Medical insurance is supposed to be a safety net, but what happens when that safety net starts costing more?

That’s the concern for many Malaysians, as reports reveal that medical insurance premiums will increase by 40% to 70% in 2025.

With some policyholders already noticing higher monthly charges on their medical cards, the frustration is real.

But an insurance agent has stepped in, arguing that the price hike isn’t as bad as people think.

“RM30 is nothing compared to a RM70,000 hospital bill”

People are understandably upset about paying more every month, but this agent believes the bigger worry should be the actual cost of medical treatment.

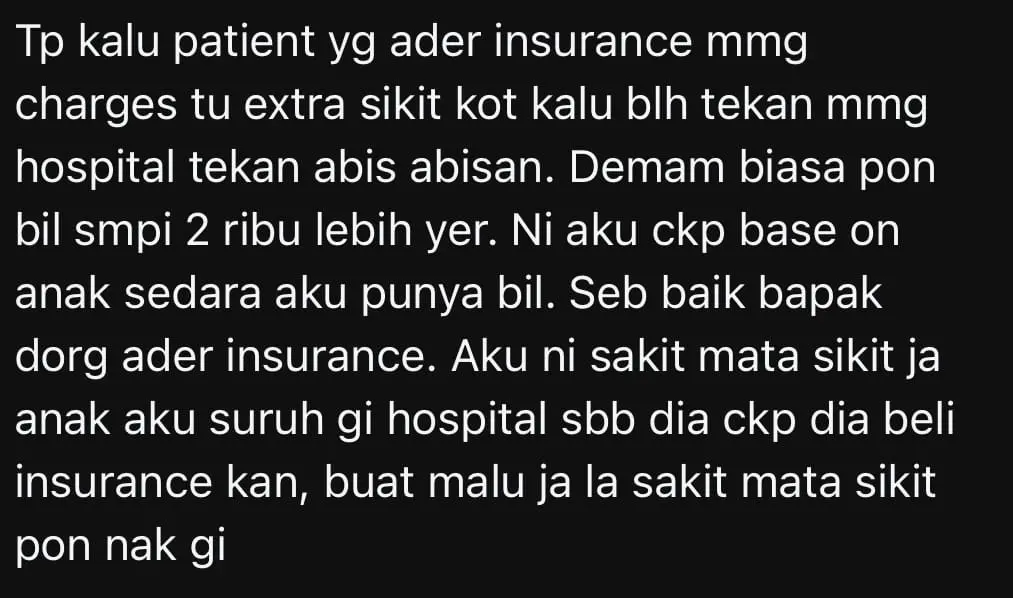

To prove their point, they shared a recent case involving one of their clients who was hospitalised after a motorcycle accident last week. The hospital bill? A jaw-dropping RM70,000.

The agent encouraged others to put things into perspective before complaining about the increase.

If a client complains about their medical card price hike, just show them this bill. My client got into a motorcycle accident last week, and the total hospital bill came up to RM70,000. If your premium only increased by RM30, just pay it. RM30 is nothing compared to paying RM70,000 in cash at the hospital. Got it? Share this with your friends and family, okay?”

Their argument? An extra RM30 a month is a small trade-off compared to being hit with an unaffordable hospital bill.

View on Threads

Netizens split over who’s really to blame

The agent’s post quickly went viral, sparking a heated debate on Threads.

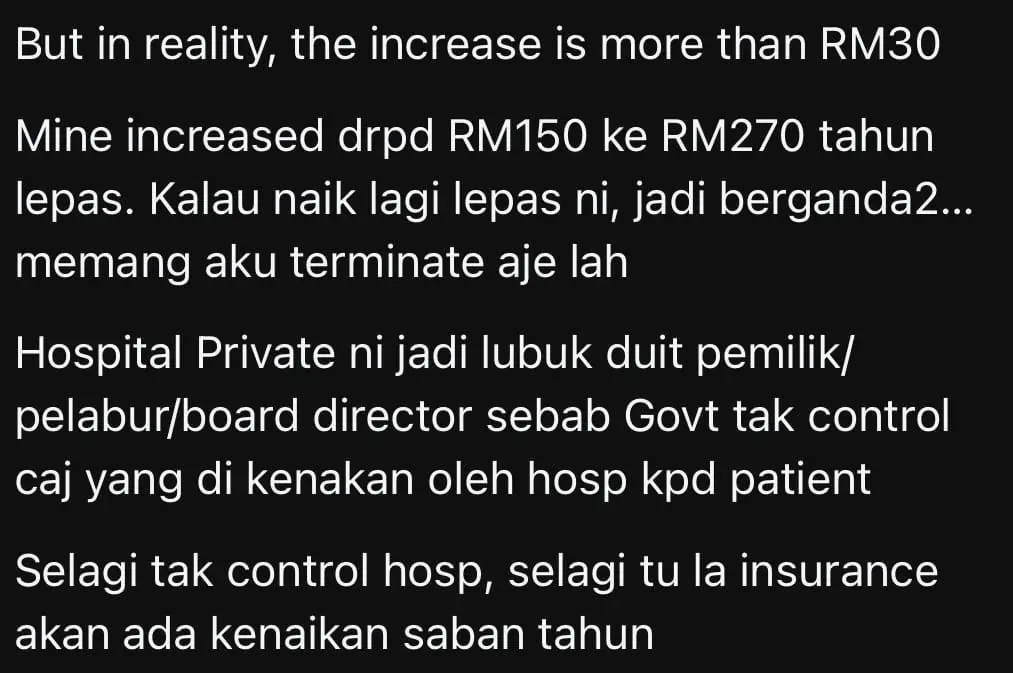

Many pointed fingers at hospitals for charging unreasonably high fees, especially when they find out a patient has insurance.

“If a patient has insurance, of course, they’ll charge more. If they can squeeze more out of you, they will. Even a simple fever can cost over RM2,000. I know this because my nephew’s bill was that much. Luckily, his dad had insurance. My kid once told me to go to the hospital for a mild eye infection because we have insurance—so embarrassing!”

Others argued that private hospitals were exploiting patients because of the lack of government regulation on pricing.

“In reality, the increase isn’t just RM30. Mine jumped from RM150 to RM270 last year. If it keeps going up, it’ll double in no time… I’ll just terminate my policy. Private hospitals are money-making machines for their owners, investors, and board directors because the government doesn’t control their pricing. Unless hospital charges are regulated, insurance premiums will keep rising every year.”

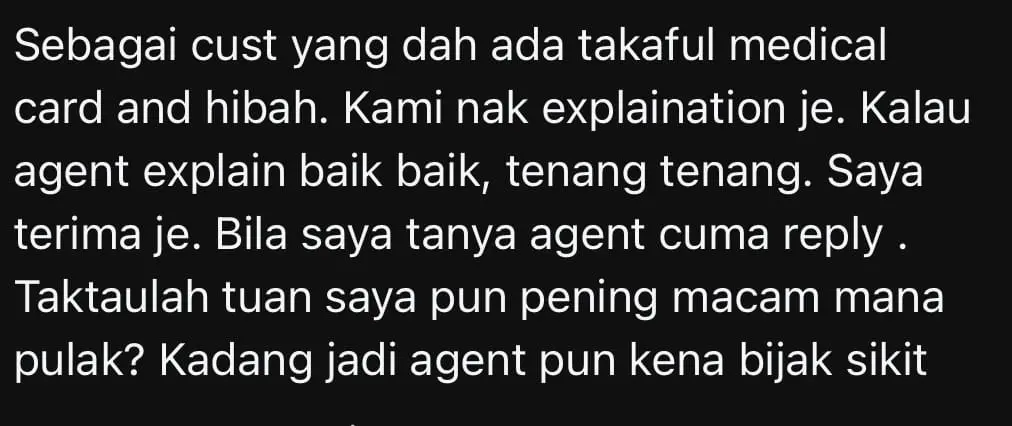

Meanwhile, some policyholders said they wouldn’t mind paying extra—as long as their insurance agents were upfront about it.

“As someone with a takaful medical card and hibah, I just want an explanation. If my agent explains things properly and calmly, I’ll accept it. But when I ask, all I get is ‘I don’t know, boss, I’m confused too.’ If you’re an agent, at least be smart about it.”

Rising premiums vs. soaring medical costs

While insurance remains an essential safety net, this debate raises a bigger issue: Are hospitals pricing treatments fairly, or are insured patients being charged more simply because they can be?

One thing’s for sure—medical expenses aren’t getting any cheaper, and policyholders will need to make some tough financial decisions moving forward.