We hear about credit scores a lot, especially when people apply for loans.

But what actually is a credit score, and why does it matter?

TikTok creator Financial Faiz explained it in the clearest way possible, and after reading this, you’ll understand how even a single RM100 can make or break your future financial plans.

Let’s break it down step by step.

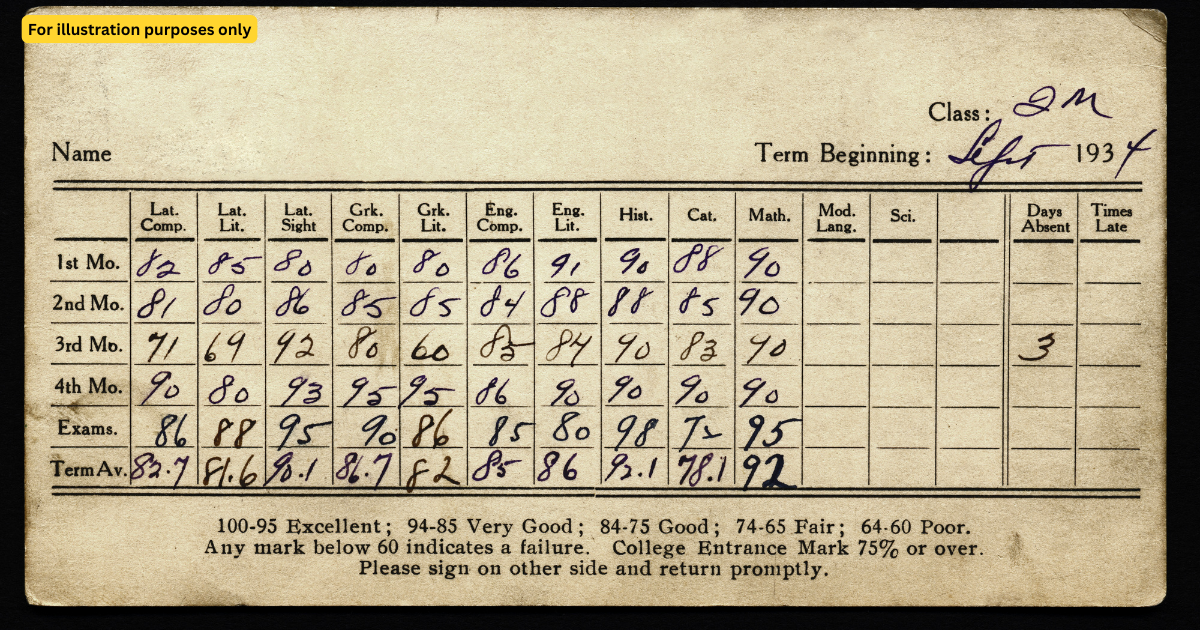

1. Your credit score is like a report card, and banks are your teachers

To begin, think of your credit score as your financial report card.

Just like how schools judge students by their grades, banks judge you by your credit score.

If your “grades” (meaning your payment history) show late payments or missed bills, banks see you as a risky borrower.

But if your record shows consistent, on-time payments and low debts, banks feel safer giving you a loan.

2. And just like school, even one small mistake matters

Now you might think, “If I just miss one small payment, it won’t make a big difference, right?”

Actually, it can. Faiz gave a simple example. Let’s say you have a RM5,000 personal loan, and your monthly payment is RM100. One month, you forget to pay. That gets recorded.

Here’s where the math comes in.

When you later apply for a housing loan where the repayment might be RM1,000 per month, the bank will look at your record and think, “If this person didn’t even pay RM100, how can we trust them with RM1,000?”

So yes, even a single missed payment can affect your chances.

3. But why are banks so strict about this?

At this point, you might wonder why banks care so much. Why are they so quick to reject applications?

Here’s why. It’s not just about you. Banks also need to protect themselves.

When a borrower doesn’t pay back, that loan becomes what’s called an NPL, or Non-Performing Loan.

Too many NPLs and Bank Negara Malaysia steps in and asks, “Why are you giving loans to people who don’t repay?”

To avoid this, banks are cautious. They rely on your credit score as a filtering tool. It is their way of protecting themselves from potential risks.

4. No credit history doesn’t mean you’re a safe bet either

Here’s a common misconception. You might think, “Well, I don’t owe anyone anything. That must mean I’m a perfect loan candidate.”

Unfortunately, that’s not how it works.

If you’ve never had a loan or credit card, banks have no data on how you manage repayments.

That makes you an unknown risk. It’s like applying for a job with no experience. You’re not bad, but you’re not proven either.

5. So how do you build a good credit history?

If you don’t have any credit record yet, don’t panic. Financial Faiz suggests starting with small, manageable credit products.

Some examples include:

- ASB financing

- A credit card with a low limit

You don’t even need to use the card regularly. In fact, Faiz says, “You don’t have to use it. But if you do, even better, as long as you pay it off on time.”

Start small, stay consistent. That’s what builds a healthy credit history.

6. How you use your credit matters just as much

Let’s take it one step further. Having a credit card is good. Using it wisely is better.

Here’s a quick example.

Say you have a credit card with a RM2,000 limit. You spend RM500 per month. That’s 25 percent usage, which is considered healthy.

But if you max out the card and only pay the minimum each month, your score will suffer, even if you don’t miss a payment.

So use your credit for things you can afford, like petrol or groceries. Then pay off the balance fully each month.

7. Your credit score can literally cost or save you thousands

Now that you understand the logic, here’s how it can impact your wallet.

Let’s say you and your friend both apply for a RM300,000 housing loan, paid over 30 years.

| Person | Credit Score | Interest Rate | Monthly Payment | Total Paid |

|---|---|---|---|---|

| You | Good | 3.5 percent | RM1,347 | RM484,920 |

| Your Friend | Poor | 5.0 percent | RM1,610 | RM579,600 |

That’s a difference of RM94,680. All because of your credit history.

8. Your financial habits follow you for life

Faiz ended his video with a strong reminder. Finance isn’t just about now. It affects you from your first job until the day you pass away.

Even after you’re gone, your financial decisions matter. Your assets need to be distributed, wills need to be written, and families need clarity.

That’s why it’s important to manage your finances properly now.

And it all starts with something most of us already have: debt.

TL;DR: Your simple guide to building and keeping a good credit score

- Always pay your bills and loans on time

- Start small if you have no credit history

- Don’t use more than 30 to 40 percent of your credit limit

- Don’t apply for too many loans at once

- Check your CCRIS or CTOS report regularly

- Avoid spending on things you couldn’t afford without credit

- Understand that your credit score is your financial trust badge

Watch the full video here: