Most people believe retirement is when life finally gets cheaper. No daily commute. No office expenses. Fewer commitments. But for many retirees, reality turns out to be the opposite.

That assumption is costing many people more than they realise. A recent HSBC study revealed that 85 per cent of retirees regret not saving enough. Many expected lower expenses after retirement, only to face unexpected bills and rising living costs.

So if so many people are getting it wrong, the big question is simple. Are you on track?

First, how much should you actually have?

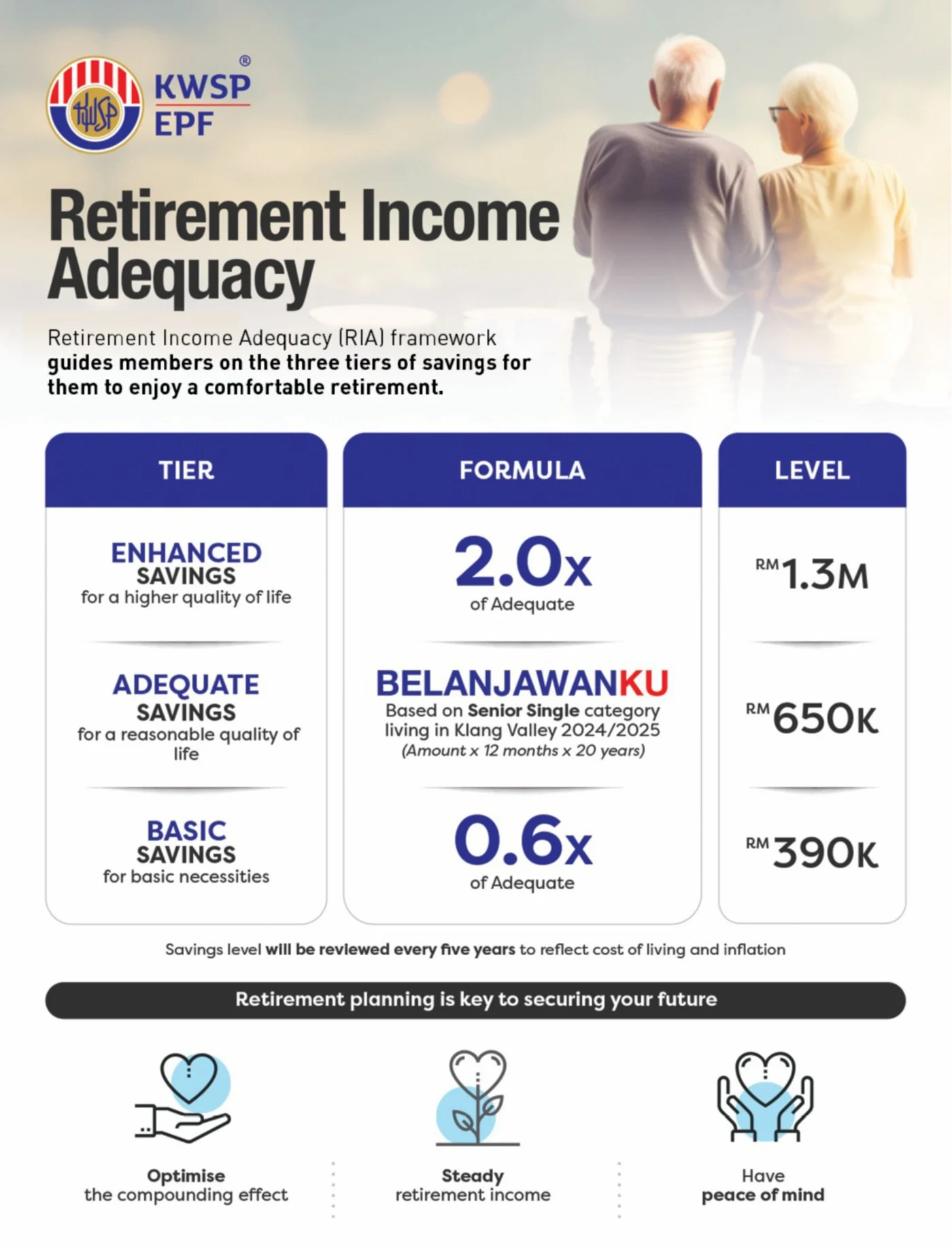

To give Malaysians clearer guidance, EPF recently introduced the Retirement Income Adequacy Framework, also known as RIA. It sets savings targets based on the kind of life you want after retirement.

RM390,000 Basic Savings

Covers essential daily needs.

RM650,000 Adequate Savings

Supports a reasonable and comfortable lifestyle.

RM1.3 million Enhanced Savings

Allows for aspirational lifestyles and more freedom in spending.

These targets will be reviewed every five years so they remain realistic as living costs rise.

And this update did not happen without reason.

Why the old RM240K target no longer works

Previously, EPF’s Basic Savings benchmark was RM240,000 at age 55, meant to provide RM1,000 per month for 20 years.

At the time, this sounded reasonable. Today, it no longer reflects reality.

• Bank Negara Malaysia estimates RM2,700 per month is needed for a reasonable standard of living

• Department of Statistics Malaysia estimates RM2,338 per month

Either way, RM1,000 per month is no longer enough to live comfortably, reported NST.

Which means relying on old benchmarks could leave many retirees short on cash later in life.

Malaysia is getting older & that changes everything

Another key factor is that Malaysians are living longer.

By 2048, 14 per cent of Malaysians will be aged 65 and above. A longer life is a blessing. But it also means your retirement savings must last much longer than before.

Without proper planning, longer life expectancy could turn into extended financial stress.

This is exactly why EPF decided to rethink its retirement system.

What is changing in EPF policies

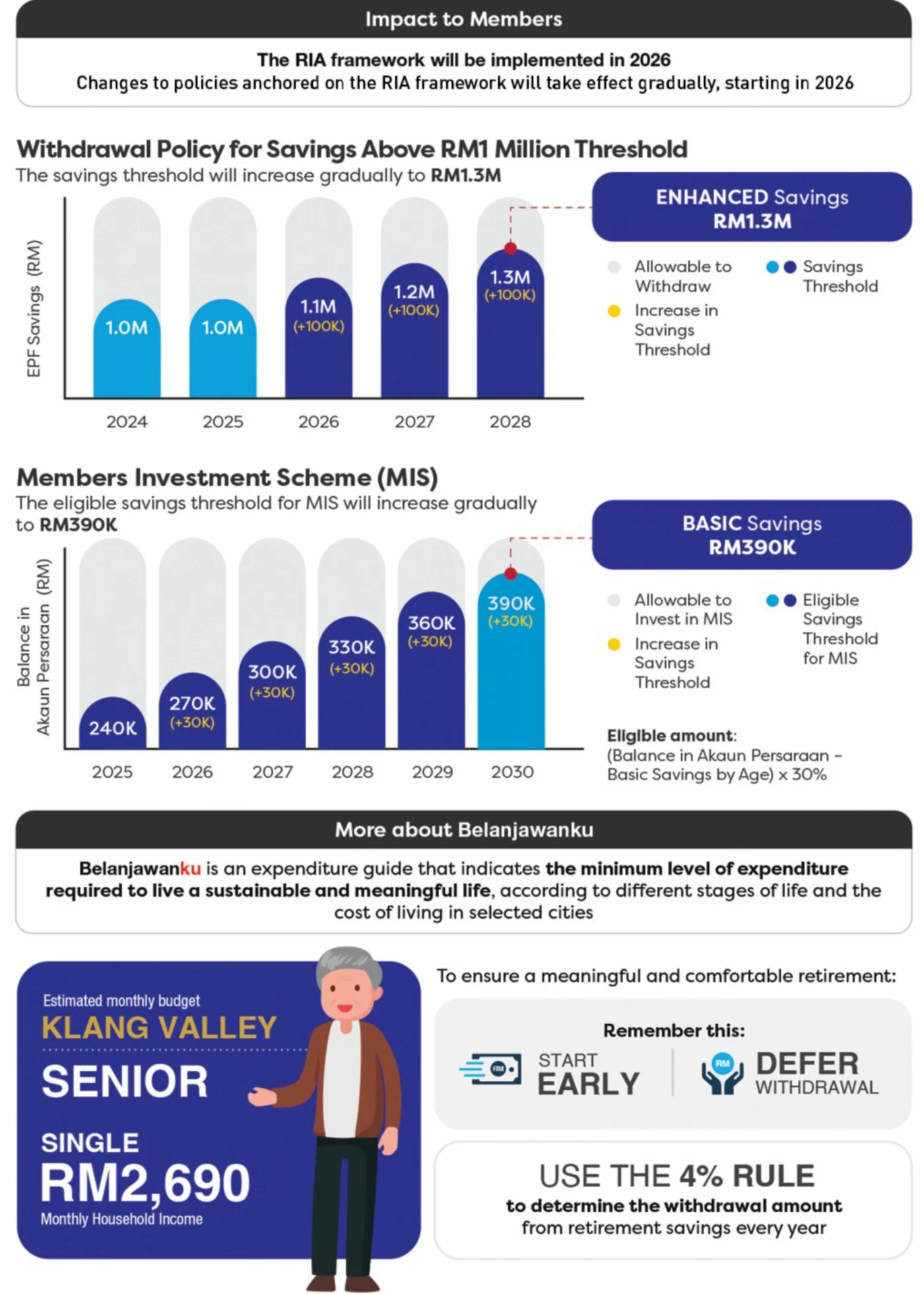

Alongside the new RIA targets, EPF is adjusting several key policies.

Previously, members could withdraw savings above RM1 million before age 55. Going forward, this withdrawal threshold will rise gradually:

• 2026 RM1.1 million

• 2027 RM1.2 million

• 2028 RM1.3 million

This aligns with the Enhanced Savings target and helps prevent members from tapping into retirement funds too early.

At the same time:

• The Basic Savings threshold will increase RM30,000 yearly over five years

• Members can invest up to 30 per cent of savings above Basic Savings through the Members Investment Scheme

• All EPF savings will continue earning dividends until age 100

In short, EPF is restructuring the system to help your money last longer.

So how much will you need per month after retirement?

Instead of guessing, EPF offers guidance through its Belanjawanku Guide.

For example, a single senior in Klang Valley needs roughly RM2,690 per month to maintain a meaningful and sustainable lifestyle.

This gives you a realistic picture of what retirement expenses may look like.

The earlier you start, the easier it gets

If these numbers feel intimidating, here is the good news. Starting early makes a massive difference.

Take the example of a worker who begins at 18 earning RM1,700 per month. With EPF contributions and normal career growth, simulations show she could accumulate about RM1.01 million by age 60.

Even after some withdrawals, she would likely still have over RM760,000, exceeding the Adequate Savings target.

That is the power of compounding returns over time.

Not there yet? You still have options

If your retirement savings feel behind schedule, there is no need to panic. You can still take action.

• Extend your working years

• Make voluntary EPF contributions through i-Simpan or i-Topup

• Delay withdrawals so dividends keep growing

• Seek free retirement advisory services at EPF branches

Retirement is no longer something to think about in the distant future. It is a reality that requires planning now. Start early. Contribute consistently. Plan intentionally.

Because when retirement finally arrives, you deserve to enjoy it, not worry about surviving it.