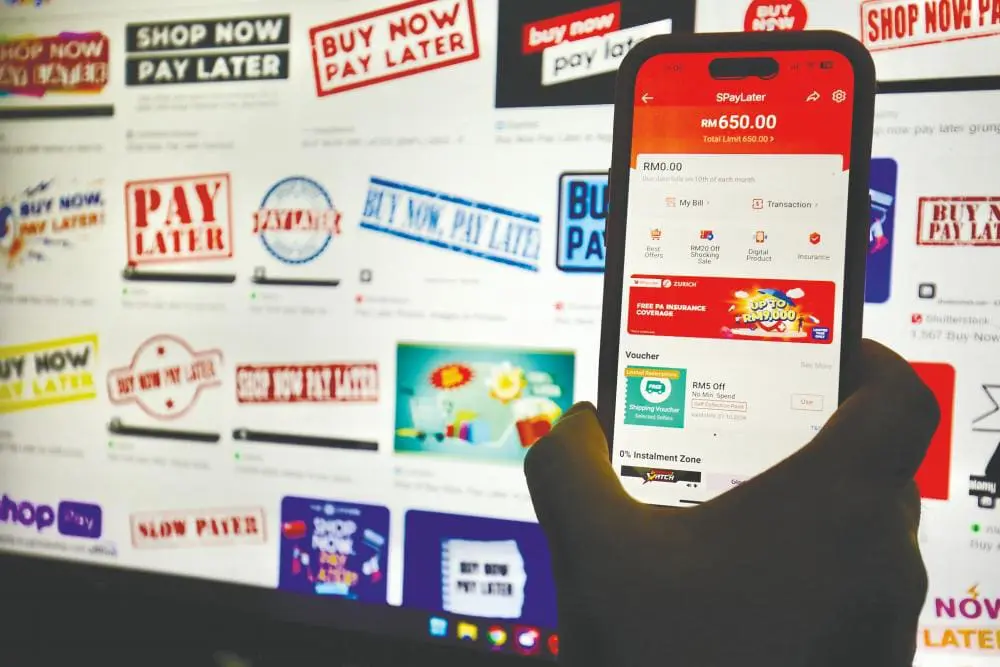

That’s where Buy Now, Pay Later (BNPL) comes in.

It lets you get what you need instantly while breaking payments into smaller chunks.

For many young Malaysians, it feels like a financial lifesaver. But here’s the catch: if not handled wisely, BNPL can quietly snowball into a serious debt problem.

And that’s exactly what recent figures suggest. BNPL transactions in Malaysia skyrocketed to RM7.1 billion in the second half of 2024, a sharp rise from RM4.9 billion in the first half, according to Second Finance Minister Datuk Seri Amir Hamzah Azizan.

This rapid increase has raised concerns about whether Malaysians are truly benefiting from BNPL, or walking into financial quicksand.

Who’s using BNPL the most?

A deeper look into the data reveals an interesting trend: young adults aged 21 to 45, earning below RM5,000 a month, are the most active BNPL users, reported Harian Metro.

On the surface, it makes sense, this group often faces financial strain from student loans, rent, and daily expenses. BNPL offers them a way to afford essentials without immediate financial pressure.

But is it really helping, or is it just masking deeper financial struggles?

For some, like Muhamad Rakib Ansari, a 24-year-old digital marketing consultant, BNPL has been a useful tool, if used wisely.

“I always make my payments on time, so it’s helped me manage my expenses better. But honestly, you have to be disciplined. Some of these BNPL repayments come with crazy hidden charges if you’re not careful,” he shared.

Others, however, have learned the hard way that BNPL can quickly turn from a convenience into a burden.

Take Muhamad Harris Zafry, a 24-year-old university student in Selangor, for example. He relies on BNPL to buy reference books and electronics, but he admits that without proper planning, the consequences can be harsh.

“BNPL helps when I need something urgently, but if you delay even a little, the penalties pile up. Before you know it, your small purchase becomes a big debt,” he admitted.

Experts call for stricter BNPL regulations

With more young Malaysians turning to BNPL, financial experts are raising a red flag: What happens when users start struggling with repayments?

To prevent a potential financial crisis, consumer advocates are now pushing for stricter BNPL regulations.

According to Federation of Malaysian Consumers Associations (FOMCA) Chief Operating Officer, Nur Asyikin Aminuddin, BNPL providers should not only make their terms clearer but also assess a user’s financial situation before approving transactions.

“Companies should assess a user’s financial standing before approving transactions. There also needs to be more transparency in fees and penalties to avoid trapping consumers in long-term debt,” she said.

She stressed that while BNPL can be a helpful financial tool, impulse spending or lack of planning could lead users into a cycle of debt.

“The key is to use BNPL for essential purchases only, not just for things we want but don’t actually need,” she advised.

Is Malaysia heading towards a BNPL debt crisis?

With 12 companies currently offering BNPL services, it’s clear that this payment method is here to stay.

But its rising popularity has also sparked concerns about household debt levels in Malaysia.

Minister Amir Hamzah acknowledged that while the situation remains under control for now, the increasing reliance on BNPL could pose a long-term risk if spending habits don’t change.

So, where does that leave BNPL users?

Financial experts are urging Malaysians to tread carefully; spend within their means, track their repayments, and avoid unnecessary BNPL purchases.

Because while buying now and paying later sounds great, the real question is: Can you really afford it?