Owning our dream car is a milestone many aspire to, but is it always a wise financial decision?

Recently, a Malaysian man took to social media to express his concerns about people earning RM4,000 a month purchasing Honda vehicles.

His post, shared on his thread account @jazzeez, sparked a heated discussion, with netizens weighing in on whether such a decision is financially sound.

Not jealous, just pity those struggling

In his post, @jazzeez highlighted how one of his clients, earning RM60,000 a month, drives a Honda Civic, which makes sense given his financial capacity.

However, he found it concerning that many earning as little as RM4,000 were also opting for Honda cars.

It’s not jealousy, but I really pity you guys struggling to survive. If you can only save a minimum of RM1,000 per month, it’s better to just drive a Malaysian car,” he wrote.

Netizens share their opinions

His remarks quickly drew mixed reactions, with some agreeing while others felt it was a matter of personal choice.

One user shared their own experience of earning less than RM5,000 while driving a Honda, saying it was manageable depending on other financial commitments and the amount set aside for the down payment.

They also pointed out that local cars aren’t necessarily cheap either, apart from models like the Axia or Saga.

Meanwhile, another netizen mentioned that those earning RM4,000 fall within the B40 income group and should prioritise their essential expenses.

‘Even we in the M40 category with extra income don’t dare to take that risk. RM4,000 is barely enough to feed and school your kids.’

While some users acknowledged @jazzeez’s point, they argued that financial circumstances vary. They pointed out that saving RM1,000 a month is already a challenge for many, adding that if someone has heavy commitments, opting for an affordable car would indeed be wiser.

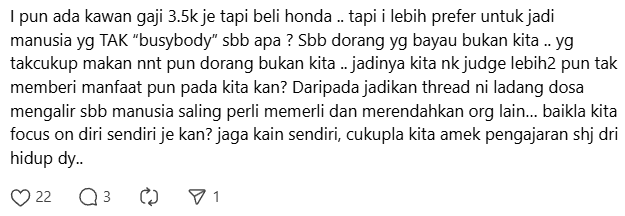

On the other hand, another netizen took a different stance, arguing that it’s ultimately a personal choice.

‘I have a friend earning RM3.5k who bought a Honda, but I’d rather not be ‘busybody’. They’re the ones paying for it, not us. If they struggle later, it’s their problem, not ours. Instead of mocking others, it’s better to focus on our own lives.‘

Is it worth the financial burden?

The debate highlights an ongoing dilemma—should one prioritise financial security or personal satisfaction when purchasing a car?

While some believe in living within their means, others argue that as long as one can afford the monthly payments, it’s a matter of personal preference.

What do you think? Would you buy a Honda on a RM4,000 salary, or would you play it safe with a more affordable option?

Share your thoughts with us in the comment section.

Here is the post:

View on Threads

READ ALSO: