Many Malaysians are drawn to the idea of working in Singapore for better pay and career opportunities. But the fear of sky-high living costs often holds them back.

Recently, a Malaysian auditor working across the Causeway shared his monthly income and expenses in 2025 on social media, revealing how much he spends in Singapore and Malaysia and how much he still manages to save.

Earns RM17k after deduction

The man earns RM22,245 (S$6,800) a month in 2025. After CPF deductions, his take-home pay stands at RM17,796 (S$5,440).

In Singapore, his biggest expense is rental at RM2,944 (S$900), followed by food and beverages at RM1,963 ($S600).

Transportation costs are surprisingly low at just RM196 (S$60). When adding telco, gym membership, insurance, and income tax, his total Singapore expenses come up to RM7,475 (S$2,285).

While living in Singapore, he continues to bear financial commitments back in Malaysia. These include:

- Family allowance: RM1,500 (S$459)

- Car loan: RM1,067 (S$326)

- Insurance, WiFi, DiGi bills, PTPTN loan, and exam fees, bringing his Malaysia expenses to RM4,052 (S$1,239).

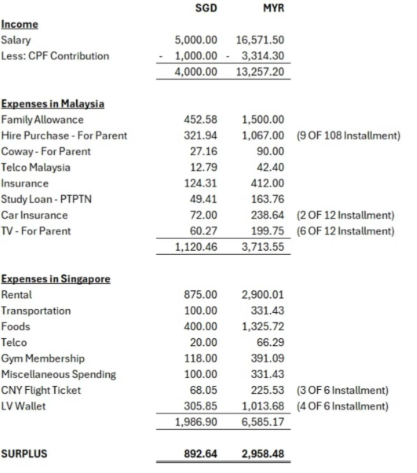

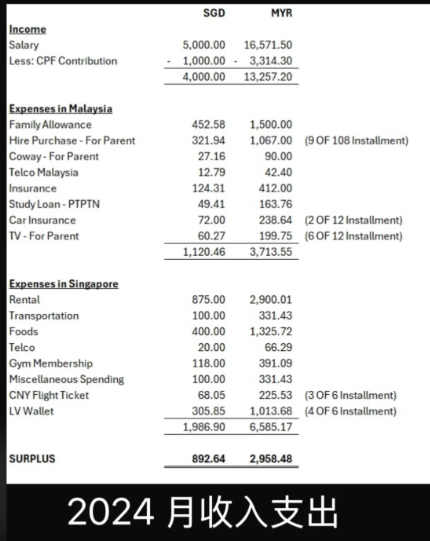

2025 vs 2024

In 2024, his rental cost was slightly lower at RM2,900 (S$875), and food expenses were only RM1,325 ($S400) compared to 2025’s RM1,963 (S$600).

Transportation costs also fell from RM331 (S$100) in 2024 to RM196 (S$60) in 2025.

The biggest change, however, was his income. In 2024, his net salary was only RM13,257 (S$4,000), but in 2025, it shot up to RM17,796 (S$5,440).

This pay rise allowed him to save RM6,269 (S$1,916) in 2025, a huge jump from the RM2,958 ($S892) surplus he managed in 2024 even with slightly higher living costs.

Never thought of working in Singapore

Speaking to WeirdKaya, the OP shared that many netizens were quick to point out how much his salary had grown over the years.

He explained that in the internal and external audit field, the career path is relatively structured, with promotions usually tied to years of service and job level.

However, he noted that performance and visibility still play a key role — top-performing employees often climb the ranks faster, while those lacking results or exposure may see little change in position or pay even after several years.

He also shared that from 2024 to 2025, his expenses barely changed except for buying Singapore insurance, increasing his family allowance, and moving from a partition room to a master bedroom.

He revealed that working in Singapore was never part of his plan.

“It was completely by accident. After spending three years in KL, I applied for jobs on JobStreet. A company invited me for an interview, and only during the session did I realise the role was in Singapore. They offered S$3,300, and I agreed the next day,” he said.