A man borrowed RM50,000 from loan sharks to support his business but ended up repaying over RM4 million and still owes RM4 million.

According to China Press, Kuala Lumpur Chinese Assembly Hall Secretary General See Foo Hoong revealed that the man, who was involved in the automotive parts business, borrowed from 16 different loan shark groups after initially borrowing from just one.

Drawn by advertisements

See explained that online loan sharks used local bank logos to appear legitimate, luring victims with seemingly transparent interest rates and repayment plans.

The victim, faced with cash flow issues since last year, was drawn to one of these advertisements and applied for a loan through WhatsApp.

However, every loan he took was subject to exorbitant fees, leaving him with only 40% to 60% of the loan amount.

Unable to repay the high interest rates, the man borrowed from other loan sharks to pay off his previous debts.

Repaid over RM4 million

See estimated that the victim borrowed over RM1 million from multiple loan sharks. With interest accumulating, his family helped him repay over RM4 million.

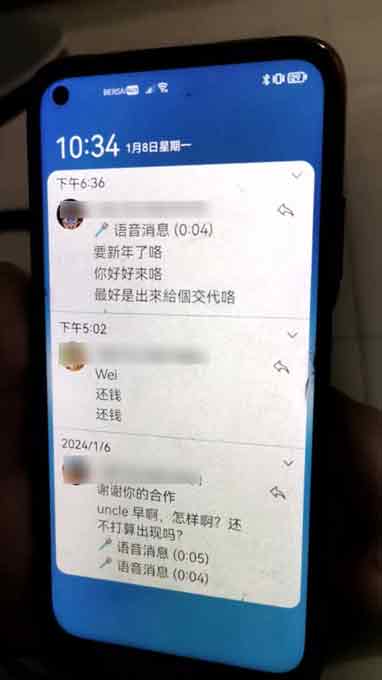

The victim also faced relentless harassment from loan sharks using different phone numbers to demand payment.

Despite repaying over RM4 million, the loan sharks claimed he still owed them another RM4 million.

Seeking help, the victim reported the matter to the police, providing evidence of bank transactions and the threatening messages.

Received only half of the loan

The man also provided copies of utility bills and his ID card. Despite applying for RM50,000 in loans, he received only RM27,000 after deductions.

As interest rates soared, the victim kept borrowing from different loan sharks to repay previous debts, eventually involving 16 groups.

See urged the public to be cautious of online loan sharks and report any suspicious activities to the authorities, highlighting the need for more stringent regulations and public awareness.

READ ALSO: