They say experience is the best teacher, but sometimes, the lesson comes too late.

One Malaysian woman trusted her employer like many of us do, never imagining that he would one day use that trust to destroy her financial future.

Years later, she now finds herself saddled with a RM250,000 debt, accused of taking out a loan she never applied for.

A court summons out of nowhere

The nightmare began with a letter.

She was going about her daily life when she suddenly received a writ of summons, demanding that she repay a massive bank loan.

Confused, she tried to recall if she had ever signed off on anything. But deep down, she knew she hadn’t.

What came next was even more shocking.

The face behind the fraud

Digging deeper, she found out that the person behind the mysterious loan wasn’t a stranger.

It was someone she knew well: her former boss.

According to her viral TikTok video, the betrayal unfolded during the Movement Control Order (MCO) period, when many administrative processes shifted online.

At the time, she was still working for the company and had no idea her name had been used in a larger scheme.

How it happened

As she pieced the story together, a disturbing picture began to form.

She claimed her ex-employer had registered her name with the Companies Commission of Malaysia (SSM) as a business partner.

Later, he quietly removed his own name, leaving her as the sole proprietor on paper without informing her.

Because it was during MCO, he allegedly handled all the online documentation and used her identity to apply for a business loan.

She only learned about it after being served legal papers.

This happened during MCO. He managed everything. I didn’t even know about the loan until one day I got a writ of summons at my house for failing to repay it,” she shared in the video.

A face-to-face confrontation

Determined to get answers, the woman and her family decided to confront him directly.

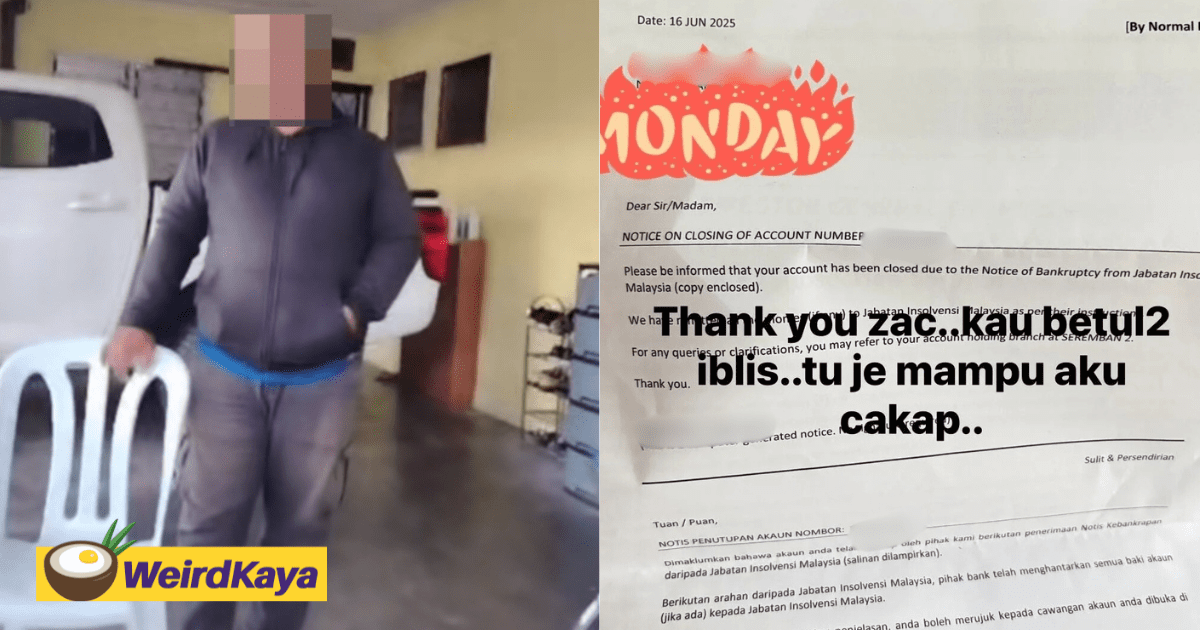

In a viral video, the group was seen approaching the man.

But according to her, rather than addressing the issue, he tried to run away.

Since then, he has reportedly gone off the grid. Yet somehow, he is still operating his business like nothing happened.

From victim to bankruptcy

The emotional toll was soon matched by financial devastation.

She revealed that she has now received a bankruptcy notice, and things have only worsened.

In a Facebook post, she shared that her bank account has been frozen, leaving her unable to withdraw any money, not even for basic family expenses or child support.