A 6-year-old girl’s MyKid card was shockingly used as a loan guarantor by her unemployed father, sparking months of harassment, threats, and even paint vandalism at his ex-wife’s home.

According to China Press, the 25-year-old man borrowed RM1,500 from loan sharks and used his daughter’s identity as a “guarantor”, falsely assuring that his ex-wife would repay the debt on behalf of their child.

Ex-wife speaks out on social media

Chen (transliteration), a 23-year-old mother from Seremban, posted about the situation online, accusing her ex-husband of misusing their daughter’s personal information to secure an illegal loan.

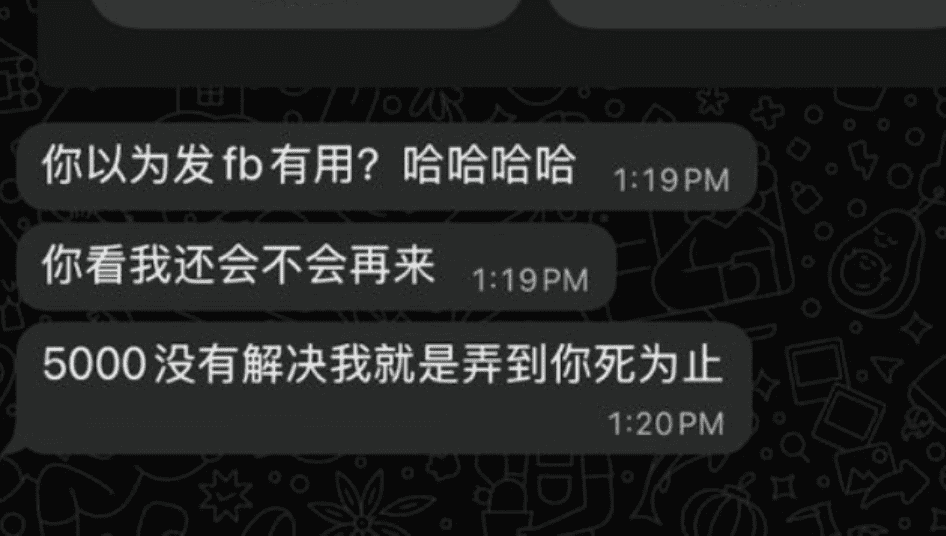

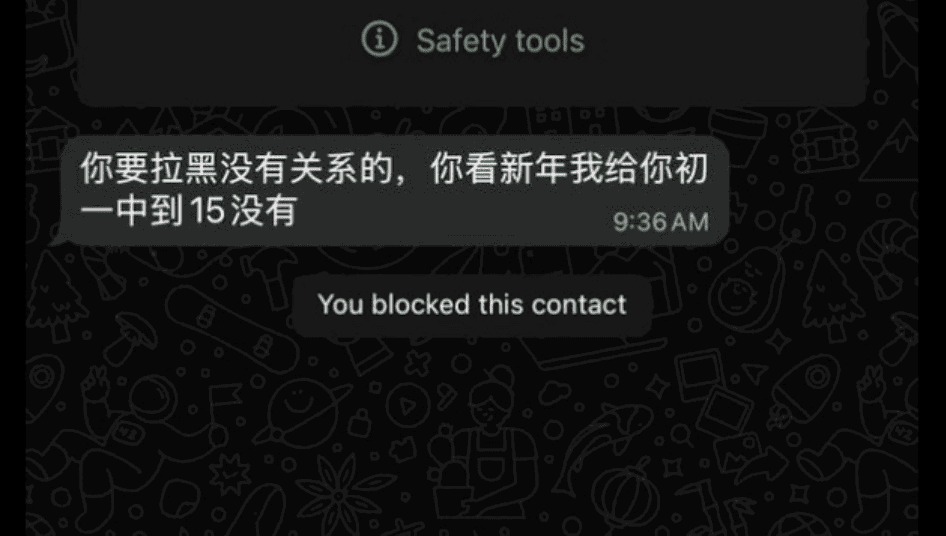

She said that since the loan was taken, she and her family members had been bombarded with threatening calls and WhatsApp messages.

Their home was even splashed with red paint twice—once on Dec 20, 2025, and again on Jan 5, 2026.

According to Chen, the threats began on Nov 20, 2025, when a stranger called demanding she repay the RM1,500 loan, claiming her daughter was the “guarantor”.

The harassment soon spread to her parents and siblings.

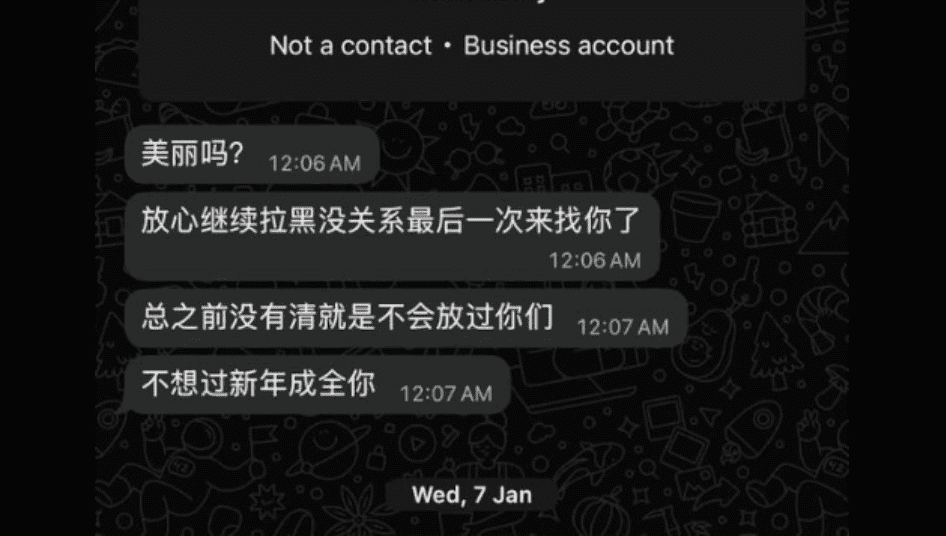

She said the first red paint incident came with a message which read “Pretty or not?”, along with a warning to repay RM5,000.

After the second incident, the threats became more aggressive, prompting Chen to file multiple police reports.

Father had no IC, never legally married

Chen revealed that she and her ex never registered their marriage due to his lack of an identity card, caused by birth certificate issues.

They had a daughter in 2019 and a son in 2023 before splitting two years ago.

She believes he accessed their daughter’s MyKid card when she applied for financial aid as a single mother and had kept the information since.

Chen said her ex-husband, who’s unemployed and often absent, relied on his adoptive parents and her own income to survive. She moved out with the children after suspecting he was cheating.

Ex-husband linked to drugs and more debt

After their breakup, Chen discovered through friends and social media that her ex had a history of drug use and had been arrested multiple times. He was also publicly named in loan shark debt collection posts.

She was further disturbed to learn that he had used her car and never returned it, leaving her to face road tax fines and unpaid insurance.

Chen shared that her ex had been seen loitering near her daughter’s kindergarten, raising concerns among teachers and parents. She now fears he may try to take the child without warning.

The fact that he used a child’s MyKid card to borrow money is unacceptable. Children can’t be guarantors. It’s illegal and puts them in danger.”

Chen urged authorities and local representatives to step in and said she hopes for a long-term solution to protect her children and elderly family members, who now live in fear.

Her biggest concern is that the situation could escalate from red paint to actual harm.

Harassment goes beyond debt recovery

Chen said the loan sharks started with one phone call but quickly escalated to non-stop harassment.

They changed phone numbers and accounts frequently to avoid being blocked, and even spied near their home.

They said they’d ‘make trouble from Day 1 to Day 15 of Chinese New Year’,” she added. One threatening message read: ‘Don’t worry, I won’t target you. I’ll go after your family.’”

Chen said this kind of intimidation was no longer just about debt—it had crossed the line into criminal behavior.

READ ALSO: