It’s important for one to be taught from a young age how to manage and save money wisely as it’s a life skill that will prove to not only be useful, but will also save one from drowning in debt.

Unfortunately, not everyone has exactly grasped the importance of financial literacy, which has since led to an alarming number of bankruptcy cases taking place, including civil servants.

10-13% Of M’sian civil servants went bankrupt, report shows

According to data recently released by the Malaysian Department of Insolvency (MDI), there has been a rise in bankruptcy cases among civil servants from 2020 to March of this year.

Based on the data, 12% of civil servants went bankrupt in 2020 before the figure dipped to 10% in 2021. However, it rose to 11% in 2022 and 13% in 2023. As for 2024, it has hit the 14% mark.

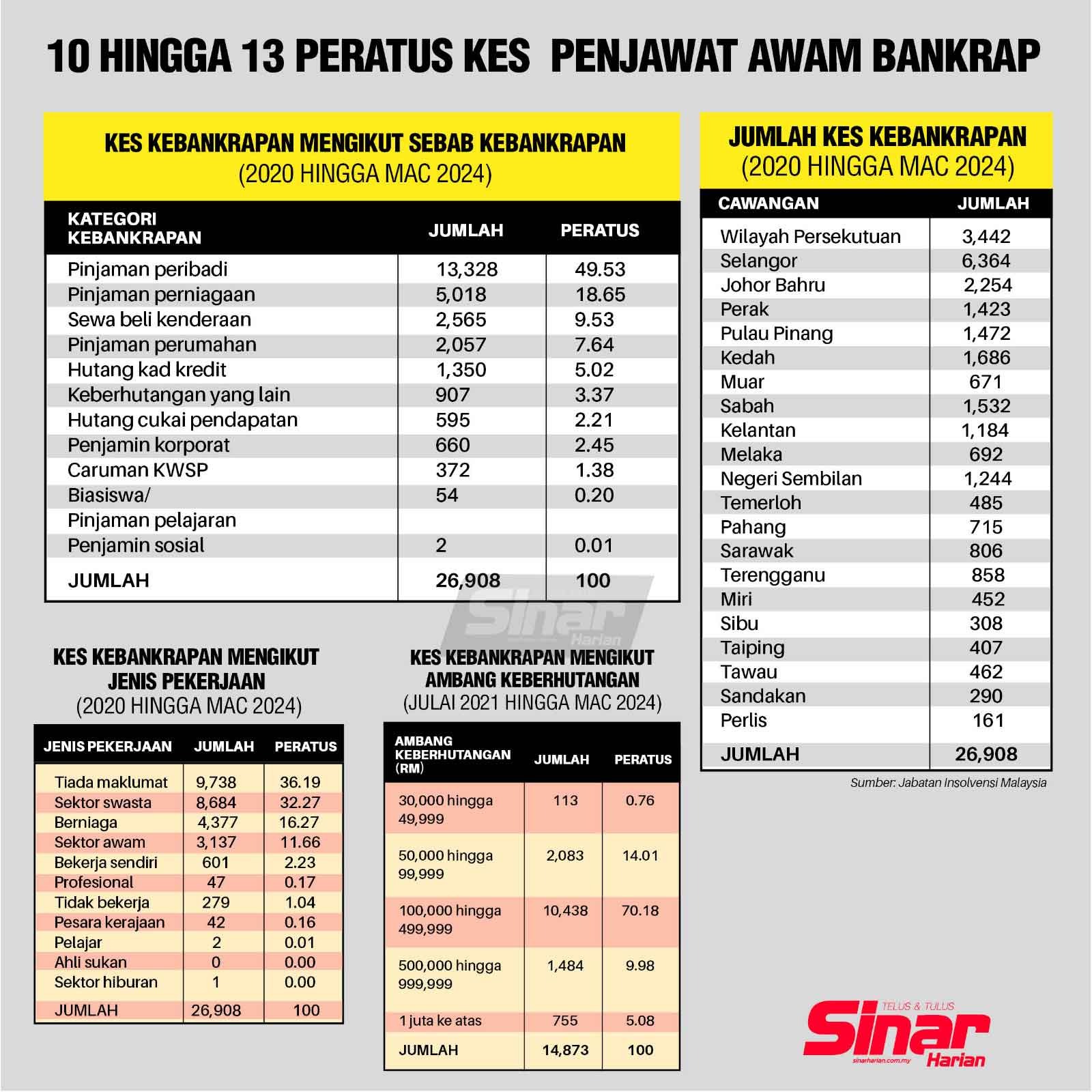

A chart shared by Sinar Harian on its Facebook page revealed that the main reason for civil servants declaring bankruptcy was due to personal loans (13,328 cases), while business loans came in second place (5,018 cases).

The chart also showed that Selangor recorded the most bankruptcies with 6,364 cases, while Perlis recorded the least amount with 161 cases as of March 2024.

Those who filed for bankruptcy also suffered dire financial consequences. According to data collected rom July 2021 to March 2024, more than 5% of civil servants had bankruptcies which exceeded RM1 million, while 70.18% lost between RM100,000 and RM499,999.

MDI director: Statistics very worrying

In light of the staggering figure, MDI director Datuk M Bakri Abd Majid said there was cause for concern for the increase of bankruptcies among civil servants.

In a statement, he said civil servants failing to manage their finances wisely affects not only them and their families, but the public service ecosystem too.

Those declared bankrupt are liable to disciplinary actions due to severe indebtedness, which damages the reputation of the public sector.

“It may also hamper their chances for salary increments, promotions and eligibility for bonuses and financial assistance,” he said.

Bakri also added that department heads must be more proactive in monitoring the debt levels of officers under their watch and be alert to sudden behavorial changes.

READ ALSO: