97% of Malaysians withdraw their entire EPF savings once they hit retirement age.

It may sound normal…until you realise most of them retire with less than RM50,000 in their accounts. And that money doesn’t last long.

Under current EPF rules, members can fully cash out at age 55 or 60. Almost everyone does so. At a modest spending rate of RM1,000 a month, RM50,000 would last just over four years.

And this is where the real problem begins.

Why lump-sum withdrawals are risky

Financial planner V. Rajendaran said retirees typically burn through their savings within three to five years, reported NST.

This often happens because:

- Regular monthly income suddenly stops

- Spending habits remain unchanged

- Poor investment decisions follow

Without a structured payout system, he explained, retirees are more likely to overspend or make poor investment choices accelerating the depletion of their savings.

But fast spending is only one side of the issue.

M’sians are living longer than before

Today, Malaysians live to about 76 years old on average. That means retirement savings must stretch across 20 years or more.

At the same time, daily living costs continue rising, putting even more pressure on limited savings.

Economist Madeline Berma warned that many Malaysians are already relying on EPF funds to cope with everyday expenses. And recent EPF policy changes may be adding to that risk.

EPF’s new structure — easier access, bigger risk?

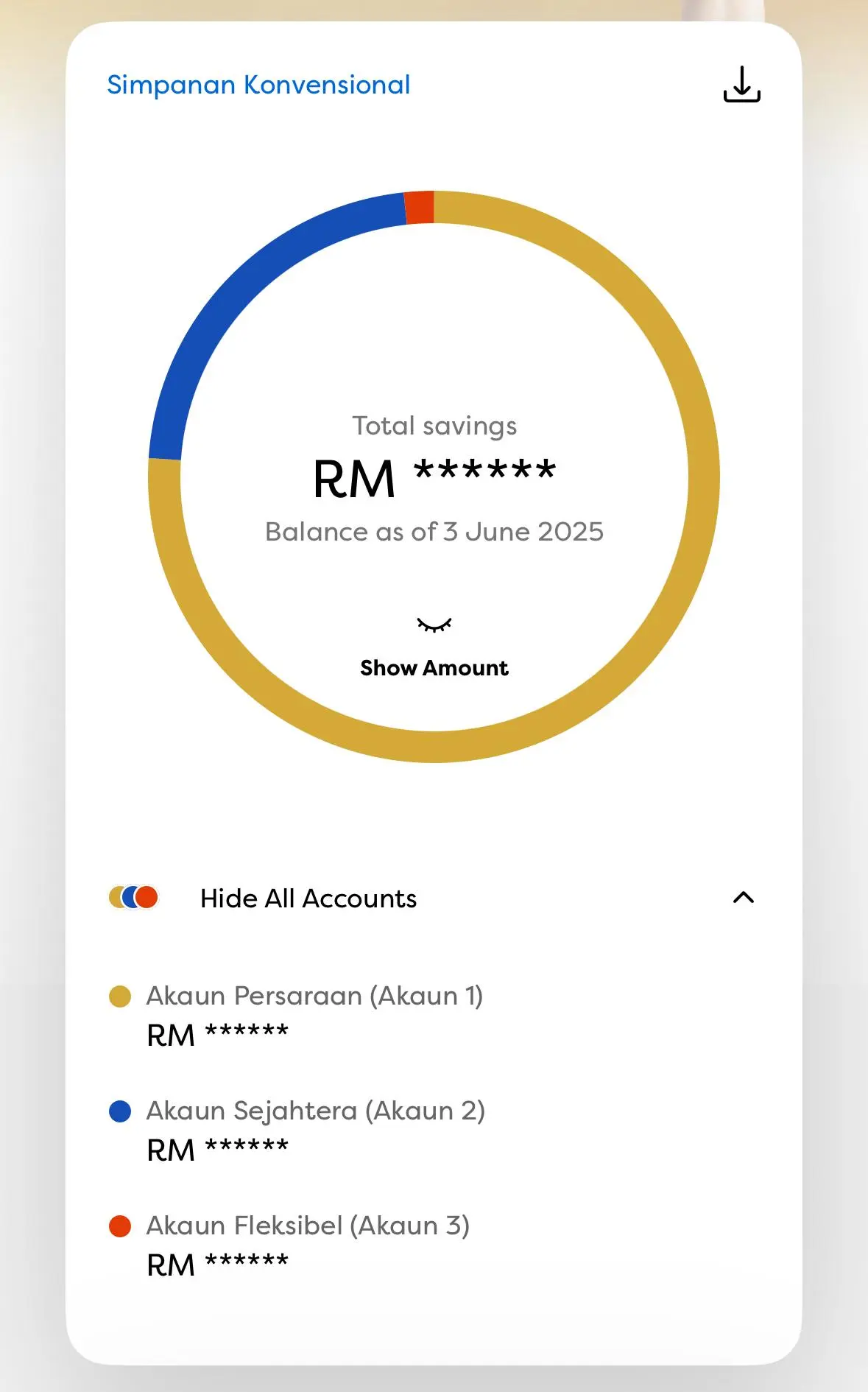

In May 2024, EPF restructured contributions into three accounts:

- Account 1 (Retirement) — 75%

- Account 2 (Wellbeing) — 15%

- Account 3 (Flexible) — 10%

The Flexible Account allows withdrawals at any time, aimed at helping during emergencies.

During the pandemic, special withdrawal schemes saw RM145 billion taken out by 7.3 million members. While necessary then, experts warn the long-term impact could be serious.

So how do other countries prevent retirees from running out of money?

Many nations don’t allow full lump-sum withdrawals. Instead, they build in safeguards.

- Singapore converts retirement savings into monthly income for life.

- Germany pays lifelong monthly pensions only.

- Sweden adjusts payouts based on life expectancy.

- The UK requires financial guidance before flexible withdrawals.

The shared goal: ensuring retirees do not outlive their savings.

Should M’sia rethink its retirement system?

Rajendaran suggested partial annuitisation, where:

- Part of EPF becomes guaranteed monthly income

- Part remains available for limited lump sums

He added that stronger pre-retirement financial education is equally important.

Malaysia’s lump-sum withdrawal culture was built for a time when people lived shorter lives and costs were lower. Today, those realities have shifted.

And without reform, experts warn more Malaysians could face financial hardship in old age simply because their savings ran out too soon.