For most Malaysians, EPF is just part of working life. Money goes in every month, dividends come out once a year, and that is that.

But recently, a well known Filipino finance educator took to social media to highlight something Malaysians often overlook.

According to Marvin Germo, a Philippines based investing expert and founder of Stock Smarts, Malaysia’s Employees Provident Fund is “one of the most quietly effective retirement systems in the region.”

Not flashy. Not loud. But a system that works.

A system built on forced discipline

Marvin broke down why EPF stands out, starting with its structure.

“Every month, 11 percent of your salary plus another 12 to 13 percent from your employer goes straight to your retirement. That’s nearly a quarter of your income saved consistently,” he explained.

He added that very few countries in Asia enforce this level of savings discipline, making EPF a powerful long term wealth building tool for ordinary workers.

“Not many countries force this level of discipline,” he wrote. “And that’s where real compounding begins.”

Steady returns without needing investment knowledge

Another key point Marvin highlighted was EPF’s investment strategy.

“EPF doesn’t just park your money,” he said. “It invests in global equities, bonds, real estate, infrastructure, and Islamic investments. Quiet, boring, professional investing. The kind that actually builds wealth.”

He also praised EPF’s consistent dividend record, noting that it has delivered stable returns for decades, even during global financial crises.

For Malaysians, this means retirement savings can grow steadily in the background without needing to actively manage investments or understand complex financial markets.

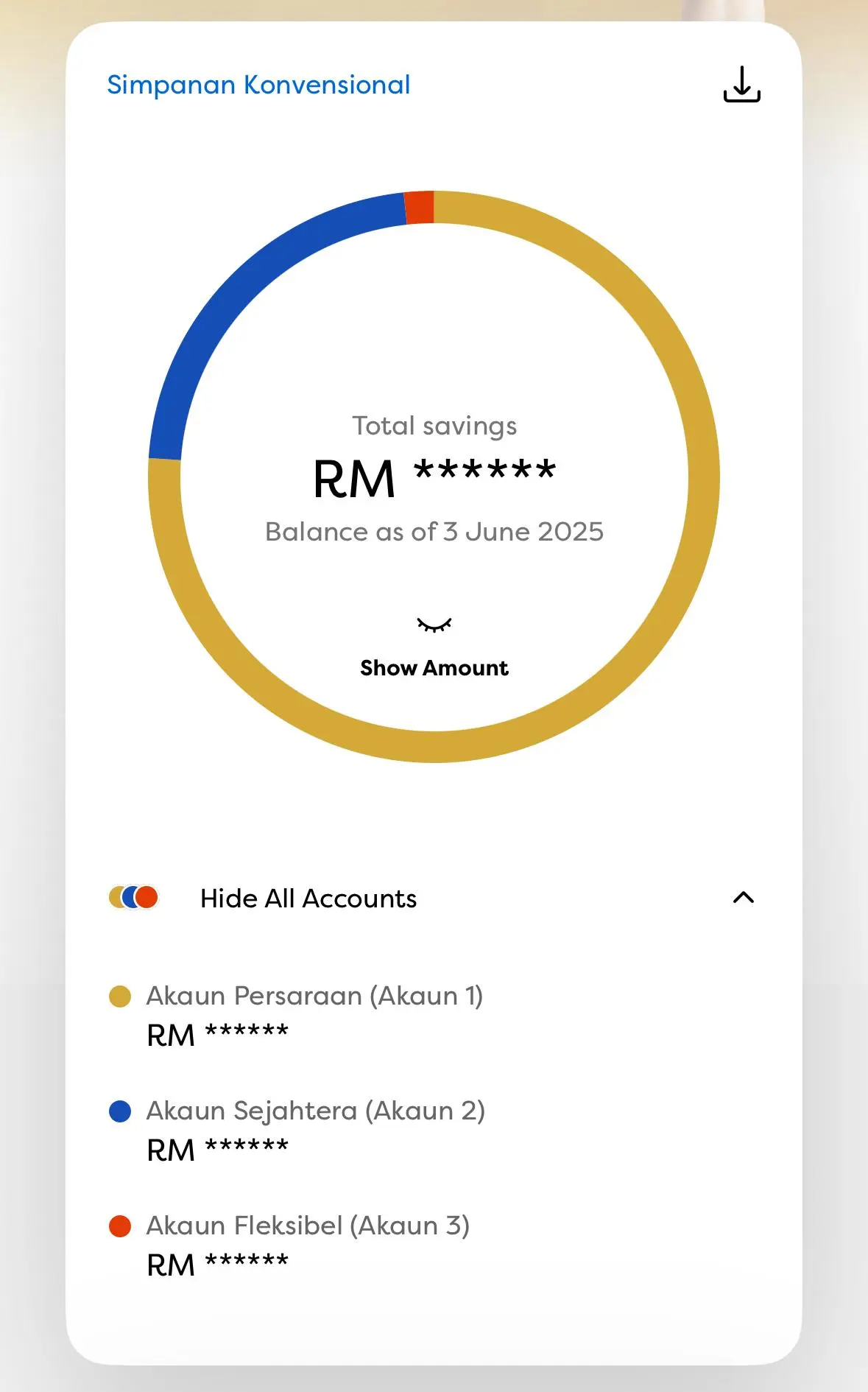

A realistic retirement path for everyday Malaysians

Marvin emphasised that EPF is not designed only for high income earners.

Someone earning an average income who contributes consistently for 30 to 40 years can realistically retire with RM500,000 to RM1 million. No special skills. No investing knowledge. No big risks,” he shared.

“Just discipline and compounding,” he added. “And that’s the whole point. EPF gives every worker a structured path to dignity in old age.”

Healthcare as an added safety net

Beyond retirement savings, Marvin also pointed out that Malaysia’s healthcare system strengthens financial security in later life.

“Malaysians benefit from highly subsidised public hospitals, low consultation fees, and affordable treatments,” he wrote. “Compared to many countries, medical costs in Malaysia don’t destroy retirement plans.”

While acknowledging no system is perfect, he described Malaysia’s healthcare ecosystem as one of the more affordable in Asia.

A quiet winner in the region

Summing up his thoughts, Marvin called Malaysia a case study worth learning from.

“When you mix high mandatory savings, consistent investment returns, transparent fund management, and affordable healthcare, you get a country where ordinary people have a fighting chance to retire securely,” he said.

“Not flashy. Not loud. Just a financial system that works.”

For Malaysians who have long viewed EPF as routine, Marvin’s praise offers a fresh reminder that sometimes, the things we take for granted are exactly what others admire most.