In a significant move to bolster its cross-border payment operations, Maybank has unveiled the extension of its QR code payment service to the vast Chinese market.

This strategic expansion is set to streamline financial transactions and provide unprecedented convenience for its users.

According to Sin Chew Daily, the innovative service is poised to benefit over 8 million Maybank MAE app users, who will now be able to transact seamlessly in China.

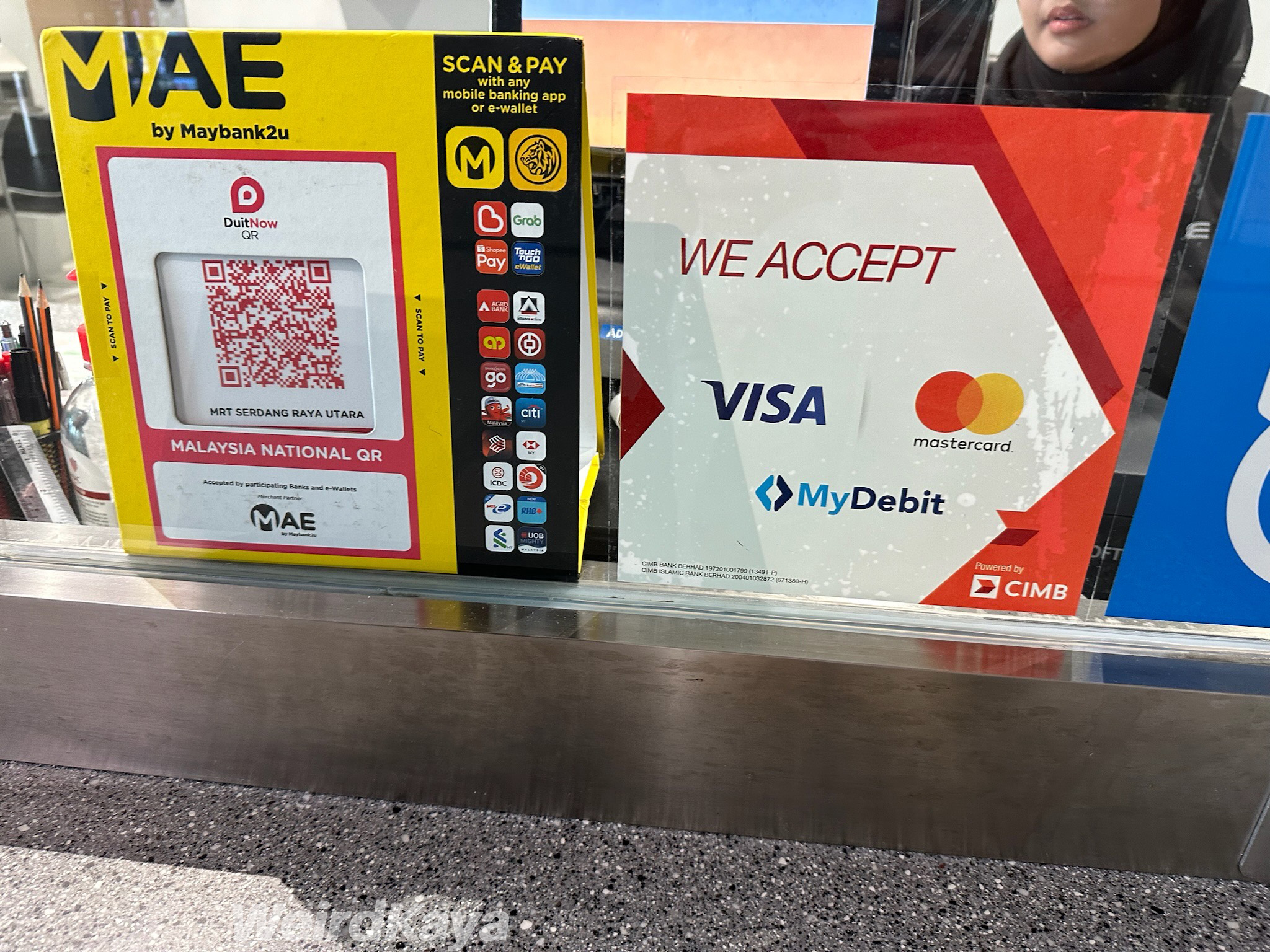

Additionally, the initiative is a boon for more than 700,000 merchants registered under Maybank QRPay, who are set to capitalize on the patronage of Chinese tourists in Malaysia.

Maybank’s foray into the Chinese market allows MAE users to engage in cashless transactions with local merchants registered with AliPay.

Once the service is launched, Maybank MAE users travelling to China will be able to make cashless payments to local merchants registered with AliPay.

To make a payment, they just need to scan a QR code using the app, enter the amount in RMB, and confirm payment details such as the exchange rate and the amount debited in Malaysian Ringgit instantly.

Similarly, Chinese tourists coming to Malaysia will also be able to make payments by scanning the DuitNow QR code through the AliPay app.

This development is part of Maybank’s early 2023 initiative, which has already seen the cross-border QR code payment service extended to Thailand, Indonesia, and Singapore.

The expansion is a testament to Maybank’s commitment to enhancing customer convenience and reflects its M25+ strategy, which aims to fortify its regional business footprint.

Dato’ John Chong Eng Chuan, CEO of Community Financial Services at Maybank, said that this move proves the bank’s dedication to facilitating cross-border payments.

“Such initiatives are not only customer-centric but also integral to the bank’s ambition to strengthen its presence across the region.

“With this latest move, Maybank will continue to pave the way for a more interconnected and efficient financial ecosystem in Southeast Asia and beyond,” he said.

Read more: