Most Malaysians sign a 30–35 year home loan without realising one thing; the loan structure you choose can literally decide whether you’re debt-free at 50 or 65.

Recently, a property consultant broke down a strategy that helped him shave more than eight years off his mortgage and save nearly RM120,000 in interest all by understanding how his bank treats extra payments.

He explained that while many assume every housing loan works the same, the truth is very different.

Depending on whether you choose a basic term loan or a flexi/semi-flexi loan, the way your instalments work and whether you can cut the principal early can completely change your financial future.

Basic term loan vs flexi loan

A basic term loan looks straightforward because:

- the instalment stays the same

- the loan duration is fixed

- it feels “safe” and predictable

But there’s a hidden drawback:

- The instalment never goes down

- Extra payment does NOT reduce your principal

- The bank treats it as advance interest unless instructed otherwise

In short, you’re locked into the full 30–35 years unless you refinance.

Meanwhile, a flexi or semi-flexi loan gives you far more control over your money:

- You can pay extra monthly

- You can dump a lump sum anytime

- You can shorten your tenure drastically

But there’s one sentence you MUST tell the bank:

“I want to pay the principal.”

If you don’t say this, the bank may treat your extra payment as interest, which does nothing to reduce your loan balance.

Every bank has its own rules, some allow online top-ups, some require counter payments, some limit the frequency but the core idea stays the same:

Every extra ringgit that hits the principal cuts months or even years off your loan.

Real numbers: RM500k property, 30-year loan

Here’s the man’s actual example:

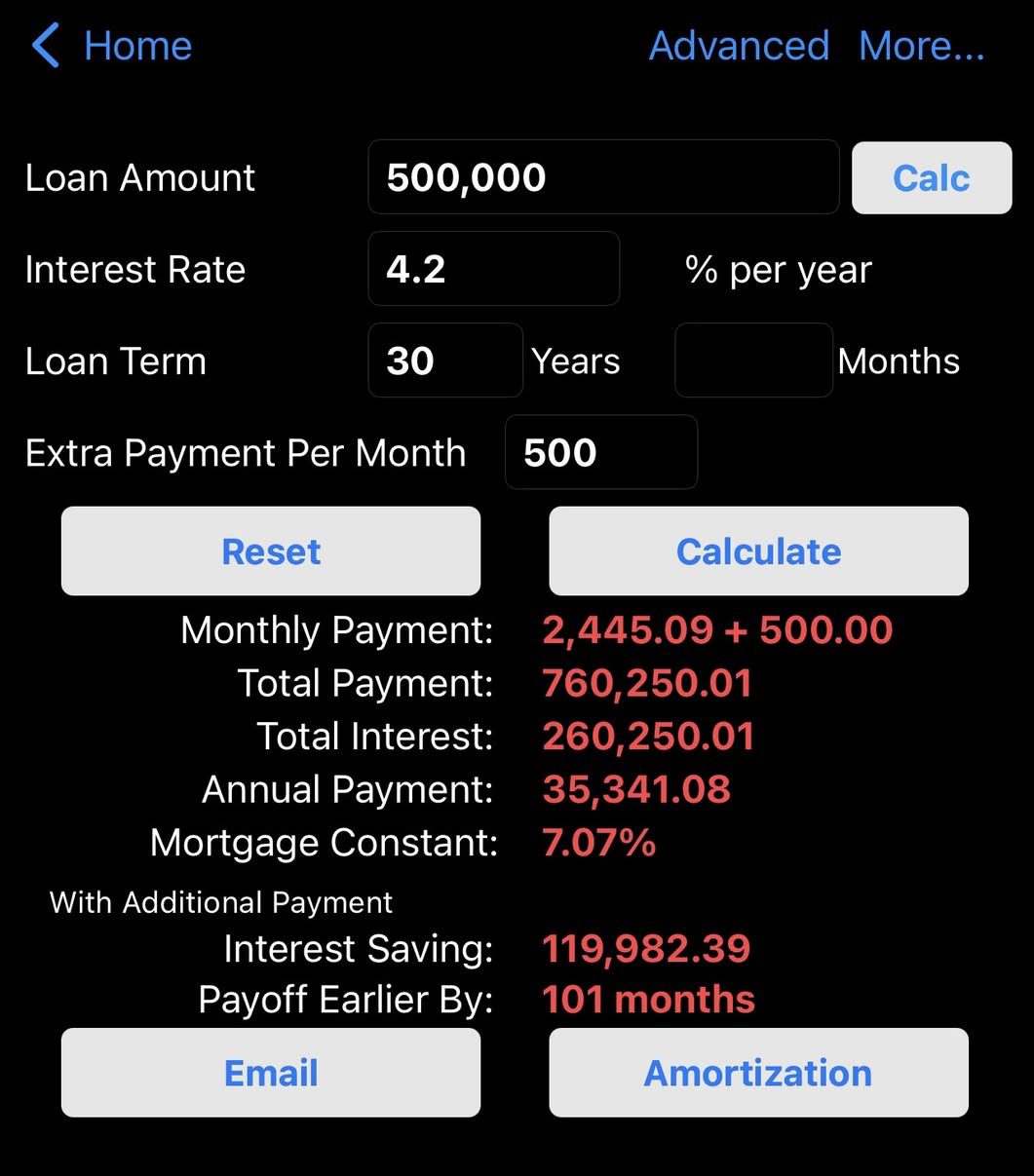

Property Price: RM500,000

Loan Tenure: 30 years

Interest Rate: 4.2%

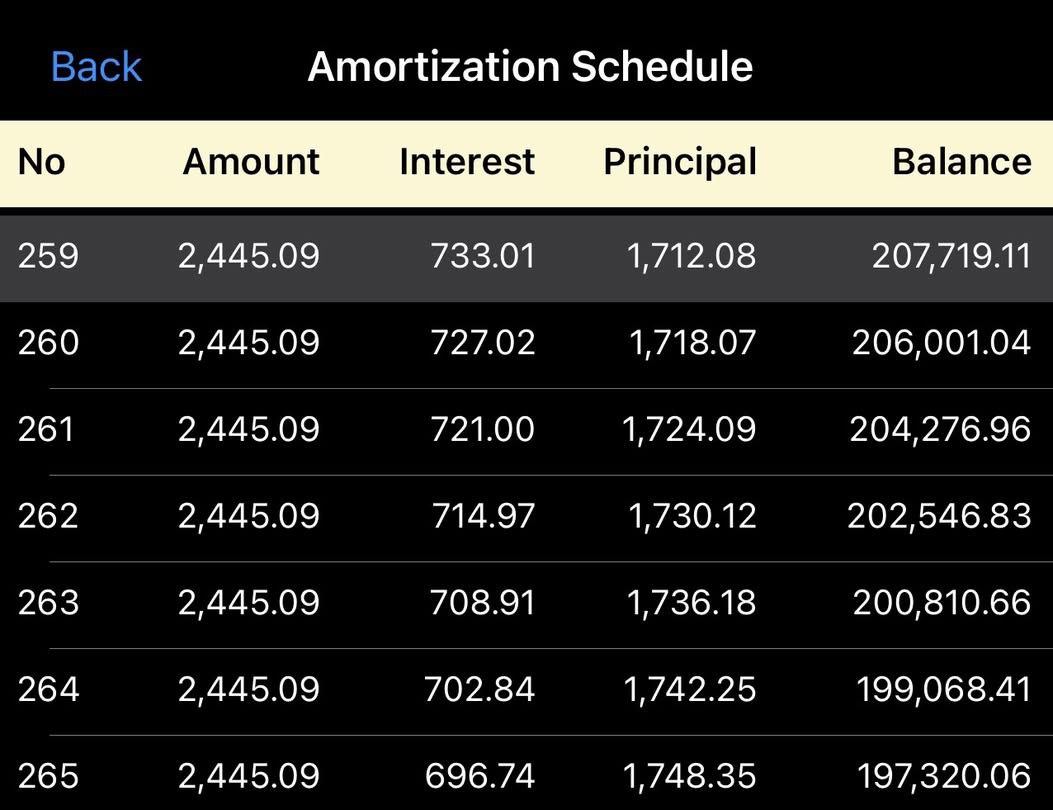

Normal Monthly Instalment: ~RM2,445

Now add RM500 extra every month, directly to the principal.

The results are shocking:

- Loan finishes 101 months earlier (about 8.4 years)

- New tenure: ~21.6 years

- Total interest saved: RM119,982 (≈ RM120k)

By just adding RM500, your mortgage shifts forward by 8 years, meaning the property starts generating pure rental income much sooner.

8 years of pure rental income

A RM500k unit in a solid location can rent for:

- RM3,000–RM4,000 a month

If your loan ends 8 years earlier, that’s:

- RM3,000 x 96 months = RM288,000

- RM4,000 x 96 months = RM384,000

This is passive cash flow before even counting capital appreciation.

In other words, clearing your loan early unlocks nearly RM300k–RM400k of rental income.

Alternate strategy: Invest the RM500 instead

The man also shared another viewpoint:

Instead of paying the extra RM500 into your loan, you can invest it separately in something like:

- Amanah Saham Bumiputera (ASB)

- Tabung Haji (TH)

- Unit trusts

- Index funds

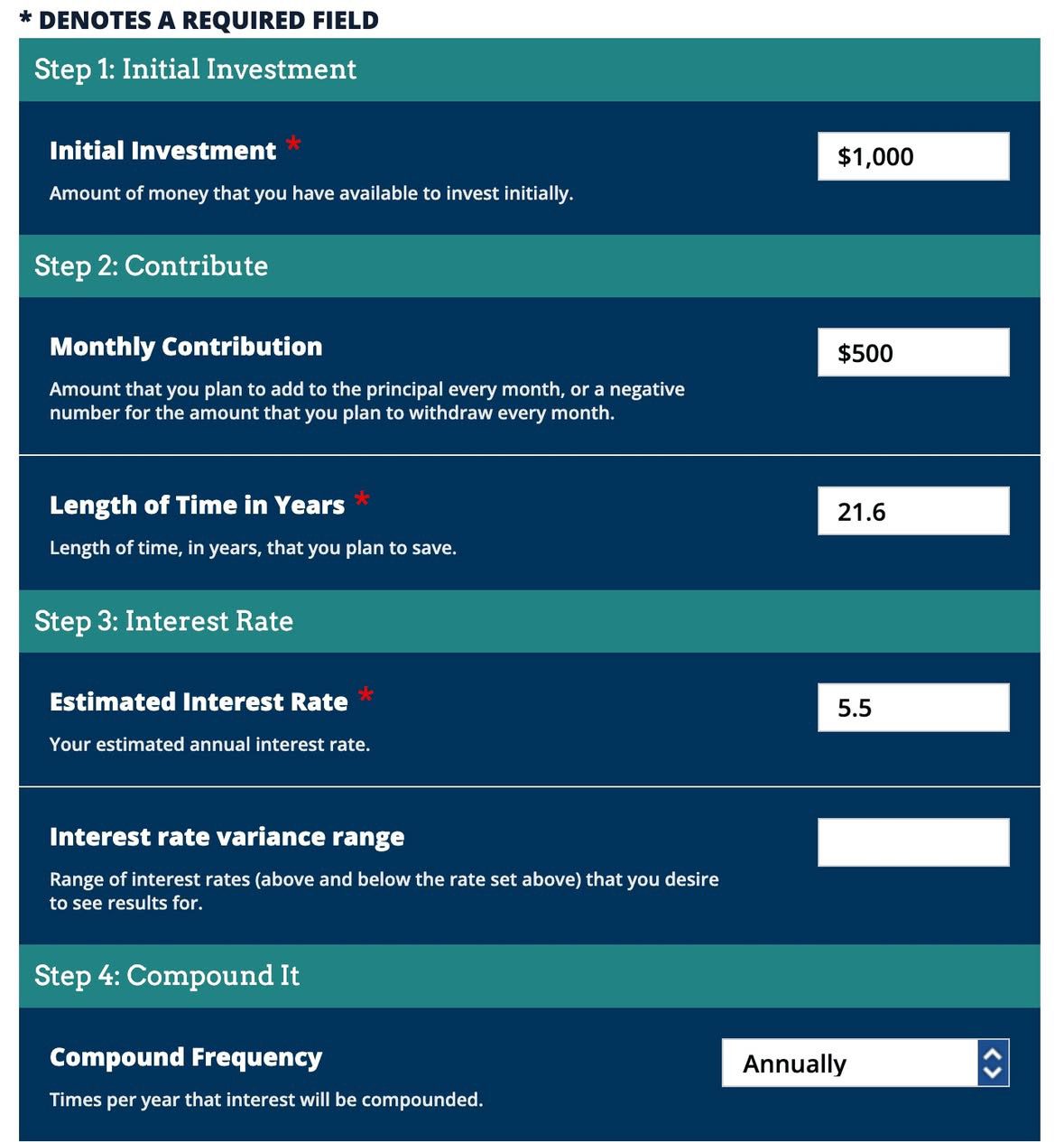

Assuming a 5.5% return, the RM500 monthly contribution grows to:

RM240,857 in 21.6 years.

After 21.6 years of normal repayments, you would’ve already paid off about RM300,000 of your loan.

This means:

- You can use the RM240k investment to settle most of the remaining loan

- And still keep RM40k+ as savings

The bottom line

Whether you choose to:

- Pay RM500 extra into the principal, or

- Invest RM500 monthly and let compounding work

The logic stays the same:

- Pay a little extra

- Cut the principal

- Shorten your loan

- Save huge interest

- Start collecting rental income earlier

For many Malaysians, this small monthly habit can reshape their entire financial life.

View on Threads