The Employees Provident Fund (EPF) has responded to growing public concern after the 13th Malaysia Plan (13MP) hinted at a possible shift to a monthly pension-like withdrawal system.

Despite clarifying that the idea is still under review, many Malaysians are not convinced.

EPF says proposal still under study

In a statement, EPF said it “takes note” of the government’s proposal and confirmed it is currently being studied.

Any decision will be made only after thorough engagement with key stakeholders and careful consideration of members’ long-term interests,” it said.

EPF also assured members that current withdrawal options remain unchanged for now, and that future announcements will be made through official channels.

Read our coverage here:

Yeo: Don’t control people’s money

Adding to public concern, former minister Yeo Bee Yin also weighed in, stating the government should not interfere with how contributors manage their retirement funds.

“EPF is people’s hard-earned money and the government should let people decide what to do with their savings.”

“EPF is people’s hard-earned money and the government should let people decide what to do with their savings,” she wrote.

“Retirees are no longer children. They don’t need the government to tell them what’s best. To borrow Bill Clinton’s words — the era of big government is over.”

Read our coverage here:

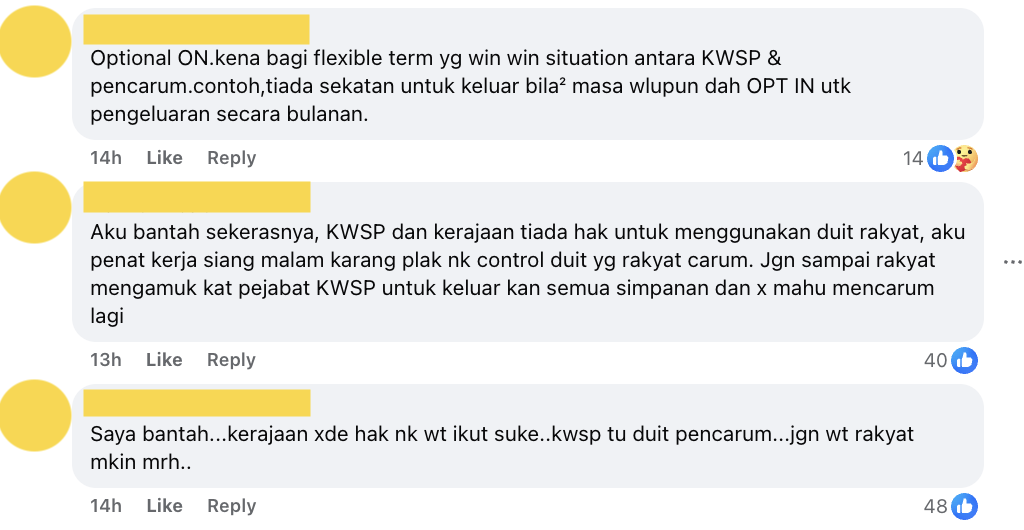

Netizens reject the idea outright

Public reaction has been largely negative, with many commenters on Facebook demanding that contributors should have full control over their savings.

Make it optional. There should be a flexible setup that benefits both EPF and contributors. For example, allow lump-sum withdrawals even after opting for monthly payouts.”

Public anger over control of funds

Others expressed stronger disapproval, saying the government and EPF have no right to dictate how contributors use their savings.

I strongly object. I work hard day and night, and now you want to control the money I contributed?

Don’t push the public to the point where they start demanding to withdraw everything and stop contributing.”

“The government has no right to interfere. That’s our money. Don’t make people even more frustrated.”

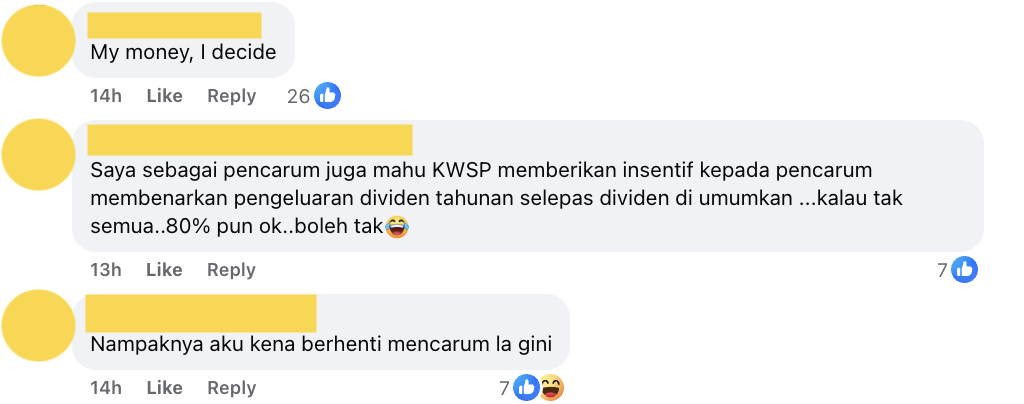

Contributors want full control

Some were more direct, saying, “My money, I decide,” while others joked that they might stop contributing altogether if the policy becomes mandatory.

One person suggested EPF allow partial dividend withdrawals annually: “If not all, at least let us take out 80% of the dividend when it’s announced.”

EPF under pressure to maintain flexibility

While EPF’s statement was intended to clarify its position, the backlash shows deep mistrust over how members’ savings are handled.

Many contributors are now calling for the plan to remain strictly optional and for any change to involve proper public consultation.