Do you think you’re earning enough to get by each month? If you constantly feel like your money isn’t stretching far enough, here’s how your spending stacks up against EPF’s latest estimations.

The latest Belanjawanku 2024/25 guide breaks down how much individuals and families in Klang Valley realistically need each month to live a modest but decent life, covering essentials like rent, food, transport, healthcare, savings, and more.

Your monthly budget can vary quite a bit depending on your lifestyle, like whether you drive or take public transport, and whether you’re living alone, with a partner, or raising kids.

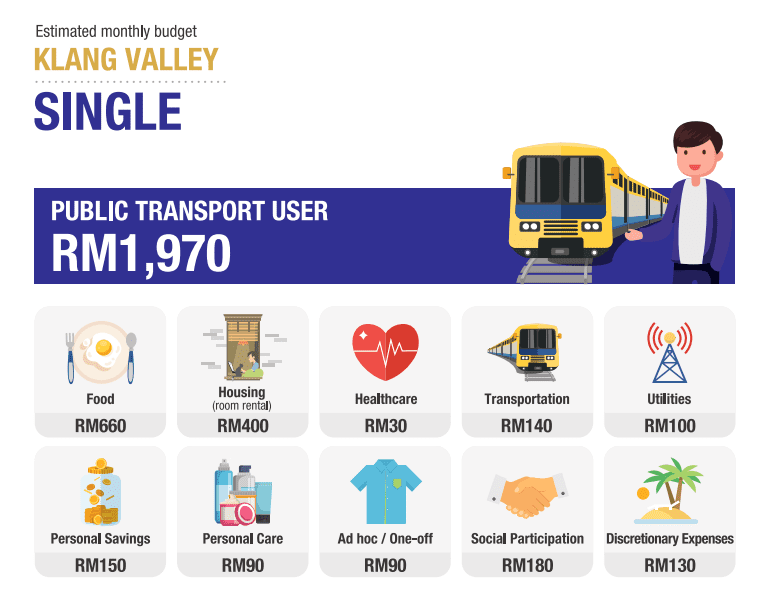

Single & public transport user: RM1,970 monthly

Those who rely on public transport can get by with a significantly lower monthly budget of RM1,970. It also includes budget estimations for different household types such as married couples with two children, single parents, and senior citizens to reflect diverse financial needs.

Here’s the breakdown of expenses:

- Transportation: RM140

- Food: RM660

- Housing (room rental): RM400

- Personal Savings: RM150

- Discretionary & Social Expenses: RM310 combined

- Ad hoc/One-off: RM90

This category shows how using public transport can help save over RM800 monthly compared to car ownership, allowing more flexibility for savings and lifestyle choices. drives up the cost of living, mainly due to fuel, maintenance, and parking expenses.

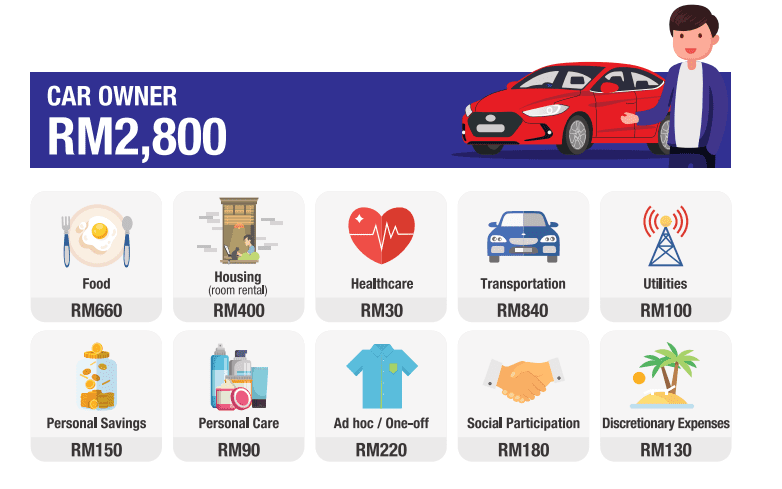

Single & car Owner: RM2,800 monthly

A single person who owns a car in Klang Valley would need an estimated RM2,800 per month to maintain a modest standard of living.

Key expenses include:

- Transportation: RM840

- Food: RM660

- Housing (room rental): RM400

- Ad hoc/One-off: RM220

- Discretionary & Social Expenses: RM310 combined

- Personal Savings: RM150

Car ownership remains a major cost driver, taking up nearly a third of the total monthly budget.

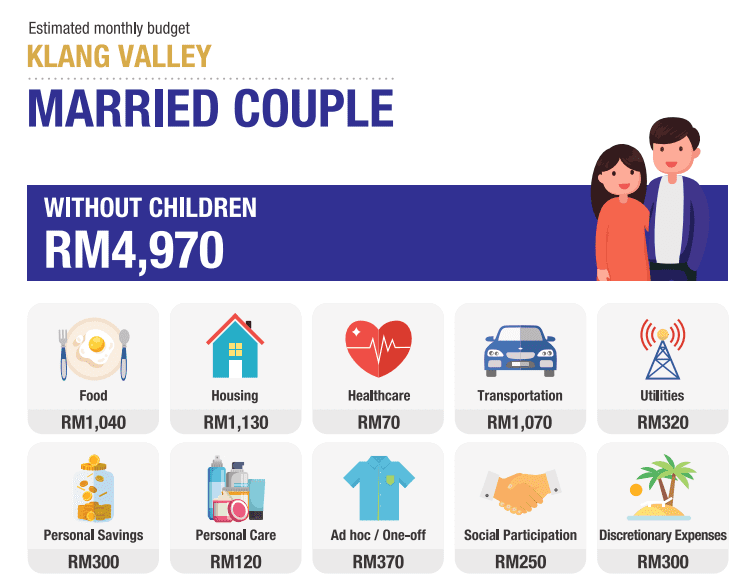

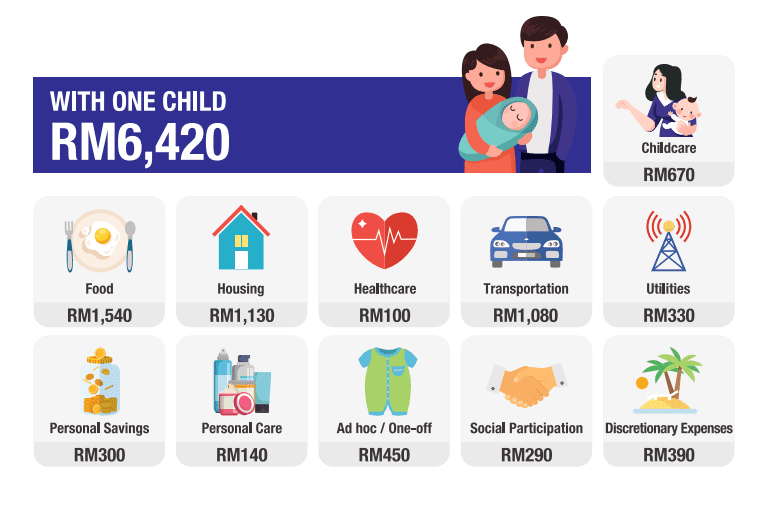

Married couples with/without kids

According to KWSP’s estimation, a married couple in Klang Valley needs about RM4,970/month without kids, while adding one child raises the budget to RM6,420/month.

The RM1,450 difference comes mainly from:

- Childcare (RM670)

- Higher food costs (+RM500)

- Slight increases in healthcare, ad-hoc, and personal care

Having a child significantly increases household expenses, making it the most financially demanding scenario in the Belanjawanku guide.

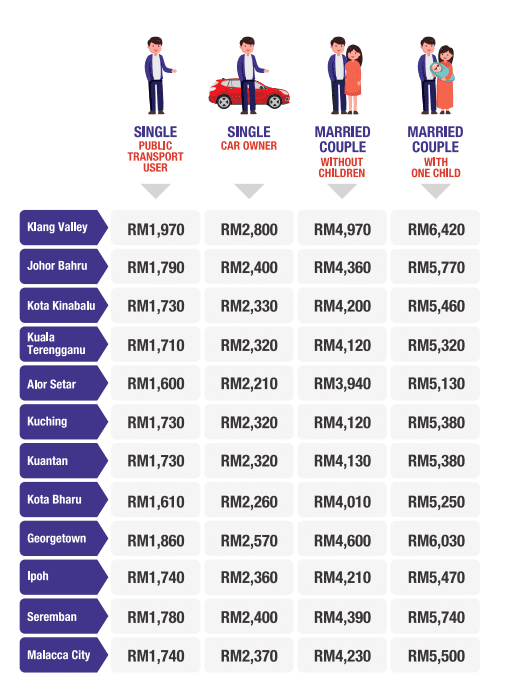

Budget for different cities

In the report, it also provided cost-of-living estimates for other cities like Johor Bahru, Kota Kinabalu, Kuching, and Georgetown, offering a practical guide to help Malaysians plan their savings based on where they live.

They also included budget estimations for different household types, such as married couples with two children, single parents, and senior citizens, to reflect diverse financial needs.

What do you think? Are you earning enough for a comfortable life in your city?