With the price of daily necessities and goods rising with each passing day, more and more Malaysians are finding it difficult to make ends meet with only one job and are often forced to take another several other jobs.

A netizen recently shared on social media how a friend of his was forced to juggle not one, but THREE jobs just to keep himself financially afloat.

M’sian man with RM3.5K salary takes on 3 jobs to pay monthly house loan

Taking to X (formerly Twitter) to share, the OP wrote that his friend, who works as an interior designer, had bought a house and had a monthly income of RM3,500.

However, as soon as his salary is banked into his account, RM1,000 is immediately being deducted in order to pay off the monthly house loan, leaving him with RM2,500 to spare — an amount that has yet to be further deducted for his EPF savings.

The OP wrote that ever since buying the house, his friend’s life has been considerably upended by the hefty expenses that comes with purchasing a house.

He’s struggling like mad to pay off the monthly house loan even though he’s currently working three jobs: his primary job, getting involved in the dropship business, and being a Grab driver.

Netizens offer support & advice

The tweet, which has since gone viral with 1.5 million views, saw netizens expressing sympathy for the OP’s friend and offered words of advice in light of his situation.

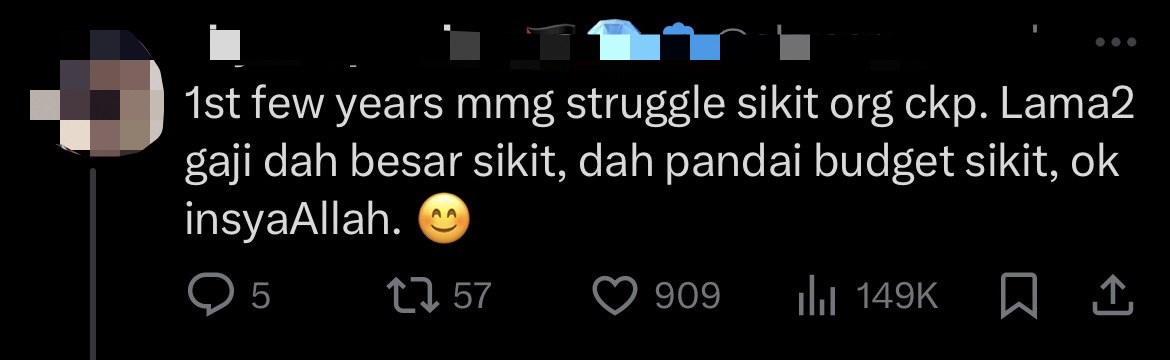

‘People say the first few years are a bit of a struggle. Eventually, as your salary increases and you get better at budgeting, things will be okay God willing.’

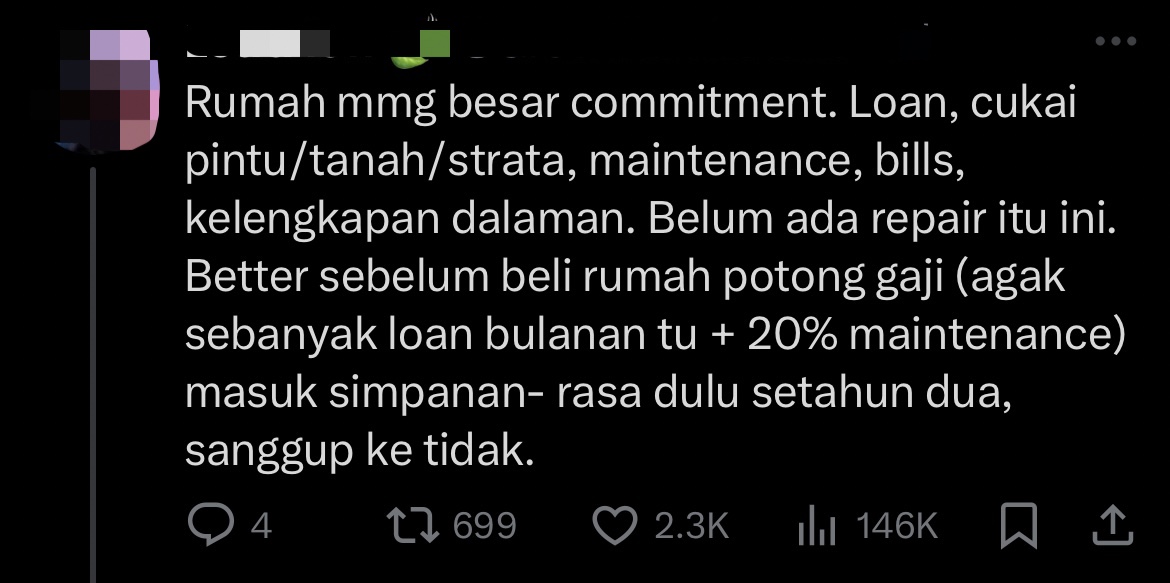

“A house is indeed a big commitment. There are loans, property taxes, maintenance, bills, and interior furnishings, not to mention repairs. It’s better to set aside part of your salary (approximately the monthly loan amount plus 20% for maintenance) into your savings before buying a house—try this for a year or two to see if you can manage it.‘

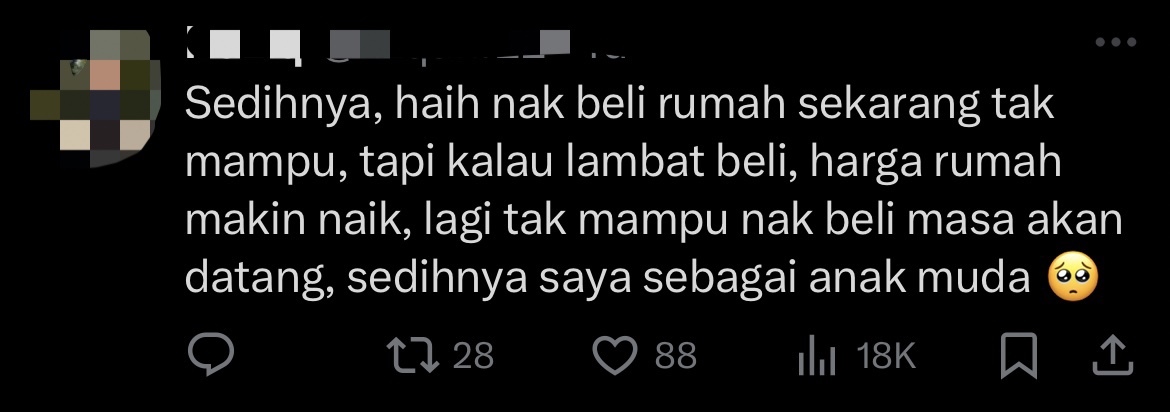

Another netizen lamented that young people nowadays are forced to reckon with the bitter truth that it will become more difficult for them to buy a house due to skyrocketing prices.

In the comment thread, the OP said that his friend was made aware of the viral tweet and thanked those who offered him their advice.

READ ALSO: