A 20-year-old university student was left devastated after losing over RM17,000 in a shocking bank transaction incident, all while she was fast asleep.

In a viral Facebook post, netizen Jing Wen shared how her GX Bank account was allegedly hacked, leading to the unauthorised transfer of her hard-earned savings in the middle of the night.

The bank later shifted the responsibility back onto her, insisting the transaction was done via her own device and face verification.

Mysterious transfers “in her dreams”

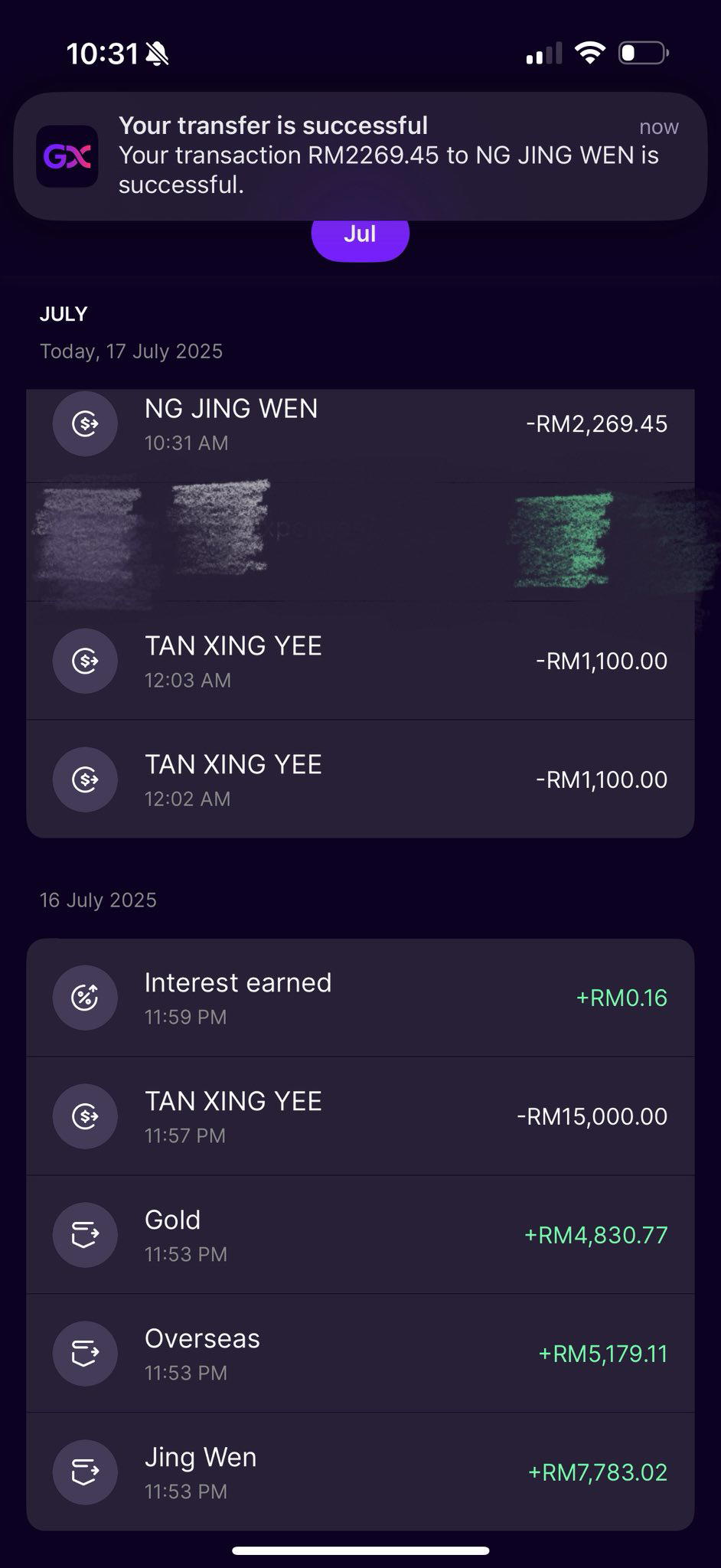

According to Jing Wen in the Facebook post, the first transaction happened at 11.53 pm on July 16, when RM17,792.90 was first transferred from three of her Savings Pockets to her Main Account.

Within the next ten minutes, RM15,000 was transferred out, followed by two separate RM1,100 transfers just after midnight, all totalling RM17,200.

The money was allegedly sent to a Boost Bank account under the name “Tan Xing Yee”, a person Jing Wen claims she has never met or interacted with.

What makes the case even more alarming is the timing and method. Jing Wen says she was already fast asleep by then, her phone by her side, and there were no signs of forced entry or tampering. She lives alone and insists no one else has access to her phone.

I didn’t authorise anything. I was asleep and live alone, my phone was with me the whole time, and there’s no way someone else could’ve done it,” she wrote.

Immediate actions upon discovery

The next morning at around 10.30 am, Jing Wen realised something was terribly wrong when she checked her GX Bank account; it only had RM2,269.45 left.

Gripped by panic, she immediately transferred the remaining balance to another bank to safeguard it.

She then contacted GX Bank’s customer service to report the issue and headed straight to the police station to lodge an official report.

On her way there, she also reached out to Boost Bank, asking them to freeze the recipient’s account in hopes of stopping any further transfers.

Once the police report was completed, she promptly sent all the relevant documents to both GX Bank and Boost Bank to assist in the investigation.

During her police report, officers reportedly told Jing Wen this looked more like a “hacking” incident rather than a typical scam, since she never clicked any suspicious links or gave away her credentials.

For ten days, there was silence until July 26, when GX Bank finally responded. They informed her that their internal investigation had been completed and that they would help her apply for a refund from Boost Bank.

Jing Wen agreed, hopeful that her money could still be recovered. But on August 3, she received devastating news.

The money had already been transferred out of the recipient’s account, and GX Bank said they could no longer retrieve it, nor would they take responsibility.

“You must’ve done it yourself”

GX Bank told Jing Wen that the large transfer required “Face Authorise” verification, which must be done through her own phone. Therefore, they believed the transaction was initiated by her.

Jing Wen, however, strongly denies this claim.

I’ve never made a transfer to Tan Xing Yee. I’ve never given anyone access to my phone. And I was fast asleep that night,” she said.

Even after the incident, my phone worked normally. There were no signs it had been hacked.”

She has since asked GX Bank to pull her full transaction history to prove that this was the first time such a recipient was involved.

Suspicious timeline and conflicting explanations

In the comment section, Jing Wen shared that as she dug deeper, she uncovered what she believed to be multiple red flags:

1. The transfer limit change didn’t follow bank rules

GX Bank said her daily transfer limit was increased from RM10,000 to RM15,000 just 10 minutes before the transfer.

But GX’s own system states that limit changes require a 1-hour cooling period before taking effect.

How could I have transferred RM15,000 just 10 minutes after changing the limit? That shouldn’t have been possible.”

2. Conflicting statements from the bank

On August 4, the bank told her she raised the transfer limit on March 1.

But in an earlier call on August 3, they said the limit was changed just before the transfer took place.

Which one is it? Why are there two versions of the same event?”

3. Security concerns

Jing Wen questions how such a transfer could be completed without her knowledge, despite the bank’s supposedly strict “face + device” verification.

If even cautious users like me can’t be protected, how can anyone feel safe storing money in digital banks?”

Justice needed

Speaking to WeirdKaya, Jing Wen stressed that her post wasn’t meant to go viral or gain sympathy.

All I want from the start is to seek fair treatment and accountability. I hope public discussion and attention can push for a proper resolution, not just for me, but to prevent others from going through this.”

Jing Wen also told WeirdKaya that during her communication with GX Bank, she was asked whether she might have been a victim of a scam, only realising it later and attempting to reframe it as a hacking incident.

One reason cited was the RM2,269.45 left untouched in her account, something the bank found unusual if it were a genuine unauthorised breach.

They questioned why a hacker would leave money behind. But to be honest, I don’t know what was going through the hacker’s mind,” she said.

All I can say is, I’m grateful they didn’t take everything. That remaining amount was my only living expense at the time.”

Jing Wen stood by her statement, firmly repeating that all three suspicious transactions were not carried out by her, and she had no knowledge or involvement in what had happened.

Everything I said was the truth,” she added. “I wasn’t part of a scam. I was asleep. And I did not make those transfers.”

As of now, she’s still waiting for a clearer answer from GX Bank and hoping her RM17,200 can still be recovered.

GXBank: Thorough investigation being conducted

In response to the incident, GXBank stated that a thorough investigation is currently underway.

We emphatise with Ms Ng Jing Wen’s situation.

While we are currently conducting a thorough investigation into the issue, we have since reached out to Ms Ng to share the preliminary results from our findings.

We are also committed to continue supporting Ms Ng through this difficult time, and collaborate with Ms Ng and the authorities to facilitate further investigations.

GXBank also emphasised that it has a strict zero-tolerance policy towards any form of fraudulent activity, criminal intent, or breaches of the law.

As a digital bank, GXBank said it regularly reviews its safety, security, and risk controls to ensure that its operations and processes continue to “uphold the trust placed in it by millions of customers and stakeholders”.

**Special thanks Jing Wen for sharing her story.

Read more:

![[UPDATED]M’sian Student Loses RM17K From Bank Account In Her Sleep, Gets Blamed For Transferring It Herself](https://cdn.weirdkaya.com/wp-content/uploads/msian-student-loses-rm17k-from-bank-account-in-her-sleep-gets-blamed-for-transferring-it-herself.png)