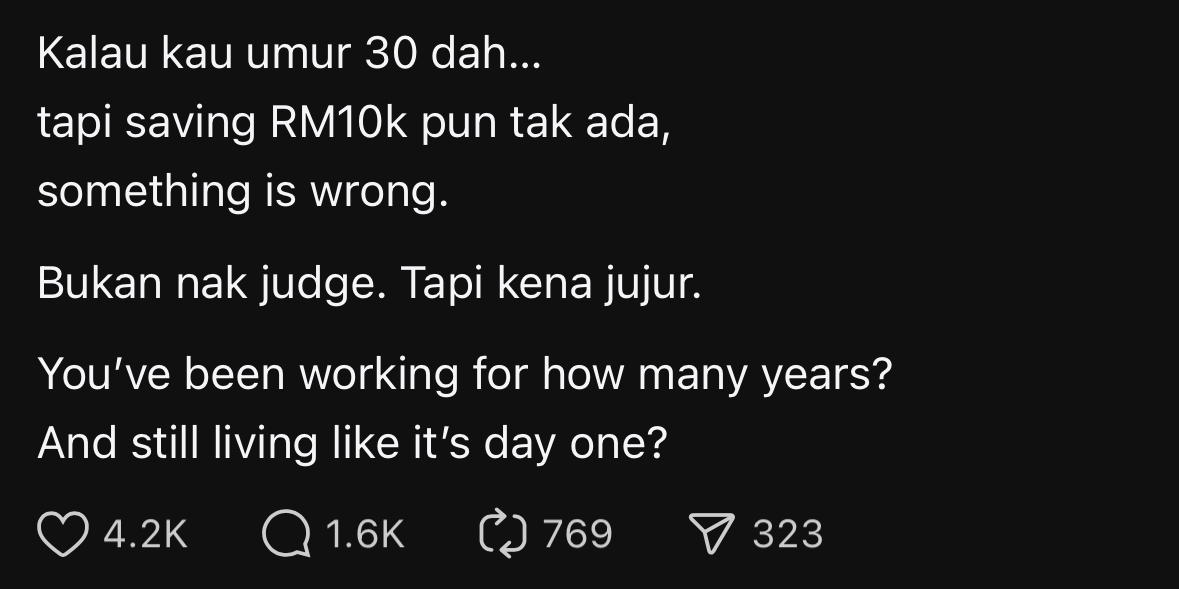

A viral social media post recently ignited a fiery debate after calling out 30-year-olds who have been working for years yet haven’t managed to save RM10,000.

The post, written in a blunt mix of Malay and English, reads:

Kalau kau umur 30 dah… tapi saving RM10k pun tak ada, something is wrong.Bukan nak judge. Tapi kena jujur. You’ve been working for how many years? And still living like it’s day one?”

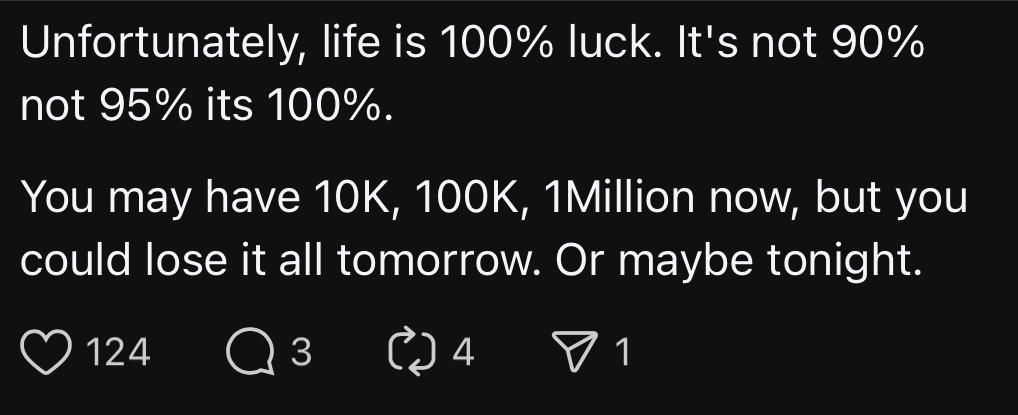

Tone-deaf or truth hurts?

Some netizens agreed with the sentiment, saying it’s a wake-up call for young adults to relook their spending habits and financial planning.

But many others slammed the post as being tone-deaf, especially in today’s economy where wages remain stagnant while living costs skyrocket.

“Try living in KL earning RM2.5k a month and see how much you can actually save,” wrote one user.

Another chimed in: “It’s not that people don’t want to save. Some are barely surviving.”

Context matters

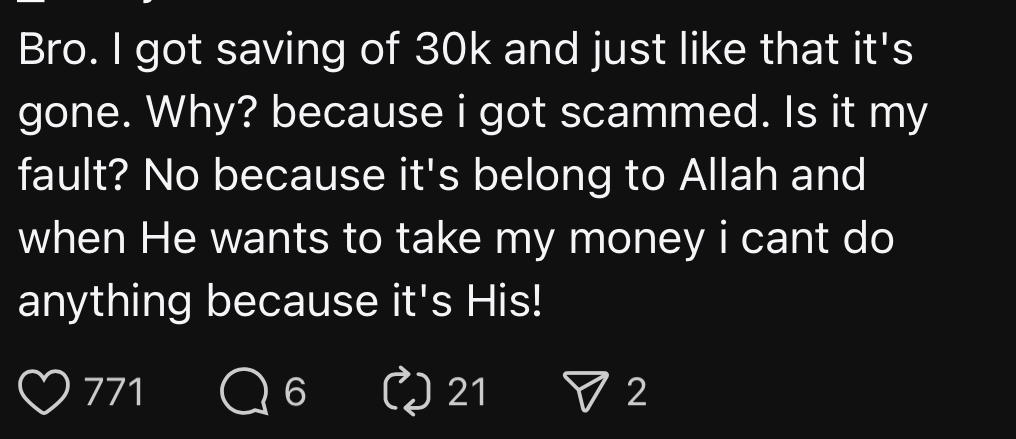

Critics pointed out that not everyone starts with the same opportunities or support system.

Factors like student loans, family obligations, low wages, and high rental costs can eat into whatever savings one tries to build.

Others felt the post unfairly shames people who may already be struggling, instead of encouraging healthy financial conversations.

According to financial advisors, while having RM10,000 saved by age 30 is a good goal, it’s not a one-size-fits-all benchmark.

Personal finance depends heavily on income, lifestyle, and unexpected life events.

The key takeaway? It’s okay to set financial goals—but let’s not shame those who are doing their best in tough times.