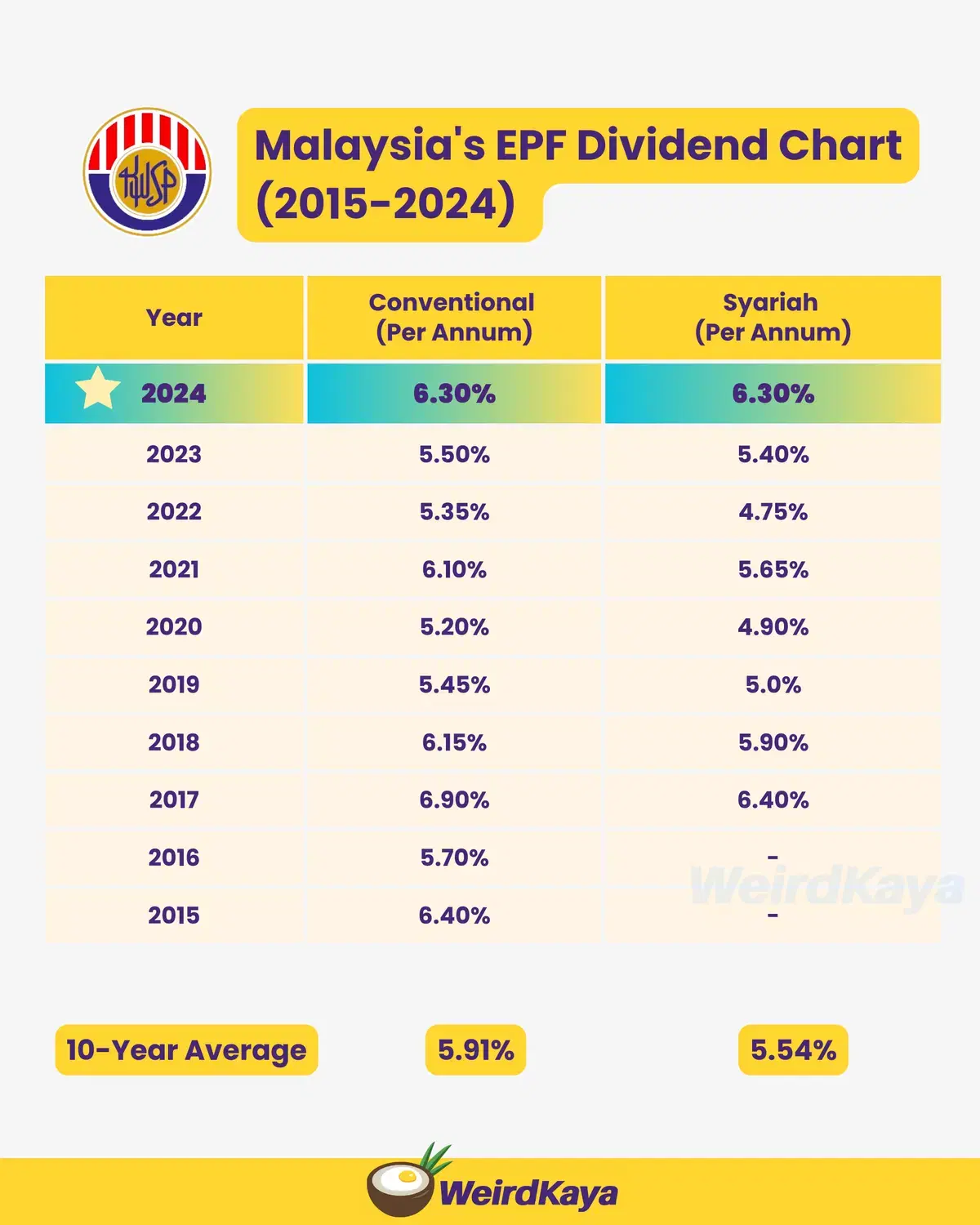

You’ve probably heard the good news. Back in March, EPF announced a 6.3% dividend for 2024. That’s a solid return, and honestly, not something we see every year.

So it’s no surprise some are thinking, “Hey, maybe I should use that money in Account 3 to pay off my home loan.”

It makes sense at first. Less loan, less stress, right? But according to finance content creator Financial Faiz, that move might actually backfire. Let’s break down why.

Let’s talk numbers

Before you rush to transfer that cash, here’s something to consider.

Most home loan interest rates in Malaysia sit around 4% to 4.3%. Meanwhile, your EPF is quietly giving you 6.3% just by staying untouched.

So here’s a quick thought experiment: Say you take RM10,000 out of EPF to reduce your loan. You might save about RM420 in interest a year. But if you’d just left it where it was, you’d earn RM630 instead.

Faiz puts it bluntly: “It’s like swapping RM10 for RM6.” And unless you enjoy losing money, that’s not a great deal.

‘But I just want to be done with the loan’

We totally get it. There’s something satisfying about wiping out debt and seeing smaller monthly payments.

But here’s where long-term thinking comes in. Your EPF isn’t just sitting there collecting dust. That 6.3% dividend compounds. That means your money is earning money, and then that money earns more money.

Give it a few years, and you might have enough to pay off your loan in one go and still have something left over.

Short-term peace of mind is great. But smart compounding? That’s where the real magic happens.

What you should actually use your EPF for

Now, if you’ve got RM10,000 in your Account 3 and you really want to clear some debt, Faiz says there’s a better target: your high-interest loans.

We’re talking credit cards, personal loans, or hire purchase. These are the ones that bleed your wallet faster than a home loan ever could.

While your housing loan may feel like the biggest burden, it’s usually the cheapest in terms of interest. So if you’re not settling it in full, it’s best to let it ride for now and tackle the more “expensive” debts first.

Don’t fall for the “just use your EPF” advice

We’ve all heard it before. “Buy a house now. If you can’t afford it later, just take money from your EPF.”

But Faiz urges Malaysians to be careful with that kind of thinking. EPF isn’t just your backup plan. It’s your future.

And with a 6.3% return, it’s working harder for you than most savings accounts or fixed deposits out there.

So unless you’re in a position to settle your entire mortgage in one go, it’s probably smarter to leave your EPF alone and let it grow.

Watch the clip here: