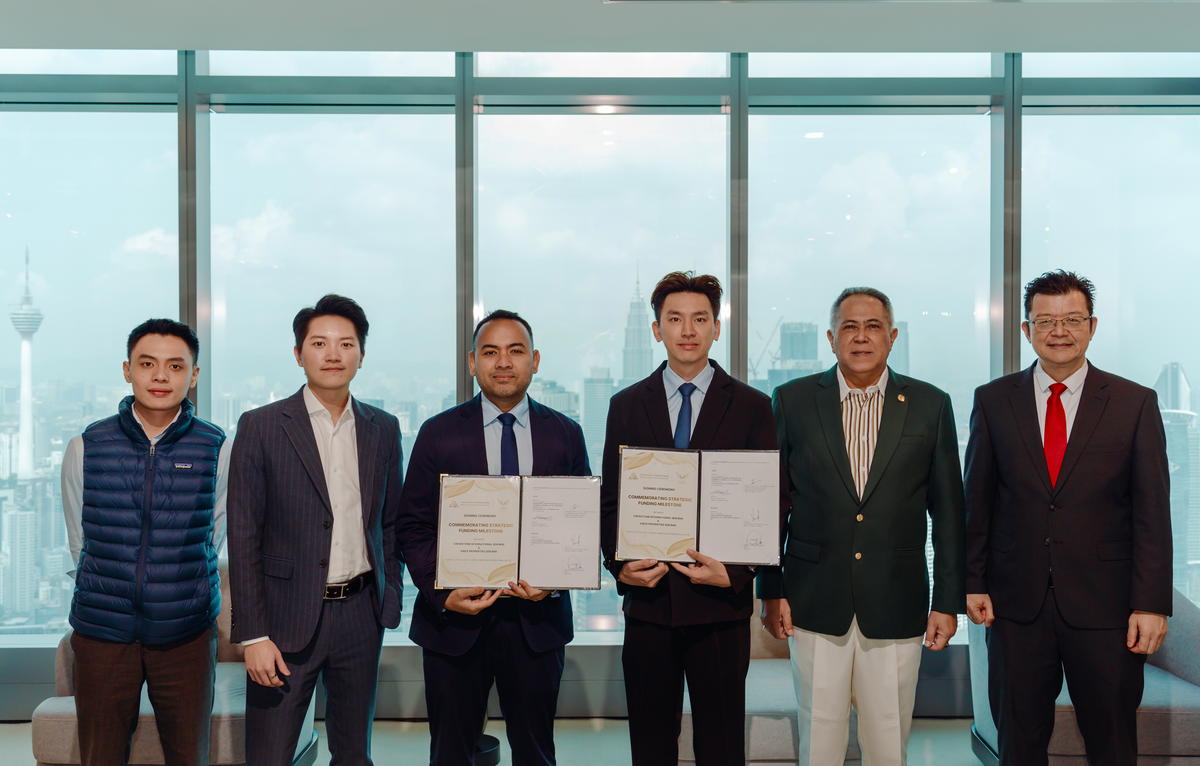

Crewstone International Sdn Bhd, a licensed and regulated private equity and private credit manager, has completed a structured, multi-tranche RM20 million investment into Vince Group, as part of an ongoing strategic partnership in Malaysian property development.

Vince Group is an established Malaysian real estate platform with a focus on en bloc acquisitions and development execution, aligning with Crewstone’s preference for operating partners with demonstrable delivery capability and monetisation visibility.

As of November 2025, Vince Group has recorded sales exceeding 800 units and generated approximately RM435 million in gross development value (GDV) across its active projects.

During this period, reported revenue increased from RM18 million to RM28 million, alongside an expansion in operational capacity across development lines.

The Group also maintains receivables of approximately RM17.5 million across completed and construction-stage projects.

Vince Group has identified a near-term development pipeline with an estimated GDV of approximately RM880 million across three projects, alongside preliminary planning for additional joint-venture developments in 2026.

These potential projects were assessed as part of Crewstone’s investment structuring and risk evaluation process.

“Our approach is to deploy capital in a structured and disciplined manner, working with operators who demonstrate execution capability and commercial realism,” said Izmir Mujab, Managing Director and CEO of Crewstone International.

This investment reflects our focus on governance, visibility, and repeatable delivery rather than speed alone.

Crewstone’s participation brings structure, governance, and long-term alignment to our development plans.

“The partnership supports disciplined execution as we progress through our pipeline,” said Datuk Vincent Nee, Founder and Visionary Leader of Vince Group.

Read more: