📢 Attention, taxpayers!

The Inland Revenue Board of Malaysia (LHDN) has announced the important tax filing deadlines for 2025.

Mark these dates to ensure a smooth filing process.

Who needs to file taxes?

Under the Income Tax Act 1967, individuals—whether Malaysian citizens or foreigners—must file taxes if they reside in Malaysia for more than 182 days in a year and earn an income here.

It’s important to understand that filing and paying taxes are different.

Filing involves reporting your income and financial details to LHDN, while tax payment is only necessary if your earnings exceed the taxable threshold.

Even if you don’t owe taxes, you are still required to file if you have an income. Keeping proper records is essential to avoid issues later on.

2025 tax filing deadlines

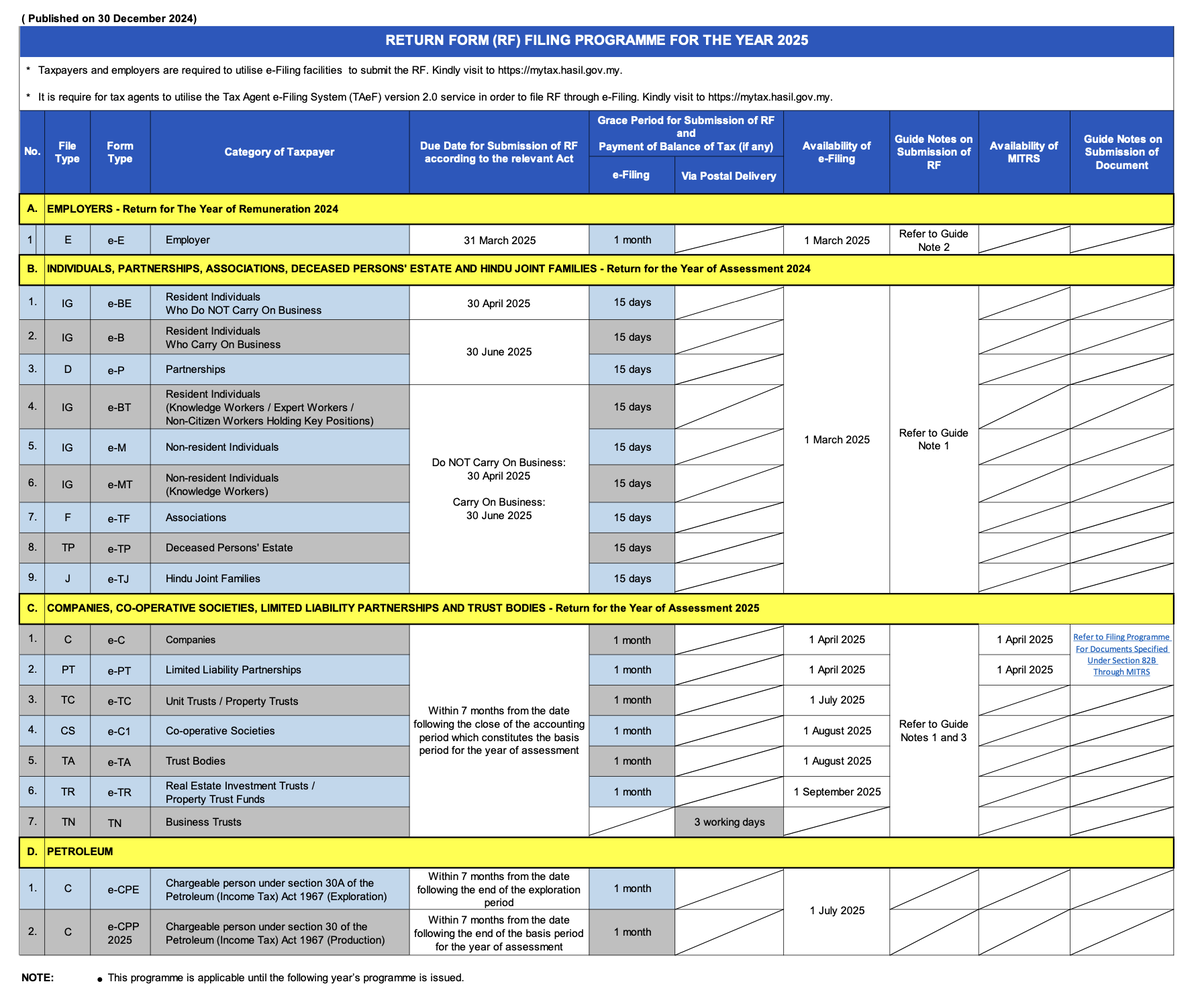

📅 March 31, 2025

- Employers: Submit employee tax forms via E Form

📅 April 30, 2025

- Salaried employees and non-business individuals: File using BE, BT, M, MT, TP, TF, or TJ Forms

📅 June 30, 2025

- Business owners: File using B, P, BT, M, MT, TF, TP, or TJ Forms

Extra 15 Days: Those filing electronically via e-Filing get an additional 15 days to submit their returns.

Taxpayers should keep all tax-related documents and receipts for at least seven years in case of future audits by LHDN. Stay prepared!