With the expansion of the Service Tax (SST) scope starting 1 July 2025, many Malaysians have raised concerns about whether their everyday banking services will be affected.

To address these concerns, Bank Negara Malaysia (BNM), along with the Association of Banks in Malaysia (ABM), Association of Islamic Banking and Financial Institutions Malaysia (AIBIM), and the Malaysian Investment Banking Association (MIBA), have stepped forward with a joint statement to reassure the public.

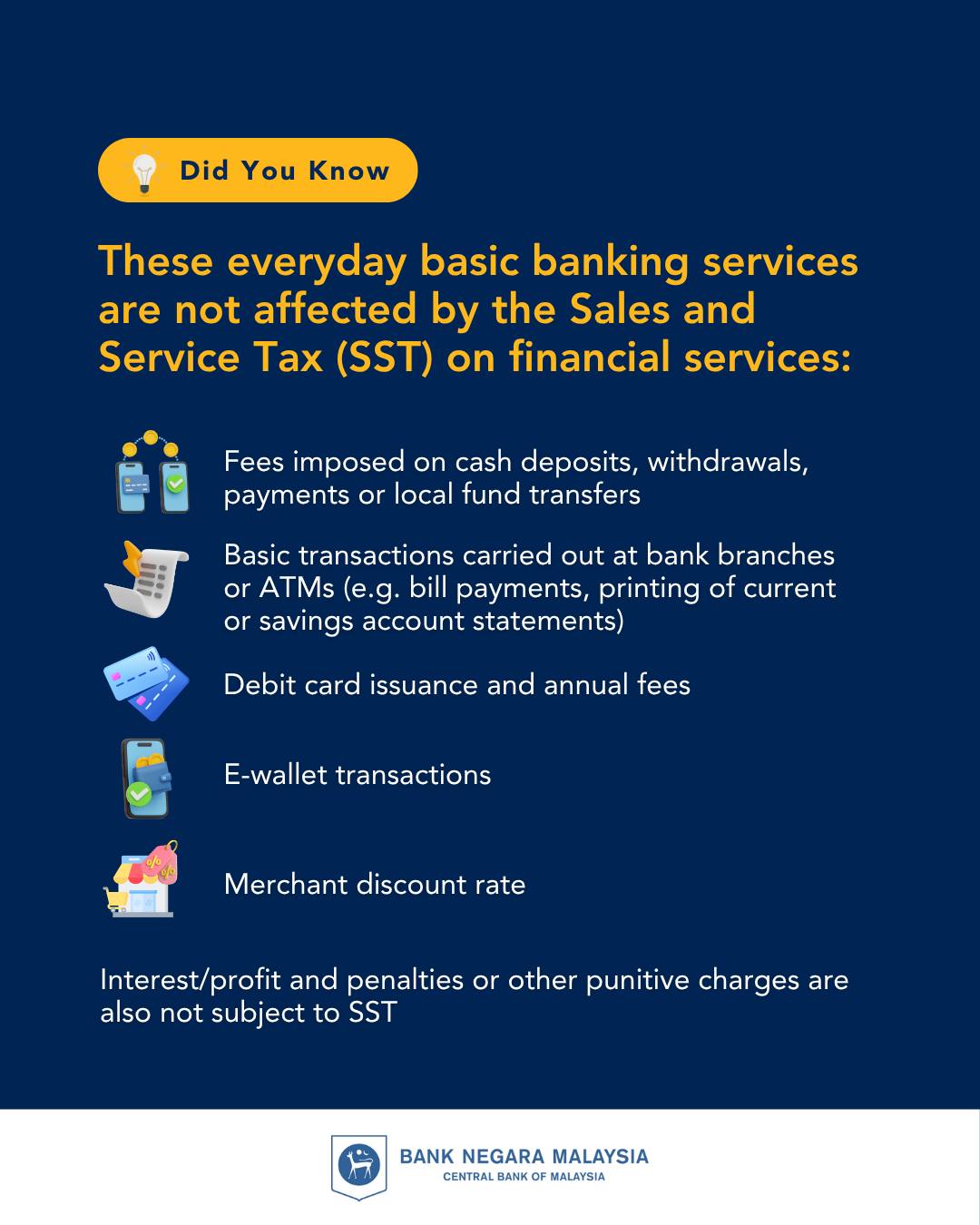

What’s NOT affected: Basic services you use daily

Let’s start with the good news. The statement clearly emphasises that essential banking services commonly used by the public will not be impacted by the new service tax rules.

Whether you’re using a savings account, current account, or even an e-wallet, the associated fees and services are not subject to SST.

Here’s a quick look at what remains tax-free:

- Cash deposits, withdrawals, local fund transfers, and bill payments

- Issuance and annual fees for debit cards

- Printing of account statements at branches or ATMs

- Annual fees for credit and charge cards

- Interest, profit, late payment charges, or other penalties

These are considered basic necessities in banking and will stay exempt from the expanded tax scope to ensure that ordinary consumers aren’t burdened.

What’s affected: Corporate & investment banking services

So, who will be affected?

According to the joint statement, the SST expansion is aimed at more specialised financial services, primarily within the corporate and investment banking sectors.

Starting 1 July 2025, under Phase 1 of the implementation, the tax will apply to selected services such as:

- Fund management

- Investment and merchant banking

- Trade financing-related services

- Treasury and corporate services (as outlined in Appendix A of the Service Tax Guide)

In short, the expansion targets high-level financial operations that are not part of regular individual banking.

TL;DR

To wrap things up:

- Your everyday banking, such as savings, debit cards, and ATM use, will not be taxed

- Only specialised services like corporate or investment banking and fund management will be affected

- Banks promise clear communication if any charges include SST

- Reach out to your bank if you need help understanding the change