Buying a car isn’t just about affording the monthly instalments, it’s about maintaining it too.

That’s something one Malaysian man’s friend learned the hard way after purchasing a Lexus LS430 last year without checking the road tax costs.

Paid RM35K cash, but missed one important detail

In a post on Threads, the man shared how his friend bought a used Lexus LS430 (2004 model) for RM35,000 in cash, inclusive of everything; insurance, road tax, and all.

But there was just one problem:

The seller never mentioned how much the annual road tax would be, and the friend didn’t think to ask.”

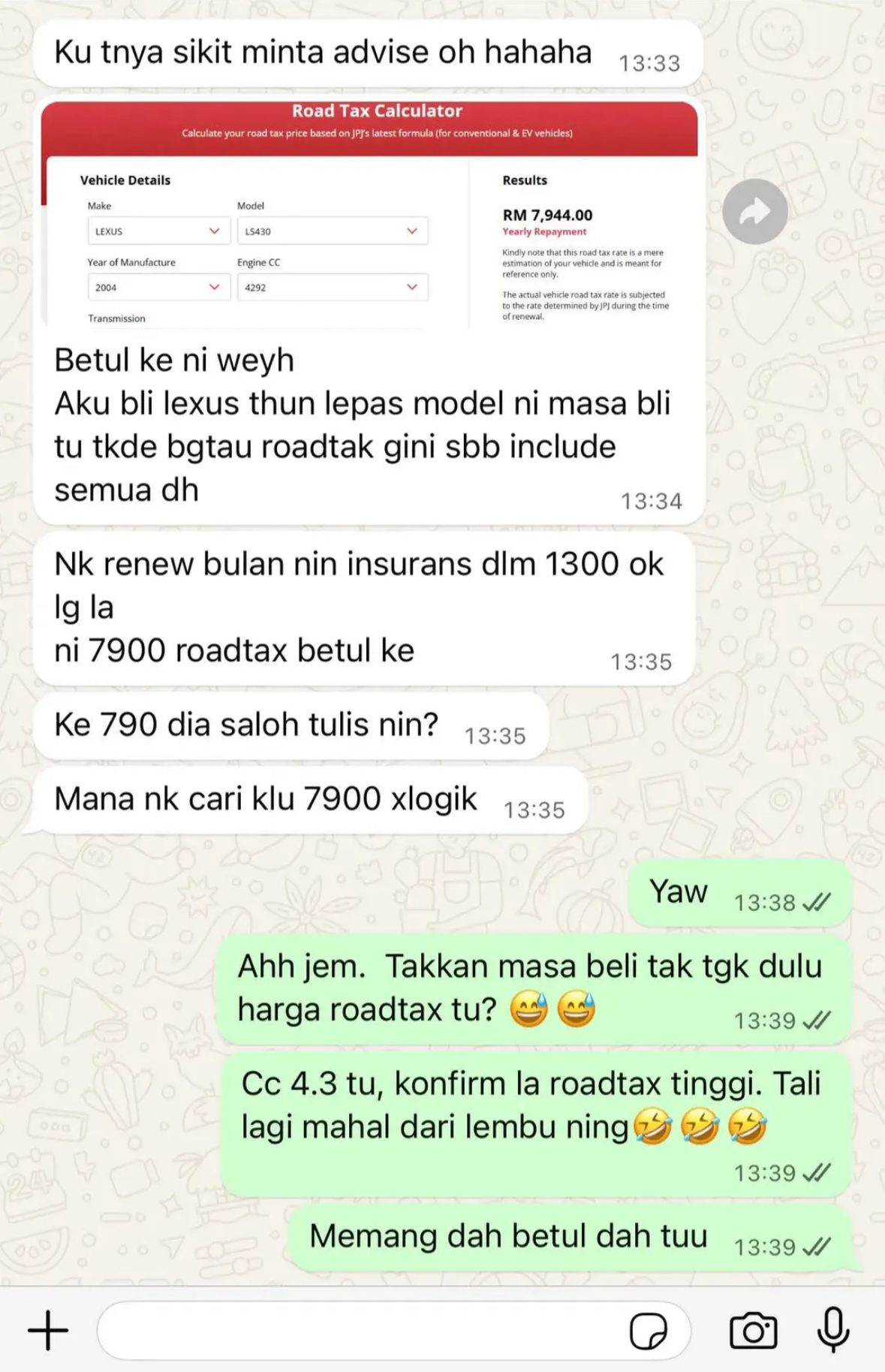

Fast forward to this year, when he wanted to renew the road tax. The total amount? A jaw-dropping RM7,944.

“It felt great to drive. “It’s got a V8 engine, 290 horsepower, 430NM torque, and a massive 80-litre fuel tank. But the fuel consumption is a bit high lah,” the man shared.

In a WhatsApp conversation shared along with the post, the OP’s friend asked whether it was a typo on the road tax amount as it was unusual for it to reach such a high amount.

Unfortunately, the Lexus LS430 came with a 4.3L engine, and road tax for vehicles with large engine capacities in Malaysia isn’t cheap.

Needless to say, the OP’s friend was shocked and chided him for not checking the car’s engine CC before purchasing it, adding that it was more expensive “than buying a cow.”

‘You should’ve known better!’

While some netizens were amused by the post, others criticised the OP for not doing basic research before purchasing the car.

Many also pointed out that engine capacity (CC) is the key factor that determines road tax rates in Malaysia, not the car’s brand or market price.

Some even joked that it’s cheaper to get fined than to pay road tax, with one writing, “Just buy insurance. If you get summoned, it’s RM300. Even 10 times a year, that’s still cheaper than paying RM7,900.”’

View on Threads

Reminder: always check the engine capacity and road tax rate before buying a car no matter how good the deal sounds!